Exploring Chinese Dividend Stocks In July 2024

As of July 2024, Chinese equities have experienced a downturn, with underwhelming manufacturing data highlighting concerns about the slowing economy. This backdrop sets a critical stage for investors looking at dividend stocks in China, where stability and consistent returns become even more valuable. In this environment, identifying stocks that offer not only dividends but also stability and potential for growth is crucial for investors aiming to navigate the complexities of the Chinese market effectively.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 4.02% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.10% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.67% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.73% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.53% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.65% | ★★★★★★ |

HUAYU Automotive Systems (SHSE:600741) | 4.72% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.60% | ★★★★★★ |

Click here to see the full list of 241 stocks from our Top Chinese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

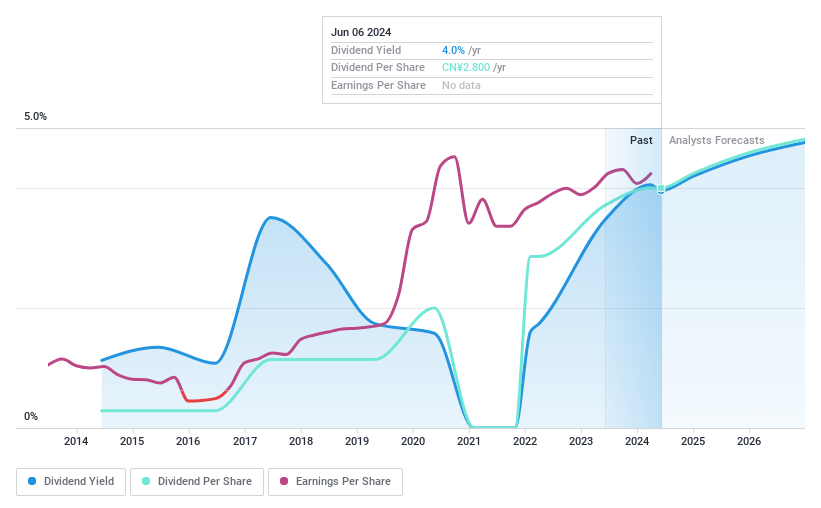

Chongqing Brewery

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chongqing Brewery Co., Ltd. operates in China, focusing on the production and sale of beers and non-alcoholic beverages, with a market capitalization of approximately CN¥30.22 billion.

Operations: Chongqing Brewery Co., Ltd. generates CN¥15.10 billion in revenue primarily from its beer sales.

Dividend Yield: 4.5%

Chongqing Brewery has shown a notable increase in sales and net income as per its latest quarterly report, with revenues climbing to CNY 4.29 billion from CNY 4.01 billion year-over-year, and net income rising to CNY 451.94 million. Despite this growth, the company's dividend history is marked by volatility and coverage issues, with dividends not well covered by earnings due to a high payout ratio of 96.9%. However, the dividend yield stands at a competitive 4.48%, which is above the market average of 2.63%.

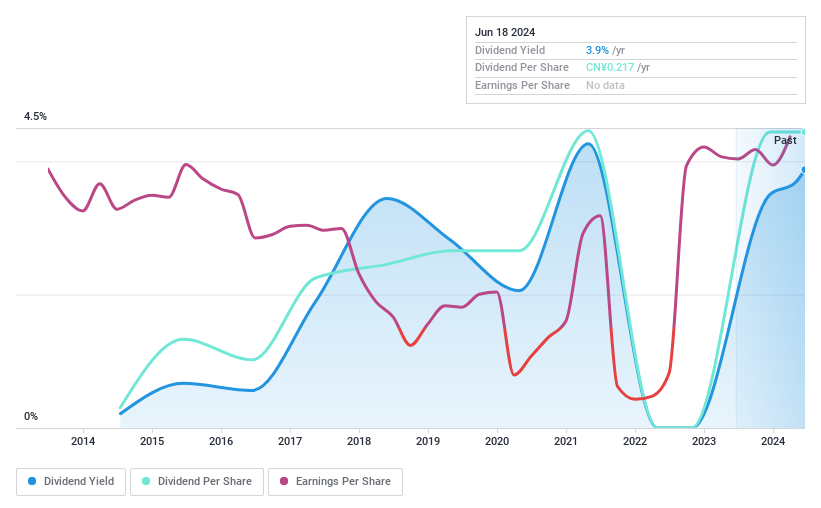

Jiangnan Mould & Plastic Technology

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. specializes in the manufacturing of plastic parts for the automobile industry, with a market capitalization of approximately CN¥5.31 billion.

Operations: The revenue segments for Jiangnan Mould & Plastic Technology Co., Ltd. are not specified in the provided text.

Dividend Yield: 3.8%

Jiangnan Mould & Plastic Technology has demonstrated a mixed performance in dividends, characterized by volatility over the past decade. Despite this, its dividends are reasonably covered with a payout ratio of 37.8% and a cash payout ratio of 22.6%, indicating sustainability from both earnings and cash flow perspectives. Recent earnings reports show significant growth, with quarterly net income more than doubling to CNY 144.41 million and annual revenue increasing to CNY 8.72 billion, suggesting potential stability going forward.

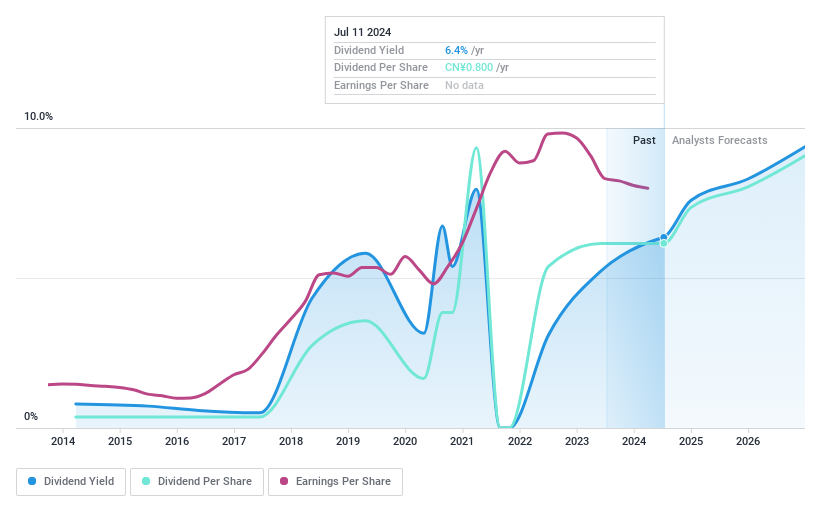

Luyang Energy-Saving Materials

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luyang Energy-Saving Materials Co., Ltd. specializes in researching, developing, producing, and selling a range of energy-saving products including ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick both domestically and internationally with a market capitalization of CN¥6.44 billion.

Operations: Luyang Energy-Saving Materials Co., Ltd. generates revenue from the sale of various energy-saving products such as ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick across domestic and international markets.

Dividend Yield: 6.4%

Luyang Energy-Saving Materials Co., Ltd. has a history of fluctuating dividends, with recent affirmations of a CNY 8.00 dividend per 10 shares for 2023, despite earnings and free cash flow not fully covering these payments, indicated by a high payout ratio of 83.4% and a cash payout ratio of 127.3%. The firm's price-to-earnings ratio stands at an attractive 13.2x compared to the broader Chinese market average of 27.8x, suggesting relative value despite its dividend coverage challenges.

Seize The Opportunity

Dive into all 241 of the Top Chinese Dividend Stocks we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600132 SZSE:000700 and SZSE:002088.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance