Exploring Secure Energy Services Among Top 3 Canadian Dividend Stocks

In the wake of recent economic indicators, the Canadian market has navigated through a mix of challenges and opportunities, underscored by the latest jobs report revealing a nuanced picture of the labor market. Amid these conditions, identifying dividend stocks with robust fundamentals becomes even more pivotal for investors seeking stability and growth potential.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.58% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.92% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.96% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 3.88% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.00% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.73% | ★★★★★☆ |

Goodfellow (TSX:GDL) | 6.97% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.64% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.41% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

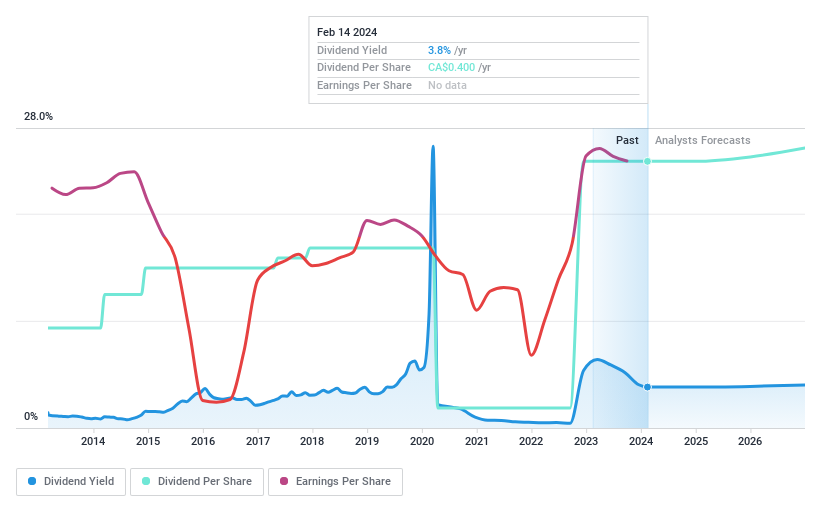

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in the waste management and energy infrastructure sectors primarily within Canada and the United States, with a market capitalization of CA$3.23 billion.

Operations: Secure Energy Services Inc. generates its revenue through three main segments: Oilfield Services with CA$399 million, Energy Infrastructure contributing CA$6.80 billion, and Environmental Waste Management (EWM) adding CA$1.05 billion.

Dividend Yield: 3.4%

Secure Energy Services recently closed a $300 million offering of 6.75% senior unsecured notes due 2029, aiming to improve its capital structure by redeeming higher-interest debt. This move, alongside a declared quarterly dividend of $0.10 per share payable in April 2024, underscores the company's strategy to enhance shareholder returns while managing its debt levels effectively. Despite a high level of debt, SES's dividends are well-supported by earnings and cash flows, with a payout ratio of 60.7% and a cash payout ratio of 49.2%, respectively. However, its dividend yield at 3.41% remains lower than the top quartile in the Canadian market, indicating room for improvement in attractiveness to income-focused investors.

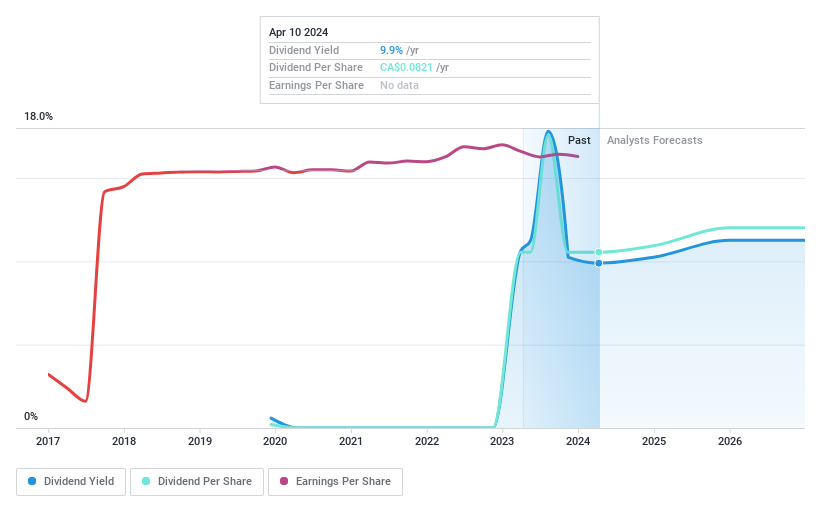

PetroTal (TSX:TAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroTal Corp. is a company focused on the development and exploration of oil and natural gas in Peru, South America, with a market capitalization of approximately CA$741.42 million.

Operations: PetroTal Corp. generates its revenue primarily from the exploration and production of oil and gas, amounting to $286.26 million.

Dividend Yield: 9.9%

PetroTal Corp. reported a decrease in revenue and net income for the year ended December 31, 2023, with revenues at USD 286.26 million and net income at USD 110.51 million. Despite this downturn, the company maintained a dividend payment of USD 0.02 per share in March 2024, reflecting its commitment to shareholder returns amidst challenges. The dividends are well-covered by earnings and cash flows, with payout ratios of 48.9% and cash payout ratio at 41.9%, respectively. Additionally, PetroTal has been active in share buybacks, repurchasing shares worth USD 6.5 million under its recent program, signaling confidence in its valuation and future prospects despite a volatile dividend history over the past four years and lower profit margins compared to the previous year.

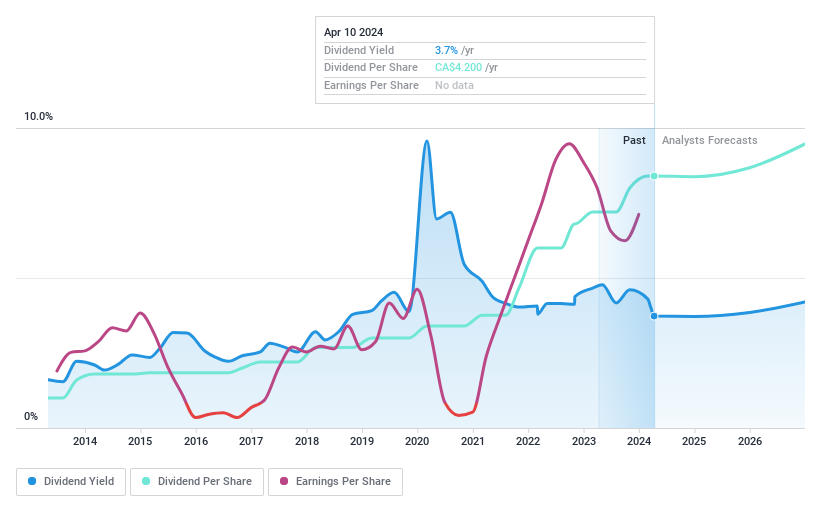

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited is a company engaged in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs), with a market capitalization of approximately CA$119 billion.

Operations: Canadian Natural Resources Limited generates its revenue primarily through three segments: Oil Sands Mining and Upgrading (CA$16.30 billion), Exploration and Production in North America (CA$17.32 billion), and smaller contributions from Midstream and Refining (CA$1.00 billion), as well as international operations in the North Sea (CA$0.44 billion) and Offshore Africa (CA$0.58 billion).

Dividend Yield: 3.7%

Canadian Natural Resources Limited (CNQ) has demonstrated a commitment to returning value to shareholders through its dividends, with a recent 5% increase in its quarterly cash dividend to CAD 1.05 per share, payable on April 5, 2024. This decision follows a year where CNQ reported a decrease in revenue and net income; however, the company's dividend payments remain sustainable with a payout ratio of 49% and covered by cash flows at a cash payout ratio of 60.5%. Additionally, CNQ is engaging in shareholder-friendly activities such as share repurchases, with an announcement on March 8, 2024, for a program to buy back up to 90.23 million shares by March 2025. Despite these positive aspects and trading below its estimated fair value by nearly 30%, CNQ's dividend yield of 3.73% is lower than the top quartile of Canadian dividend payers at over six percent, signaling potential room for growth or reconsideration for yield-focused investors.

Taking Advantage

Get an in-depth perspective on all 40 Top Dividend Stocks by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance