Exploring ANY Biztonsági Nyomda Nyrt And Two Other Leading Dividend Stocks

Amid fluctuating global markets, where the Dow Jones Industrial Average faced significant losses while the Nasdaq Composite reached new heights, investors are continually seeking stable returns. In this context, dividend stocks like ANY Biztonsági Nyomda Nyrt present a compelling case for those looking to potentially enhance portfolio resilience through regular income streams.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 8.21% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.23% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 5.91% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.65% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.95% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.51% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 4.09% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

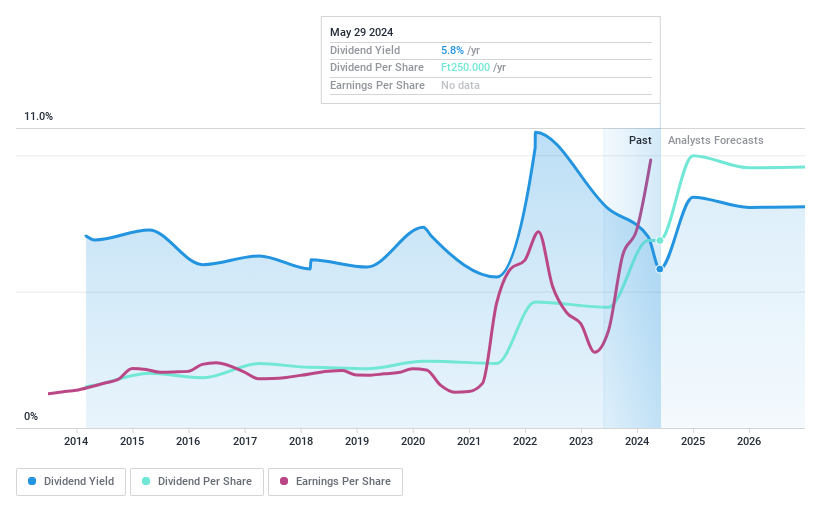

ANY Biztonsági Nyomda Nyrt

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANY Biztonsági Nyomda Nyrt. is a security printing company based in Europe with a market capitalization of approximately HUF 61.54 billion.

Operations: ANY Biztonsági Nyomda Nyrt generates its revenue primarily from Security Products and Solutions at HUF 35.47 billion, followed by Card Production and Personalization at HUF 12.61 billion, and Form Production and Personalization, Data Processing contributing HUF 10.96 billion, alongside Traditional Printing Products which earned HUF 1.86 billion.

Dividend Yield: 5.8%

ANY Biztonsági Nyomda Nyrt. has shown a significant earnings growth of 253.3% over the past year, with revenue projected to grow annually by 2.96%. Despite this, its dividend yield of 5.83% remains below the top Hungarian market payers and is not adequately covered by either earnings or cash flow, indicating potential sustainability issues. Dividends have been increased recently and historically show stability over the past decade, yet challenges in free cash flow persist which could impact future payments.

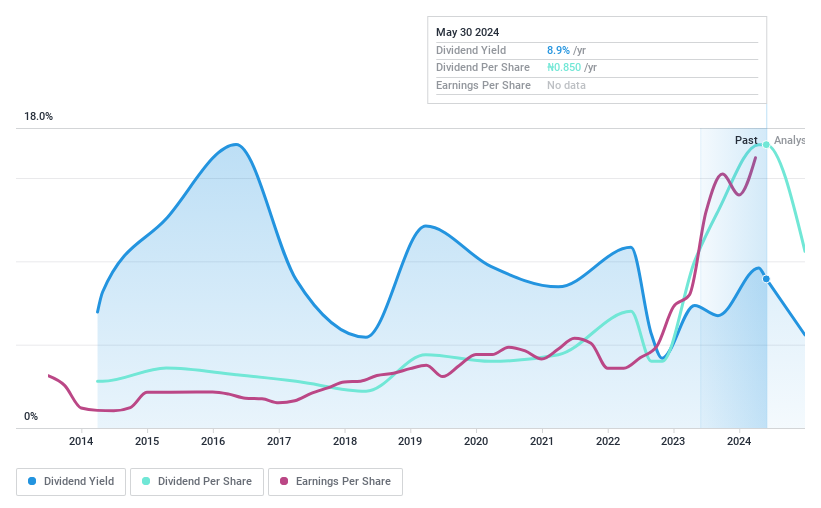

Fidelity Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity Bank Plc, operating in Nigeria, offers a range of banking products and services to both corporate and individual customers, with a market capitalization of approximately NGN 334.40 billion.

Operations: Fidelity Bank Plc generates its revenue by providing a variety of banking products and services to both corporate entities and individual clients across Nigeria.

Dividend Yield: 8.9%

Fidelity Bank has demonstrated robust earnings growth, with net income doubling to NGN 31.44 billion this quarter from NGN 15.61 billion a year ago. Despite a high dividend yield of 8.95%, its dividends have shown volatility over the last decade and an unreliable growth pattern, complicating forecasts for future stability. Additionally, the bank's high bad loans ratio at 4.1% and a low allowance for bad loans at 96% suggest potential risks in maintaining these payments, despite a low payout ratio of 23.6%.

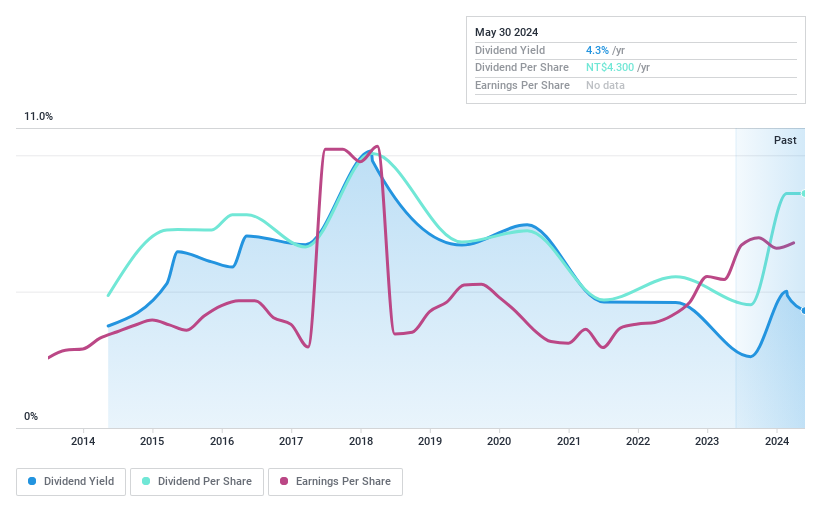

Axiomtek

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axiomtek Co., Ltd. is a global company engaged in the design, manufacture, and sale of industrial computers and embedded platforms, with a market capitalization of approximately NT$10.19 billion.

Operations: Axiomtek Co., Ltd. generates its revenue primarily from three geographic segments: America (NT$3.14 billion), Taiwan (NT$1.88 billion), and Europe (NT$1.29 billion).

Dividend Yield: 4.3%

Axiomtek Co., Ltd. recently increased its dividend to TWD 4.3 per share, reflecting a positive shift in its distribution policy amidst a challenging financial backdrop with first-quarter sales dropping to TWD 1,409.11 million from TWD 1,577.53 million year-over-year. Despite this decline, net income rose to TWD 147.9 million from TWD 123.82 million, supported by earnings growth of 26.8% over the past year and a stable payout ratio of 58%. However, the company's dividend history has been marked by volatility and inconsistency over the past decade, raising concerns about the reliability of future payments despite current coverage by earnings and cash flows (payout ratio: 58%, cash payout ratio: 62.9%).

Key Takeaways

Unlock more gems! Our Top Dividend Stocks screener has unearthed 1947 more companies for you to explore.Click here to unveil our expertly curated list of 1950 Top Dividend Stocks.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BUSE:ANYNGSE:FIDELITYBK TPEX:3088

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance