Exploring HEXPOL And Two More High Yield Dividend Stocks In Sweden

As global markets show signs of cautious optimism, with easing inflation concerns in major economies and mixed performances across European indices, investors are increasingly looking for stable returns amidst the uncertainty. In this context, exploring high-yield dividend stocks like HEXPOL in Sweden becomes particularly appealing as they offer potential for steady income in a fluctuating market environment.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.21% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.69% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.36% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.07% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.01% | ★★★★★☆ |

Duni (OM:DUNI) | 4.39% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.64% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.24% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.12% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 3.91% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

HEXPOL

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) specializes in the development, manufacture, and sale of polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia, with a market capitalization of approximately SEK 44.88 billion.

Operations: HEXPOL AB generates SEK 20.48 billion from its Compounding segment and SEK 1.59 billion from its Engineered Products segment.

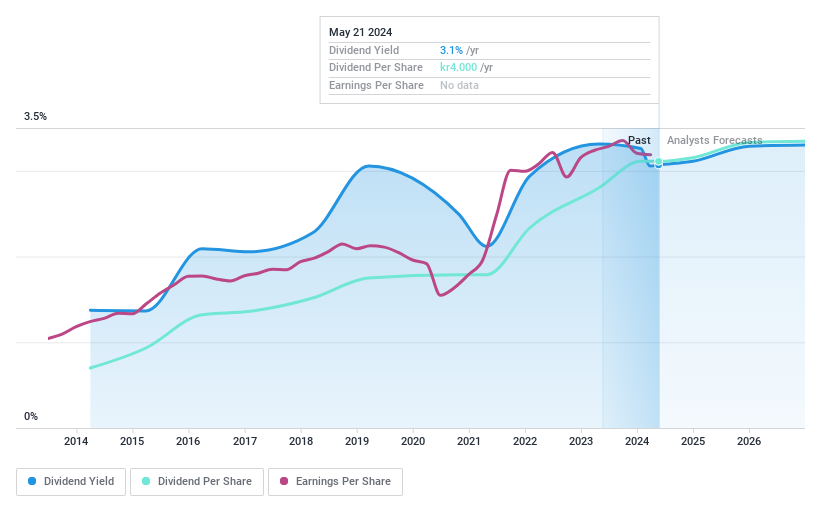

Dividend Yield: 3.1%

HEXPOL AB, a Swedish polymer company, declared a dividend of SEK 6.00 per share for 2023, with a record date of April 30, 2024. The firm's dividends are well-covered by earnings and cash flows with payout ratios near 54.9% and 54.6% respectively, indicating sustainability. Despite the modest yield of 3.07%, which is below the top quartile in Sweden's market at over 4%, HEXPOL has maintained stable dividend growth over the past decade. Recent strategic moves include seeking acquisitions to bolster growth, aligning with its financial stability and ongoing commitment to shareholder returns.

Nordea Bank Abp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nordea Bank Abp is a financial services provider operating in Sweden, Finland, Norway, Denmark, and internationally, with a market capitalization of approximately SEK 460.70 billion.

Operations: Nordea Bank Abp generates revenue through its Personal Banking (€4.75 billion), Business Banking (€3.55 billion), Large Corporates & Institutions (€2.46 billion), and Asset and Wealth Management (€1.44 billion) segments.

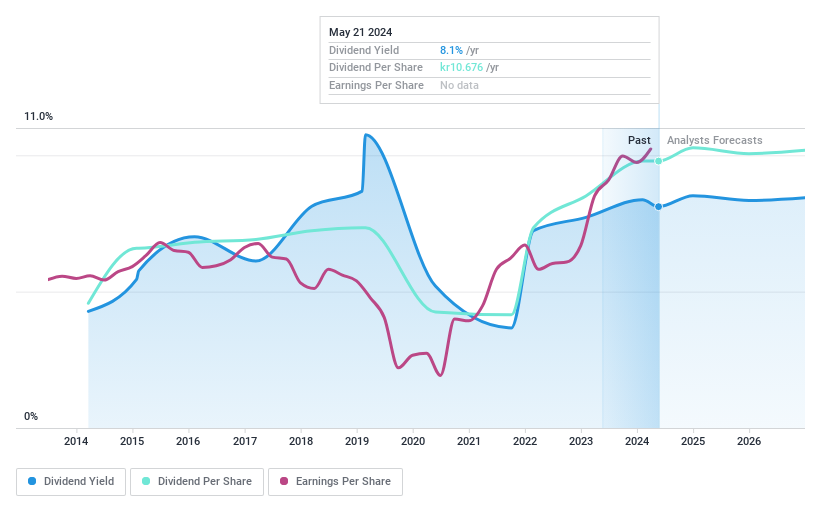

Dividend Yield: 8.1%

Nordea Bank Abp reported a strong first quarter in 2024, with net interest income and net income showing significant increases from the previous year. The bank has set a dividend of EUR 0.92 per share, maintaining its commitment despite an unstable dividend track record over the past decade. Earnings have grown substantially over the past five years, although future forecasts suggest a slight decline. The recent AGM rejected environmental amendments proposed by shareholders but confirmed strategic board changes, enhancing governance expertise.

AB SKF

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and related services with a market capitalization of approximately SEK 107.21 billion.

Operations: AB SKF generates SEK 29.79 billion from its Automotive segment and SEK 72.25 billion from its Industrial segment in revenue.

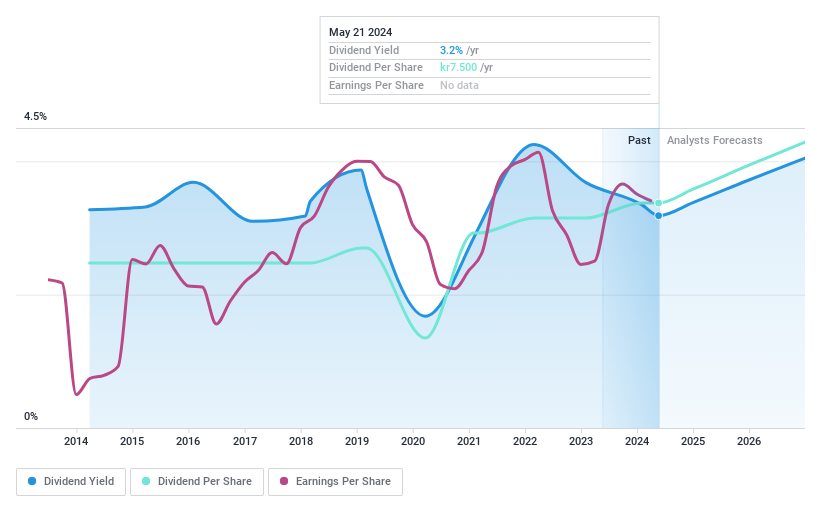

Dividend Yield: 3.2%

AB SKF recently approved a dividend of SEK 7.50 per share, effective for shareholders registered by 28 March 2024. Despite this, the company's dividend history has been marked by volatility and unreliability over the past decade. In Q1 2024, AB SKF reported a decrease in sales and net income compared to the previous year, with earnings per share also dropping from SEK 4.55 to SEK 4.15. The company anticipates a negative currency impact of approximately SEK 200 million on operating profit in Q2 based on current exchange rates.

Click here to discover the nuances of AB SKF with our detailed analytical dividend report.

Our valuation report unveils the possibility AB SKF's shares may be trading at a discount.

Make It Happen

Delve into our full catalog of 22 Top Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:HPOL B OM:SKF B and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance