Exploring Dividend Stocks On Euronext Amsterdam Acomo And Two Others

As global markets navigate through a complex landscape of varying interest rate expectations and economic signals, the Netherlands market remains an intriguing area for investors, particularly those interested in dividend stocks. Amid these dynamics, understanding what characterizes a resilient and potentially rewarding dividend stock becomes crucial, especially in a market environment where cautious optimism around corporate earnings and economic resilience prevails.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.62% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.75% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.56% | ★★★★☆☆ |

Van Lanschot Kempen (ENXTAM:VLK) | 9.84% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.36% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.12% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Acomo

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. is a company based in the Netherlands that specializes in sourcing, trading, processing, packaging, and distributing both conventional and organic food ingredients globally, with a market capitalization of approximately €514.16 million.

Operations: Acomo N.V. generates revenue from various segments including Tea (€120.62 million), Edible Seeds (€257.29 million), Food Solutions (€24.07 million), Spices and Nuts (€429.96 million), and Organic Ingredients (€436.38 million).

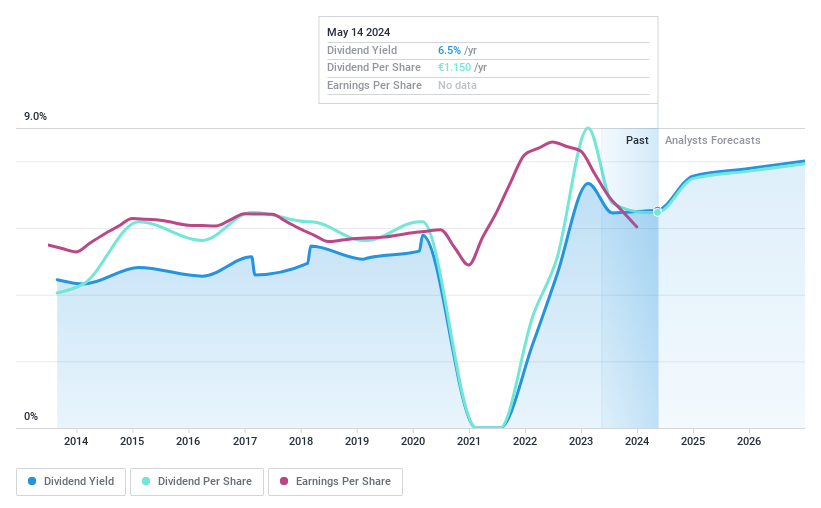

Dividend Yield: 6.6%

Acomo's dividend yield of 6.62% ranks in the top 25% in the Dutch market, offering an attractive return compared to the average of 5.58%. Despite trading at a significant discount to its estimated fair value, Acomo's dividends have shown volatility over the past decade and carry a high level of debt. However, dividends are well-supported by earnings with a payout ratio of 85.7% and robustly covered by cash flows at a cash payout ratio of 26.1%.

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands, with a market capitalization of approximately €579.44 million.

Operations: Koninklijke Heijmans N.V. generates revenue from three main segments: Real Estate (€411.79 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

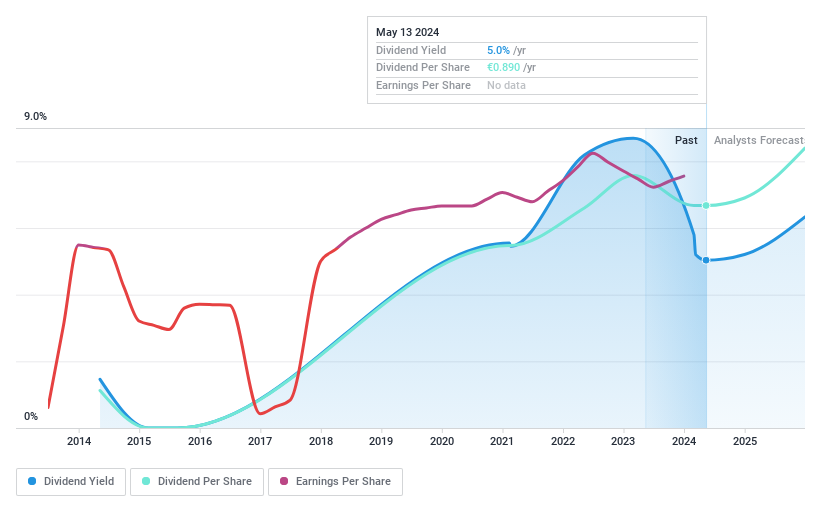

Dividend Yield: 4.1%

Koninklijke Heijmans offers a dividend yield of 4.12%, below the top tier in the Dutch market, yet its dividends are supported by a payout ratio of 37.1% and a cash payout ratio of 59%. Despite this reasonable coverage, dividends have been volatile over the past decade, reflecting an unstable track record. The company's earnings are projected to grow by 10.21% annually, but past earnings growth was impacted by significant one-off items. Recent events include a stock split effective May 7, 2024.

Van Lanschot Kempen

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV operates as a financial services provider offering a range of solutions in the Netherlands and internationally, with a market capitalization of approximately €1.72 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

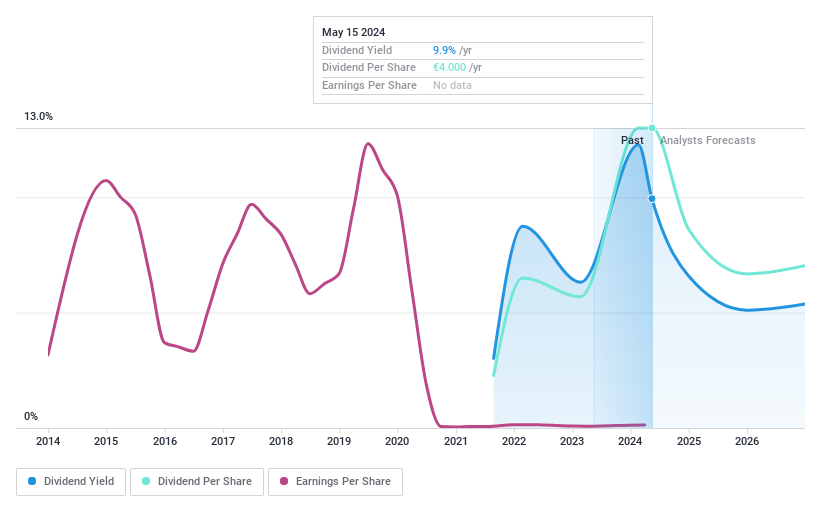

Dividend Yield: 9.8%

Van Lanschot Kempen, despite a short dividend history of less than 10 years, shows promise with a growing dividend and a top quartile yield of 9.84% in the Dutch market. The company's payout ratio stands at 70.9%, indicating current earnings cover dividends well, with forecasts suggesting continued coverage at 66.6%. However, shareholder dilution occurred over the past year, and the company has only recently stabilized its dividend payments. Recent strategic moves include refinancing €100 million of Tier 1 notes and appointing a new Chief Risk Officer effective June 2024.

Taking Advantage

Unlock more gems! Our Top Euronext Amsterdam Dividend Stocks screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Top Euronext Amsterdam Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ACOMO ENXTAM:HEIJM and ENXTAM:VLK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance