Exploring Penns Woods Bancorp And Two More Leading Dividend Stocks

Amidst a fluctuating market landscape, where speculation about Federal Reserve rate cuts is influencing investor sentiment and indices are nearing record highs, understanding stable investment options becomes crucial. In this context, dividend stocks like Penns Woods Bancorp offer potential resilience and predictable income streams, aligning well with the current economic dynamics and investor needs for steadier returns.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.88% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.95% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.87% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.14% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.92% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.86% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.17% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.75% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.89% | ★★★★★☆ |

Union Bankshares (NasdaqGM:UNB) | 6.29% | ★★★★★☆ |

Click here to see the full list of 214 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

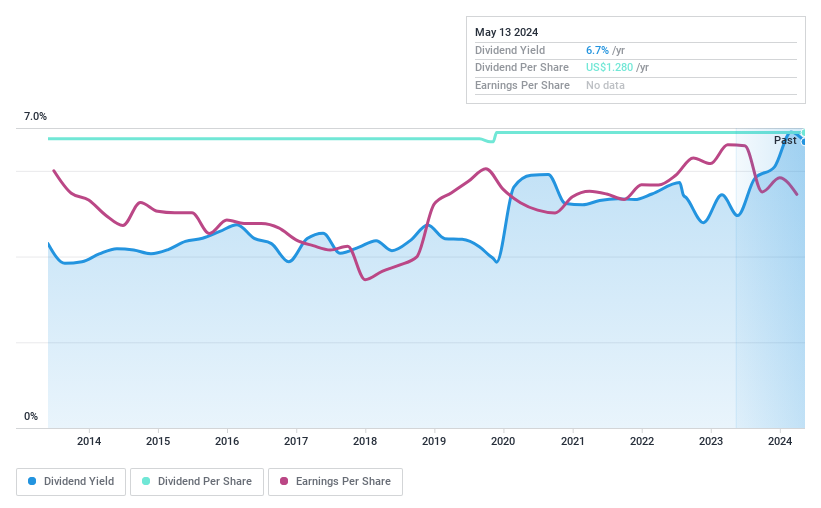

Penns Woods Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Penns Woods Bancorp, Inc. serves as the bank holding company for Jersey Shore State Bank, offering commercial and retail banking services to a diverse clientele, with a market capitalization of approximately $151.42 million.

Operations: Penns Woods Bancorp, Inc. generates its revenue primarily through community banking, which accounted for $63.69 million.

Dividend Yield: 6.4%

Penns Woods Bancorp recently confirmed a quarterly dividend of US$0.32 per share, payable on June 25, 2024, showcasing its commitment to shareholder returns. Additionally, the company announced a share repurchase program targeting up to 5% of its outstanding shares by May 2025. Despite a slight dip in net income and net interest income in Q1 2024 compared to the previous year, Penns Woods maintains an attractive dividend yield of 6.37%, supported by a reasonable payout ratio of 58.7%. The firm's dividends have shown stability and growth over the last decade, affirming its position as a solid candidate for dividend investors seeking reliability and potential income growth.

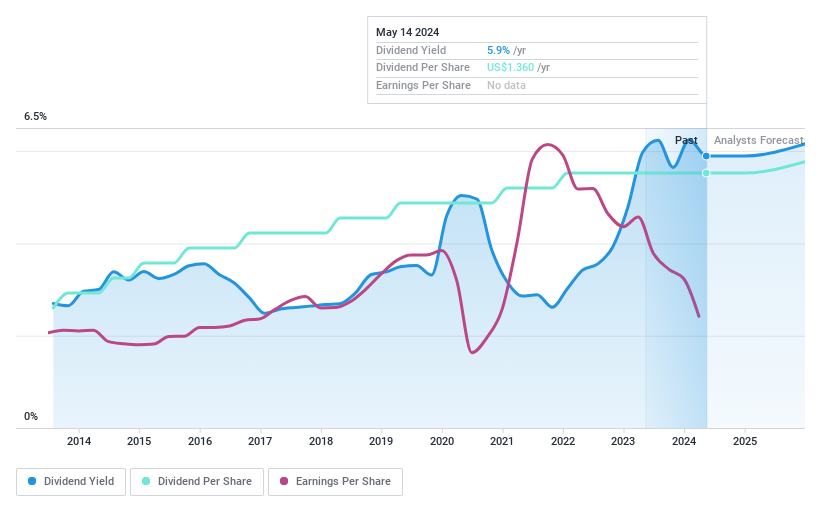

Sandy Spring Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sandy Spring Bancorp, Inc., serving as the bank holding company for Sandy Spring Bank, offers a range of services including commercial and retail banking, mortgage, private banking, and trust services in the United States, with a market capitalization of approximately $1.05 billion.

Operations: Sandy Spring Bancorp, Inc. generates its revenue primarily through commercial and retail banking, along with mortgage, private banking, and trust services.

Dividend Yield: 5.9%

Sandy Spring Bancorp has maintained a steady dividend, recently declaring US$0.34 per share for Q2 2024. Despite a 33.7% undervaluation and promising earnings growth forecast at 17.31% annually, concerns arise from its reduced profit margins year-over-year—from 35% to 23%. The firm's dividends are well-supported with a payout ratio of 66.4%, indicating sustainability despite insufficient data on future coverage by earnings or cash flows. Recent leadership changes with Charles S. Cullum ascending as CFO could signal strategic shifts or continuity in financial stewardship.

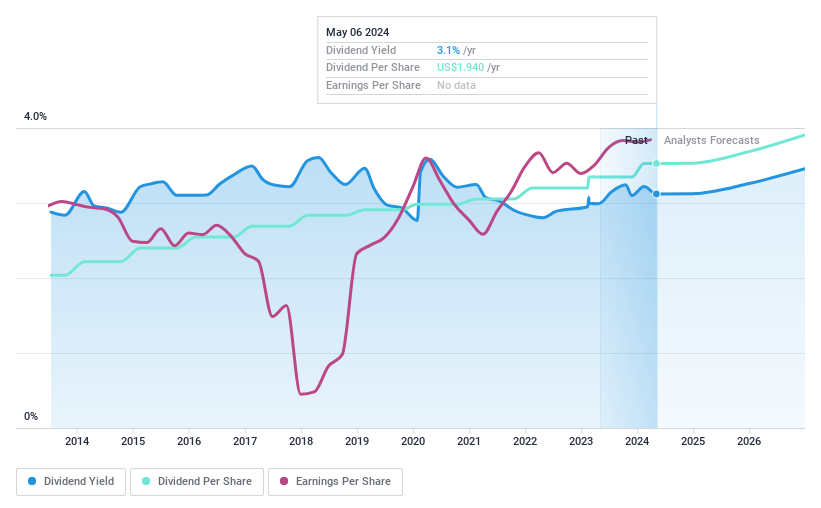

Coca-Cola

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Coca-Cola Company, a global beverage corporation, engages in the manufacturing, marketing, and sale of various nonalcoholic drinks with a market capitalization of approximately $271.10 billion.

Operations: Coca-Cola generates its revenue primarily from the sale of nonalcoholic beverages, totaling approximately $46.07 billion.

Dividend Yield: 3%

The Coca-Cola Company has been active in the fixed-income market, completing multiple offerings totaling over US$3.98 billion, with terms ranging up to 2064 and rates as high as 5.4%. These strategic moves could bolster long-term financial stability but also reflect a substantial increase in debt levels. Recently declared a quarterly dividend of US$0.485 per share, maintaining its reputation for reliable payouts supported by a payout ratio of 74.7% and covered by earnings and cash flows (83.4%). Despite this, its dividend yield of 3.03% remains modest compared to top US dividend payers.

Unlock comprehensive insights into our analysis of Coca-Cola stock in this dividend report.

Our valuation report unveils the possibility Coca-Cola's shares may be trading at a discount.

Where To Now?

Discover the full array of 214 Top Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:PWOD NasdaqGS:SASR and NYSE:KO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance