Exploring ASX Growth Companies With Insider Ownership As High As 28%

As the ASX200 navigates a modest downturn, with sectors like IT facing challenges while materials gain from commodity price recoveries, investors are keenly watching market dynamics. In such an environment, growth companies with significant insider ownership can offer a unique investment perspective, potentially aligning management interests closely with shareholder outcomes in these fluctuating conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 52.2% |

CardieX (ASX:CDX) | 12.2% | 115.3% |

Chrysos (ASX:C79) | 21.3% | 63.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cobram Estate Olives

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is a food and agribusiness company specializing in olive farming and milling, with operations in Australia and the United States, and a market capitalization of approximately A$738.83 million.

Operations: The company generates revenue through its Boundary Bend Wellness segment at A$1.48 million, and its olive oil operations in the USA and Australia, which bring in A$63.06 million and A$163.33 million respectively.

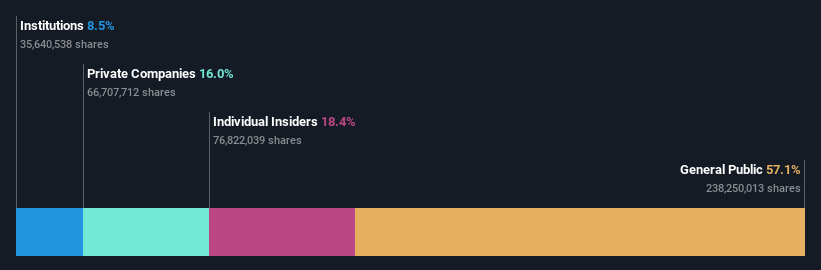

Insider Ownership: 18.4%

Cobram Estate Olives, an Australian growth company with high insider ownership, exhibits a promising financial trajectory despite certain challenges. While its revenue growth at 17.5% per year outpaces the broader Australian market's 5.3%, it falls short of the more aggressive 20% annual target often associated with high-growth firms. The company recently achieved profitability and expects earnings to increase significantly, forecasting a robust 32.8% annual growth rate compared to the market's average of 13%. However, Cobram Estate is managing a high level of debt which could pose challenges to sustaining long-term growth and capital returns, as indicated by its relatively low forecasted Return on Equity of 11.7%.

Cettire

Simply Wall St Growth Rating: ★★★★★★

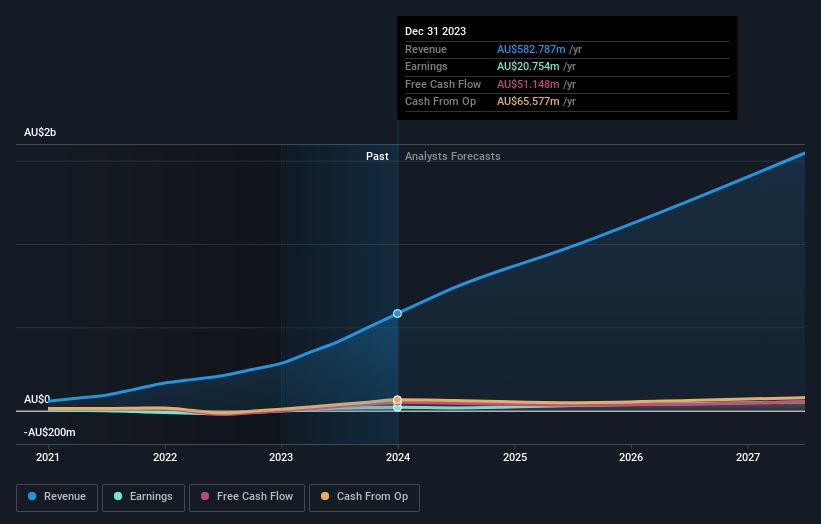

Overview: Cettire Limited operates as an online retailer of luxury goods, serving customers in Australia, the United States, and other international markets, with a market capitalization of approximately A$517.05 million.

Operations: Cettire generates its revenue primarily through online retail sales, amounting to A$582.79 million.

Insider Ownership: 28.7%

Cettire, an Australian e-commerce retailer, is positioned for significant growth with earnings expected to rise by 26.7% annually, outpacing the market's forecast of 13%. Its revenue growth projection at 23.6% annually also exceeds the broader market expectation of 5.3%. Despite this promising outlook, the company's share price has been highly volatile recently and shareholders experienced dilution over the past year. Additionally, Cettire trades at a substantial discount to its estimated fair value.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

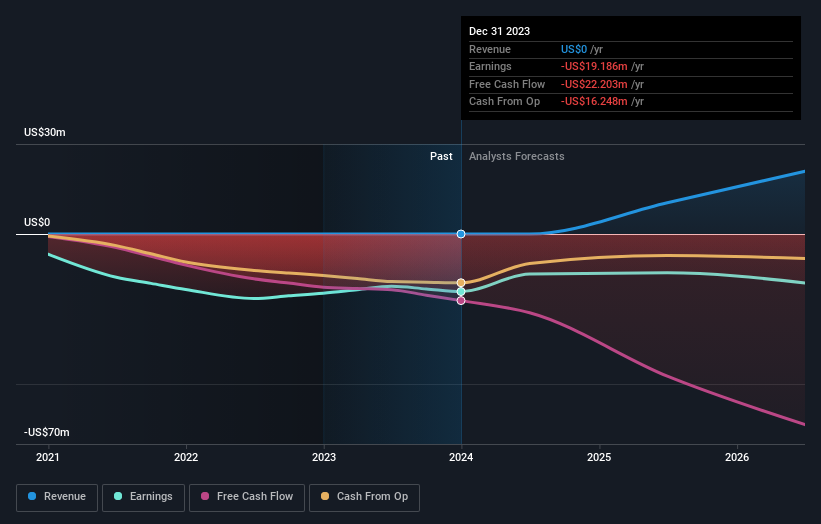

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$560.79 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.8%

IperionX, an emerging leader in advanced titanium manufacturing, has recently expanded its market presence through strategic partnerships and equity offerings. Notably, the company secured a significant deal with Vegas Fastener Manufacturing to supply the U.S. Army with specialized titanium components, reflecting its growing influence in critical high-performance sectors. Despite trading at a substantial discount to its estimated fair value and experiencing shareholder dilution over the past year, IperionX is poised for rapid revenue growth (76.2% annually) and is expected to become profitable within three years. This trajectory is bolstered by recent agreements like that with United Stars Holdings, promising up to 80 metric tons of titanium products annually for defense and technology applications.

Get an in-depth perspective on IperionX's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility IperionX's shares may be trading at a premium.

Taking Advantage

Navigate through the entire inventory of 89 Fast Growing ASX Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:CBO ASX:CTT and ASX:IPX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance