Exploring iDreamSky Technology Holdings And Two Other Undervalued Small Caps With Insider Actions In Hong Kong

Amid a backdrop of global market fluctuations and specific downturns in Hong Kong's Hang Seng Index, investors might find potential opportunities in undervalued small-cap stocks. These smaller companies, often less scrutinized by mainstream analysts, can offer unique growth prospects especially when insider actions suggest confidence in the firm's future.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Xtep International Holdings | 11.0x | 0.8x | 41.23% | ★★★★★☆ |

Wasion Holdings | 12.2x | 0.9x | 25.28% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 8.0x | 0.7x | -24.10% | ★★★★☆☆ |

Nissin Foods | 15.0x | 1.3x | 36.46% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.8x | 0.1x | -1.91% | ★★★★☆☆ |

Transport International Holdings | 11.4x | 0.6x | 44.97% | ★★★★☆☆ |

Abbisko Cayman | NA | 102.8x | 32.13% | ★★★★☆☆ |

Giordano International | 8.7x | 0.8x | 35.93% | ★★★☆☆☆ |

China Leon Inspection Holding | 10.5x | 0.8x | 22.65% | ★★★☆☆☆ |

China Lesso Group Holdings | 3.8x | 0.3x | -71.70% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

iDreamSky Technology Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: iDreamSky Technology Holdings is a company that specializes in game and information services, including SaaS and other related services.

Operations: Game and Information Services, including SaaS and related services, generated CN¥1.92 billion in revenue. The company's gross profit margin stood at 35.14% as of the latest reporting period.

PE: -9.5x

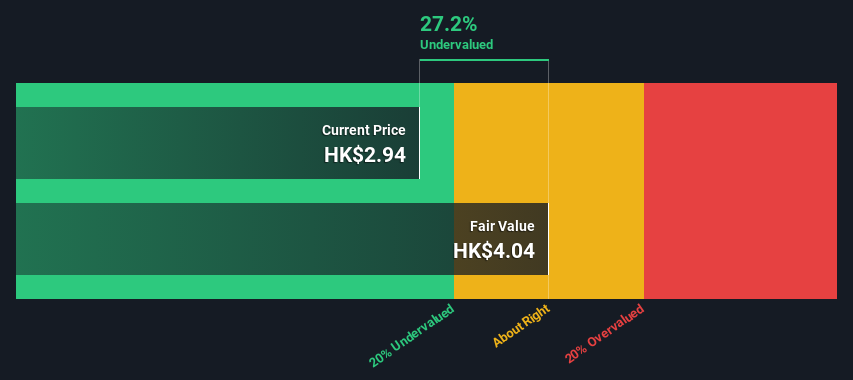

iDreamSky Technology Holdings has recently demonstrated insider confidence, with significant share purchases made by insiders, signaling strong belief in the company's prospects. Despite facing shareholder dilution over the past year, earnings are anticipated to surge by 104% annually. Operating solely on external borrowing heightens financial risk but also underscores a lean operational model free of customer deposit liabilities. With its upcoming annual general meeting and Q1 results report, stakeholders are keenly watching for further growth indicators.

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company focused on various business sectors, with a market capitalization of approximately CN¥1.27 billion.

Operations: The company's gross profit margin saw a notable increase from 9.05% in the third quarter of 2013 to approximately 59.07% by the end of the second quarter of 2024, reflecting significant efficiency improvements in managing cost of goods sold relative to revenue, which escalated from CN¥102.90 million to CN¥4745.07 million over the same period.

PE: 4.3x

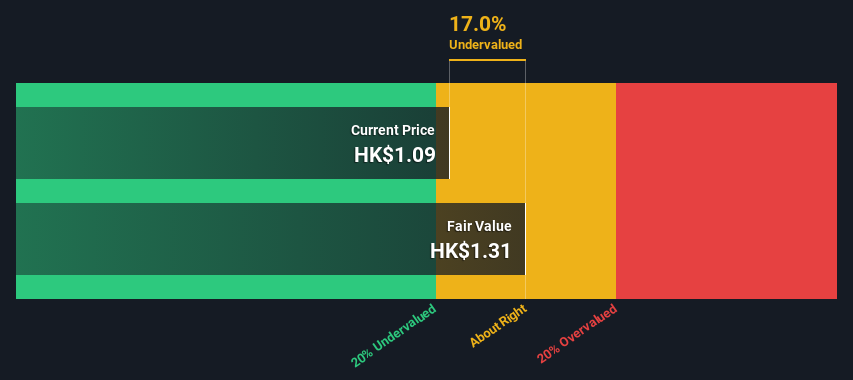

Kinetic Development Group, a lesser-known entity in Hong Kong's bustling market, recently showcased insider confidence with significant share purchases. This move, coupled with their strategic amendments to company bylaws and consistent dividend payouts—HKD 0.05 per share finalized at the latest annual meeting—signals a robust governance framework and commitment to shareholder returns. Despite relying solely on external borrowing, which presents a higher risk funding model, the firm's ability to maintain financial stability while navigating corporate adjustments reflects its potential resilience and growth prospects in an evolving market landscape.

Abbisko Cayman

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a company focused on the development of innovative medicines, with a market capitalization of CN¥19.06 billion.

Operations: The company generates revenue primarily from the development of innovative medicines, with a consistent gross profit margin of 100% across various reporting periods. However, it has experienced significant operating losses due to high R&D and general administrative expenses, leading to negative net income margins that have shown improvement from -107.42% in early 2021 to -22.64% by mid-2024.

PE: -4.5x

Abbisko Cayman, a lesser-known entity in Hong Kong’s bustling market, has recently demonstrated insider confidence with significant share repurchases initiated on June 18, 2024. This move underscores the belief insiders hold in the company's prospects amidst its current challenges of lacking meaningful revenue and profitability forecasts pointing downwards. However, promising clinical results from its FGFR4 inhibitor for treating liver cancer hint at potential strategic value, suggesting avenues for growth despite financial headwinds.

Key Takeaways

Navigate through the entire inventory of 20 Undervalued Small Caps With Insider Buying here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:1277 and SEHK:2256.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance