Exploring Breedon Group And Two More Undervalued Small Caps With Insider Action In The United Kingdom

Amidst a backdrop of fluctuating global markets and political uncertainties, the United Kingdom's financial landscape remains dynamic, with recent shifts in indices and economic indicators painting a complex picture for investors. In such an environment, identifying undervalued small-cap stocks like Breedon Group requires a keen understanding of market fundamentals and the potential impact of broader economic events.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ultimate Products | 9.4x | 0.7x | 20.17% | ★★★★★★ |

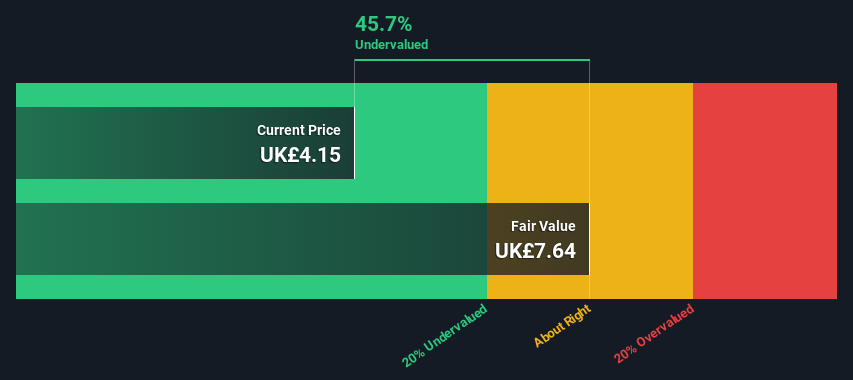

Breedon Group | 13.5x | 1.0x | 45.69% | ★★★★★☆ |

GB Group | NA | 3.2x | 21.11% | ★★★★★☆ |

THG | NA | 0.4x | 41.65% | ★★★★★☆ |

Bytes Technology Group | 25.6x | 5.8x | -1.55% | ★★★★☆☆ |

CVS Group | 21.1x | 1.2x | 41.36% | ★★★★☆☆ |

M&C Saatchi | NA | 0.6x | 48.57% | ★★★★☆☆ |

Norcros | 8.0x | 0.5x | -13.34% | ★★★☆☆☆ |

Robert Walters | 18.7x | 0.2x | 42.65% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.8x | 44.68% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Breedon Group

Simply Wall St Value Rating: ★★★★★☆

Overview: Breedon Group operates primarily in the construction materials sector in Great Britain and Ireland, focusing on cement and aggregates, with a market capitalization of approximately £1.20 billion.

Operations: The entity generates revenue through diverse geographical segments, with Great Britain being the most significant contributor at £1.03 billion, followed by Ireland at £235.5 million and Cement at £331.2 million. The gross profit margin has shown a notable increase from 27.32% in 2013 to 34.49% in recent periods, reflecting improved operational efficiency over time.

PE: 13.5x

Recently, insiders at Breedon Group demonstrated their confidence by purchasing shares, signaling potential underappreciated value. With earnings expected to grow annually at 9.36%, the company's reliance on external borrowing—though riskier—hasn't deterred insider investments. This activity aligns with the perception that Breedon may be positioned for upward trajectory despite its funding strategy. Such insider moves often suggest a belief in the firm’s prospects and stability, making it a noteworthy consideration in the realm of undervalued entities within its sector.

Mitie Group

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitie Group is a UK-based facilities management company that operates across various sectors including business services, technical services, communities, and central government and defense.

Operations: The company's gross profit margin has shown variability over recent periods, ranging from 10.86% to 11.25%, reflecting changes in cost of goods sold and revenue dynamics. Notably, the gross profit increased to £475.8 million on revenues of £4299.6 million by the end of 2023, indicating a margin of approximately 11.07%.

PE: 11.9x

Mitie Group, a notable player in the UK's small-cap landscape, has demonstrated strong financial performance with a 38% dividend increase and robust year-over-year earnings growth. With sales surging to £4.45 billion and net income reaching £126.3 million, the company's strategic maneuvers include replacing Vinci at Coventry and Rugby Hospital, enhancing its market position. Insider confidence is evident as they recently purchased shares, signaling belief in the firm’s prospects amidst plans to repurchase £50 million worth of shares by September 2024.

Click to explore a detailed breakdown of our findings in Mitie Group's valuation report.

Assess Mitie Group's past performance with our detailed historical performance reports.

Sirius Real Estate

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate is a company that specializes in owning and operating business parks, offices, and industrial complexes primarily in Germany, with a market capitalization of approximately €1.31 billion.

Operations: Property Investment generates €289.40 million in revenue, with a notable gross profit margin of 57.50%. This segment involves substantial operating expenses and non-operating income fluctuations impacting net income margins, which recently recorded at 37.25%.

PE: 16.0x

Sirius Real Estate, a notable player in the UK's real estate sector, recently bolstered its financial agility by raising £152.5 million through equity offerings, setting a solid foundation for future acquisitions. This move follows their declaration of increased dividends and robust earnings growth, signaling strong operational health. Notably, insider confidence is evident as Asset Management Director Craig Hoskins recently invested approximately £216 thousand in company shares, markedly increasing their stake by over 93%. These strategic decisions underscore Sirius' commitment to growth and shareholder value amidst its pursuit of expanding its asset base in Germany and the UK.

Taking Advantage

Dive into all 29 of the Undervalued UK Small Caps With Insider Buying we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BREE LSE:MTO and LSE:SRE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com