Exploring Civmec Plus Two Notable Dividend Stocks in Singapore

The Singapore stock market has recently shown a flicker of optimism, climbing 1.7% over the last week, though it still reflects a downtrend from the previous year with a 6.7% decline. Despite this backdrop, earnings across the market are expected to grow by 7.3% annually, suggesting potential opportunities for investors focused on stocks that offer stable dividends in uncertain times.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.55% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.07% | ★★★★★☆ |

Asia Enterprises Holding (SGX:A55) | 7.04% | ★★★★★☆ |

Food Empire Holdings (SGX:F03) | 3.07% | ★★★★☆☆ |

Oversea-Chinese Banking (SGX:O39) | 5.95% | ★★★★☆☆ |

LHT Holdings (SGX:BEI) | 5.88% | ★★★★☆☆ |

OKP Holdings (SGX:5CF) | 2.92% | ★★★★☆☆ |

AnnAik (Catalist:A52) | 6.45% | ★★★★☆☆ |

Hong Leong Finance (SGX:S41) | 6.54% | ★★★★☆☆ |

UOB-Kay Hian Holdings (SGX:U10) | 4.44% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited is an investment holding company specializing in construction and engineering services for various sectors including energy, resources, infrastructure, marine, and defense within Australia, with a market capitalization of approximately SGD 406 million.

Operations: Civmec Limited generates its revenue primarily through three segments: Energy (A$46 million), Resources (A$753 million), and Infrastructure, Marine & Defence (A$106 million).

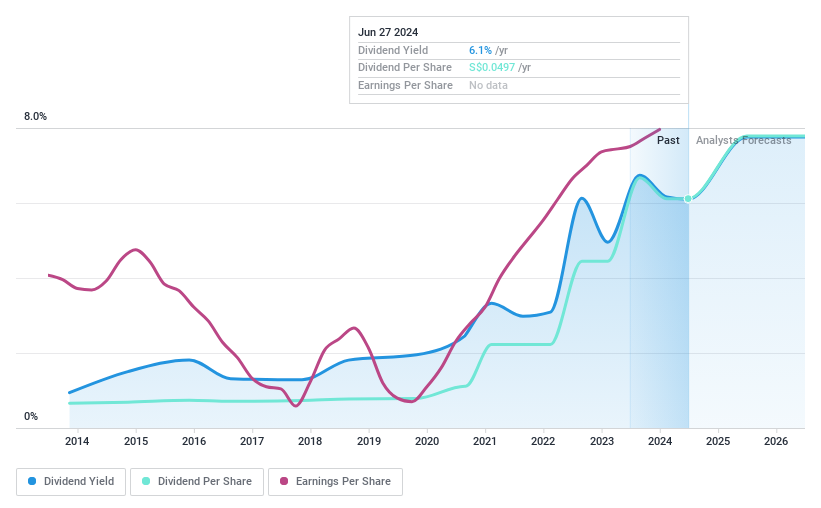

Dividend Yield: 6.1%

Civmec (SGX:P9D) presents a mixed picture for dividend-seeking investors. The company has demonstrated commendable financial prudence, significantly reducing its debt to equity ratio over five years and maintaining more cash than total debt, ensuring stability. Earnings have grown at a robust rate annually over the past five years, although this growth has decelerated in the last year. Dividend payments have not only been reliable and stable for a decade but are also well-supported by both earnings and free cash flow, with payout ratios that suggest sustainability. However, Civmec's dividend yield is slightly lower than the top quartile of Singapore market payers, and while profits are expected to grow, they may not surge dramatically. Revenue forecasts also indicate moderate growth ahead.

Dive into the specifics of Civmec here with our thorough dividend report.

Upon reviewing our latest valuation report, Civmec's share price might be too pessimistic.

Discovering a possibly undervalued opportunity can be exciting, but ensuring it fits well within your investment goals is essential. Do so seamlessly using the analytical power of Simply Wall St's portfolio tool.

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited is a multifaceted financial marketplace offering securities and derivatives trading and clearing services, with a market capitalization of approximately SGD 10.24 billion.

Operations: Singapore Exchange Limited generates revenue primarily through its integrated trading and clearing services for securities and derivatives, with a notable segment in fixed income, currencies, and commodities contributing SGD 371.53 million.

