Exploring May 2024's Top Three Dividend Stocks

As the U.S. stock market shows signs of strength, with the S&P 500 nearing its all-time high and the Dow Jones Industrial Average extending its winning streak, investors are keenly awaiting more economic data that could influence market movements. In such a vibrant market environment, dividend stocks remain a point of interest for those looking to potentially stabilize their portfolios with steady income streams amidst fluctuating economic indicators.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.12% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.82% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.04% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.82% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.70% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.67% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.64% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.86% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.42% | ★★★★★☆ |

Evans Bancorp (NYSEAM:EVBN) | 4.98% | ★★★★★☆ |

Click here to see the full list of 203 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

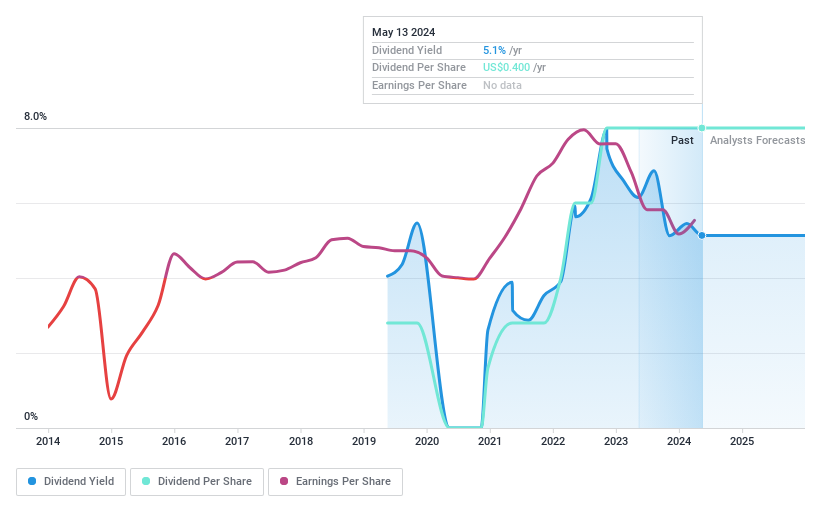

Pangaea Logistics Solutions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions Ltd. operates globally, offering seaborne dry bulk logistics and transportation services to industrial clients, with a market capitalization of approximately $364.88 million.

Operations: Pangaea Logistics Solutions Ltd. generates its revenue primarily from the transportation-shipping segment, amounting to $490.32 million.

Dividend Yield: 5.1%

Pangaea Logistics Solutions has a mixed track record with dividends, having paid them for only 5 years with some volatility and a notable annual drop over 20%. Despite this, the dividend yield stands at a competitive 5.13%, higher than the US market average of 4.66%. The dividends are reasonably covered by both earnings and cash flows, with payout ratios of 52% and 78.6% respectively. However, profit margins have decreased from last year's 10.1% to current 7%, indicating potential pressure on profitability. Recent financials show an increase in net income and basic earnings per share in Q1 2024 compared to the previous year, alongside consistent dividend payments.

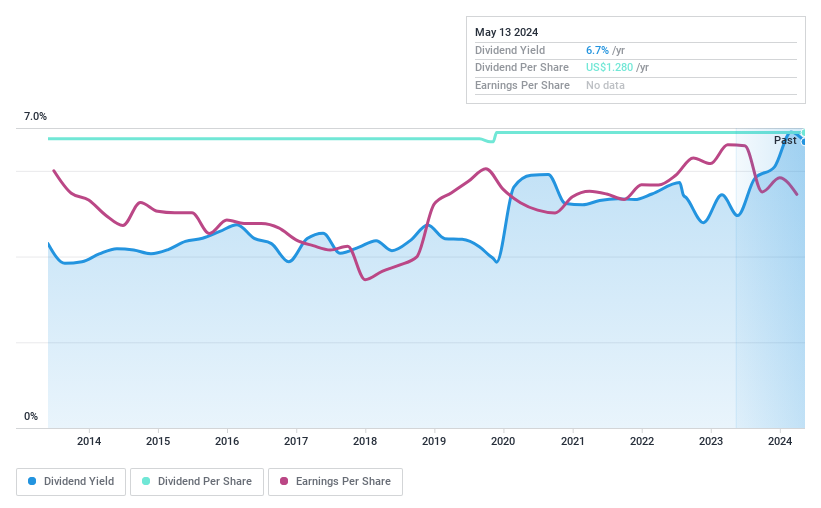

Penns Woods Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Penns Woods Bancorp, Inc., serving as the bank holding company for Jersey Shore State Bank, offers commercial and retail banking services to a diverse clientele including individuals and corporations, with a market capitalization of approximately $144.04 million.

Operations: Penns Woods Bancorp, Inc. generates its revenue primarily through community banking, accounting for $64.02 million.

Dividend Yield: 6.7%

Penns Woods Bancorp reported a decrease in net interest income and net income for Q1 2024, with earnings per share also falling from the previous year. Despite these declines, the company maintains a robust dividend yield of 6.68%, ranking in the top 25% of US dividend payers. The dividends, supported by a reasonable payout ratio of 58.7%, have shown stability and growth over the past decade, indicating reliability despite recent financial setbacks. Additionally, no shares were repurchased in the last quarter of 2023 under its announced buyback plan.

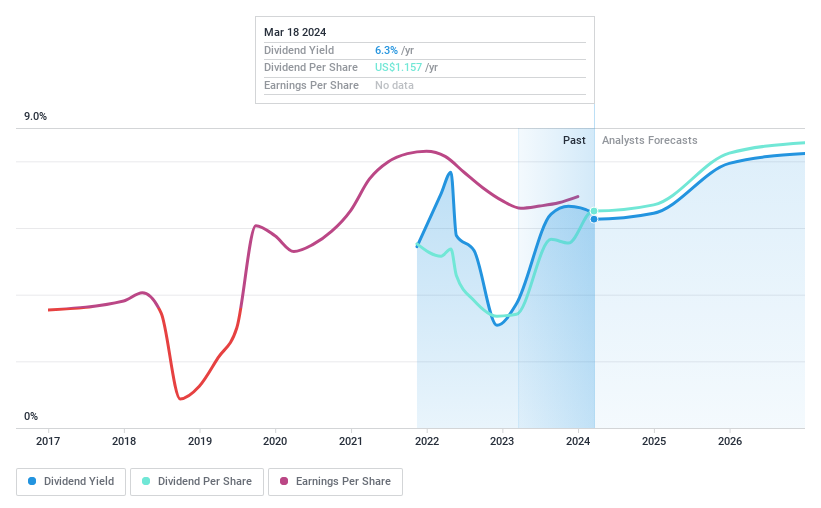

Qifu Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qifu Technology, Inc. operates a credit-tech platform known as 360 Jietiao in the People's Republic of China, with a market capitalization of approximately $3.26 billion.

Operations: Qifu Technology, Inc. generates its revenue primarily from unclassified services, totaling CN¥16.29 billion.

Dividend Yield: 5.5%

Qifu Technology has demonstrated a mix of challenges and strengths in its dividend profile. Despite a relatively short history of dividend payments, the company's dividends are well-covered by both earnings and cash flows, with payout ratios of 28.7% and 18.5% respectively. However, the dividend track record is unstable due to volatility in payments over less than a decade. Recently, Qifu announced a substantial share buyback program valued at US$350 million and reaffirmed its semi-annual dividend policy, planning to distribute about US$170 million for fiscal year 2023 based on up to 30% of its net income after tax from the preceding six months.

Seize The Opportunity

Click here to access our complete index of 203 Top Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:PANL NasdaqGS:PWOD and NasdaqGS:QFIN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance