Exploring Euronext Paris Dividend Stocks In May 2024

Amidst a backdrop of cautious optimism in European markets, where the CAC 40 Index recently saw a modest decline, investors continue to seek stable returns through dividend stocks. As we explore Euronext Paris Dividend Stocks in May 2024, understanding the broader economic signals and market dynamics becomes crucial for identifying stocks that not only offer attractive dividends but also stability in fluctuating market conditions.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.13% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.65% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.37% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 6.16% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.16% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.22% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.51% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.99% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.60% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.27% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services across multiple client segments in France, with a market capitalization of approximately €1.04 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates €505.07 million from its retail banking operations in France.

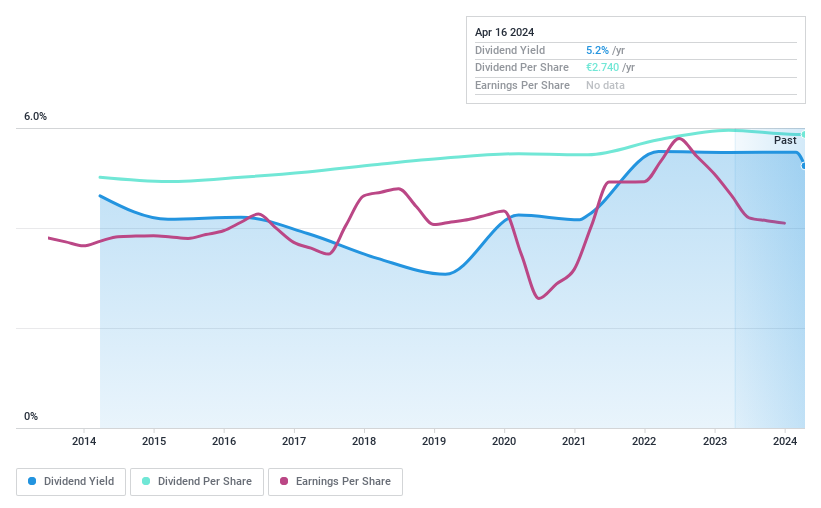

Dividend Yield: 5.2%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc reported a decrease in net interest income and net income for 2023, with figures at €362.84 million and €175.58 million respectively. Despite this, the company maintains a stable dividend history over the past decade, recently declaring a cash dividend of €2.74 per share due April 16, 2024. Trading significantly below estimated fair value and with a modest payout ratio of 30.9%, its dividends appear sustainable though yield remains low at 5.21% compared to top French payers.

Compagnie Générale des Établissements Michelin Société en commandite par actions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions is a global manufacturer and seller of tires, with a market capitalization of approximately €26.80 billion.

Operations: Compagnie Générale des Établissements Michelin generates €14.34 billion from its Automotive segment, €6.98 billion from Road Transportation, and €7.03 billion in its Specialty Businesses sector.

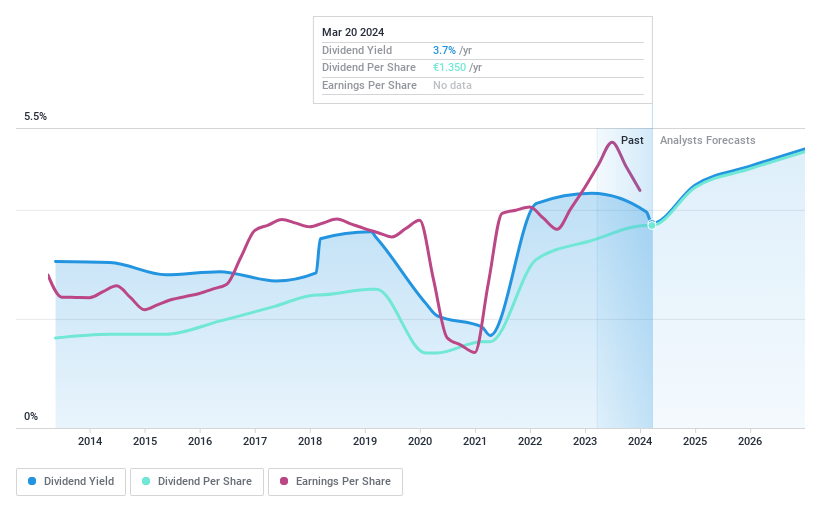

Dividend Yield: 3.6%

Compagnie Générale des Établissements Michelin has demonstrated a mixed track record in dividend reliability, with payments showing volatility over the last decade. Despite this, dividends are well-covered by both earnings and cash flows, with payout ratios of 48.7% and 31.6% respectively. Recent financial activities include issuing €497.19 million in fixed-income bonds to strengthen its capital structure. However, its dividend yield of 3.6% remains below the French market's top quartile average of 5.21%.

Colas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA is a global company that constructs and maintains transport infrastructure, with a market capitalization of approximately €5.71 billion.

Operations: Colas SA's revenue is primarily derived from its various regional road construction and maintenance operations, including €5.97 billion from Roads France-Overseas France/IO, €3.36 billion from Roads EMEA (Europe-Middle East-Africa), €2.38 billion from Canada Routes, €2.24 billion from Roads United States, and smaller contributions of €1.38 billion from Railways and Other Activities and €0.47 billion from Roads Asia-Pacific.

Dividend Yield: 4.2%

Colas exhibits a lower dividend yield of 4.2%, underperforming the top French dividend payers' average of 5.35%. Despite this, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 81.3% and 58.9% respectively, indicating reasonable financial management. However, Colas has faced challenges with dividend stability and reliability over the past decade, reflecting a volatile track record that could concern conservative dividend investors seeking consistent returns.

Click here to discover the nuances of Colas with our detailed analytical dividend report.

Our expertly prepared valuation report Colas implies its share price may be too high.

Taking Advantage

Click this link to deep-dive into the 31 companies within our Top Euronext Paris Dividend Stocks screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CRLA ENXTPA:ML and ENXTPA:RE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance