Exploring SGX Stocks With Estimated Intrinsic Discounts Ranging From 44.5% To 47.3%

The Singapore stock market continues to show resilience amidst global economic fluctuations, attracting attention from investors looking for value in a diverse market landscape. In this context, understanding what constitutes an undervalued stock is crucial, especially when considering investments that may offer significant intrinsic discounts in the current environment.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

LHN (SGX:41O) | SGD0.33 | SGD0.38 | 12% |

Singapore Technologies Engineering (SGX:S63) | SGD4.32 | SGD8.20 | 47.3% |

Hongkong Land Holdings (SGX:H78) | US$3.22 | US$5.80 | 44.5% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.925 | SGD1.65 | 44% |

Digital Core REIT (SGX:DCRU) | US$0.575 | US$1.10 | 47.7% |

Seatrium (SGX:5E2) | SGD1.41 | SGD2.61 | 46% |

Nanofilm Technologies International (SGX:MZH) | SGD0.84 | SGD1.47 | 42.7% |

Let's dive into some prime choices out of from the screener

Seatrium

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors with a market capitalization of SGD 4.80 billion.

Operations: The company generates revenue primarily through its segments in rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding which collectively contribute SGD 7.26 billion, along with a smaller segment in ship chartering bringing in SGD 31.63 million.

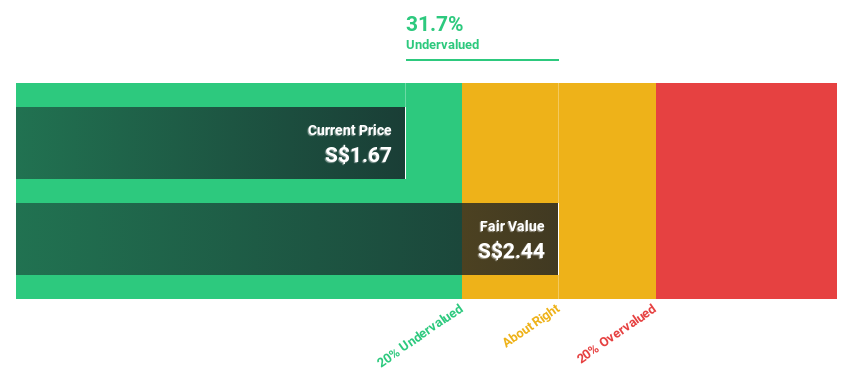

Estimated Discount To Fair Value: 46%

Seatrium Limited is trading at S$1.41, significantly below its estimated fair value of S$2.61, marking a 46% undervaluation based on discounted cash flow analysis. Analyst consensus forecasts a substantial 92.4% potential increase in stock price, with earnings expected to grow by 72.23% annually. Despite this growth, its projected Return on Equity of 8.2% remains modest compared to benchmarks. Recent contracts with GE Vernova and BP hint at robust operational expansion but share price volatility persists, reflecting market caution amidst recent high-profile executive changes and legal settlements.

The analysis detailed in our Seatrium growth report hints at robust future financial performance.

Click here to discover the nuances of Seatrium with our detailed financial health report.

Hongkong Land Holdings

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia and other international locations with a market cap of approximately $7.11 billion.

Operations: The company generates revenue from two primary segments: Investment Properties, which contributed approximately $1.08 billion, and Development Properties, accounting for about $0.76 billion.

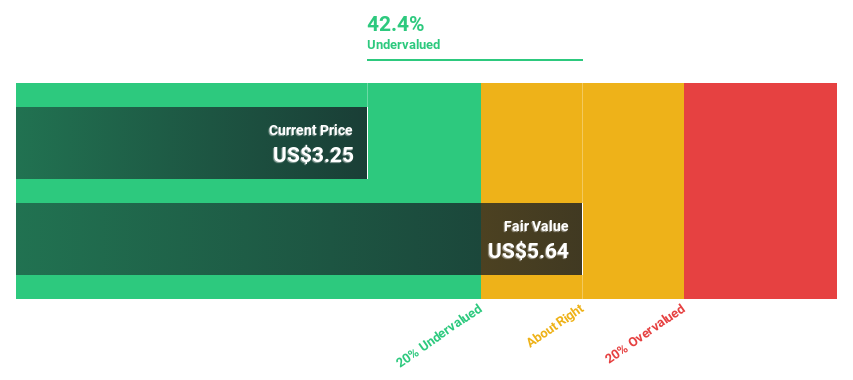

Estimated Discount To Fair Value: 44.5%

Hongkong Land Holdings, priced at S$3.22, is significantly undervalued by 44.5% against a fair value estimate of S$5.8, reflecting strong potential despite moderate growth forecasts. The company's revenue is expected to grow annually by 4.6%, outpacing the Singapore market's 3.6%. While its Return on Equity is projected to remain low at 2.4%, earnings are anticipated to increase substantially each year at a rate of 43.34%. However, its current dividend yield of 6.83% is poorly supported by earnings, suggesting financial caution.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering company with a market capitalization of SGD 13.47 billion.

Operations: The company's revenue is segmented into Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

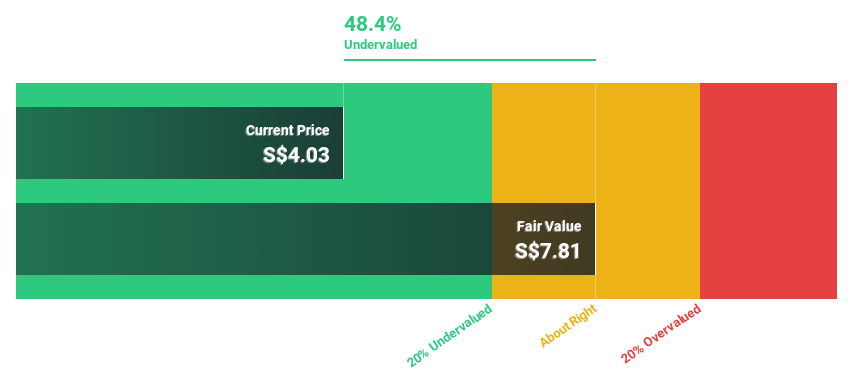

Estimated Discount To Fair Value: 47.3%

Singapore Technologies Engineering, trading at S$4.32, is valued below the estimated fair value of S$8.20, indicating a significant undervaluation by more than 20%. Earnings have shown modest growth of 1.1% annually over the past five years and are projected to increase by 11.6% per year, outpacing the Singapore market's average. Despite this promising growth and a recent share repurchase initiative signaling confidence from management, concerns exist due to its high level of debt and unstable dividend track record.

Taking Advantage

Embark on your investment journey to our 7 Undervalued SGX Stocks Based On Cash Flows selection here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:5E2 SGX:H78 and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com