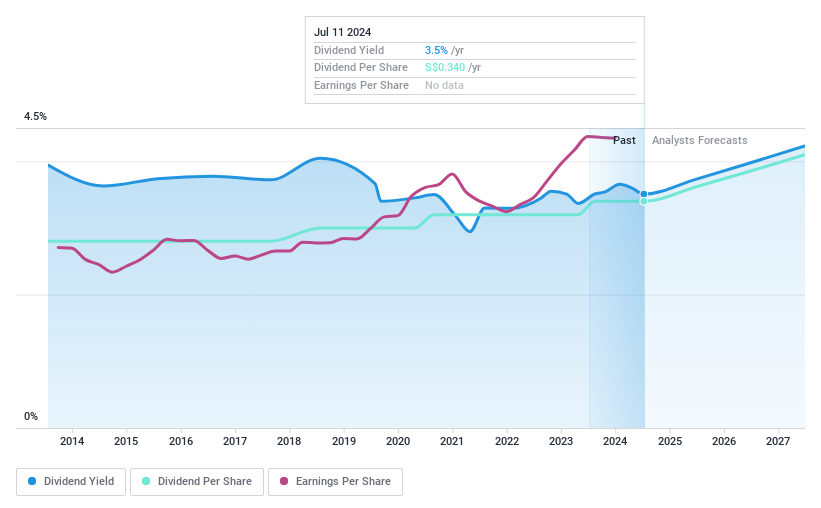

Dividend Yield: 3.6%

Singapore Exchange (SGX:S68) stands as a prudent choice for investors focused on dividends, with a track record of reliable and incrementally growing payouts over the last decade. Despite not being the highest yielder in Singapore's market, its dividend sustainability is underpinned by a sound financial structure, where cash reserves surpass total debt and both earnings and operating cash flow comfortably cover dividend obligations. The company has seen consistent profit margin improvement and earnings growth outpacing its five-year average, though it should be noted that debt to equity ratio has risen and future profit growth is not projected to be substantial.

Click to explore a detailed breakdown of our findings in Singapore Exchange's dividend report.

After identifying this stock as a potential bargain, streamline your investment strategy and monitor its progress with the comprehensive analytics provided by Simply Wall St's portfolio tool.

LHT Holdings (SGX:BEI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LHT Holdings Limited is a company that specializes in the manufacturing and trading of wooden pallets and timber-related products, operating across Singapore, Malaysia, and other international markets, with a market capitalization of approximately SGD 45.26 million.

Operations: LHT Holdings Limited generates its revenue primarily from the manufacture and trade of wooden pallets and packaging materials, which contributed SGD 36.943 million, alongside its other business segments including timber-related products, pallet rental services, and Technical Wood® products.

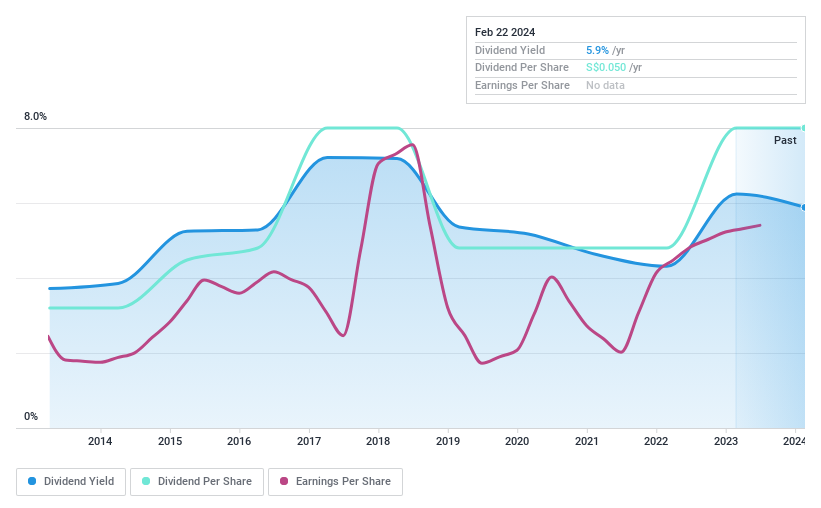

Dividend Yield: 5.9%

LHT Holdings, a debt-free enterprise, presents a conservative dividend play with its earnings expanding by 6.4% annually over five years and accelerating to 11.9% in the last year, outstripping its own historical performance. The company's dividends are underpinned by robust profit margins that have improved from the previous year and are sustainably financed with low payout ratios from both earnings and cash flows. However, investors should note BEI's dividend yield is modest relative to top market payers and its history of volatile payouts may raise concerns about long-term reliability despite recent growth trends.

Having identified potential in an undervalued stock is only part of successful investing as continuous evaluation is also key. Make it effortless with Simply Wall St's portfolio tool.

Final Remarks

Harness the power of data-driven insights to uncover dividend gems in Singapore's market using the Simply Wall St screener. Take a closer look at our Top Dividend Stocks list of 24 companies by clicking here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance