Exploring Three ASX Growth Companies With High Insider Ownership

Amidst a backdrop of fluctuating market conditions, with the ASX200 experiencing a slight downturn and sectors like real estate and consumer staples facing declines, investors are keenly observing movements within the Australian market. In this environment, understanding the significance of insider ownership in growth companies can provide valuable insights, especially when high insider ownership might signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

DUG Technology (ASX:DUG) | 28.3% | 43.3% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Let's dive into some prime choices out of from the screener.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.35 billion.

Operations: The primary revenue segment for the business, generating A$339.32 million, comes from mine operations.

Insider Ownership: 18.6%

Earnings Growth Forecast: 22.8% p.a.

Emerald Resources, an Australian growth company with high insider ownership, is trading at A$74.5% below its estimated fair value. Despite recent shareholder dilution, EMR's earnings have surged by 53.4% over the past year and are projected to grow at 22.76% annually for the next three years—outpacing both its previous performance and market averages. The company also reported a significant increase in half-year sales to A$176.75 million from A$133.69 million, boosting net income to A$46.87 million from A$26.59 million previously.

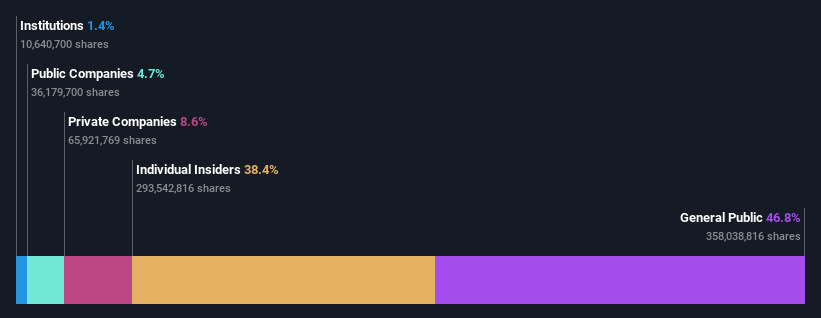

OM Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OM Holdings Limited operates globally, focusing on mining, smelting, trading, and marketing manganese ores and ferroalloys, with a market capitalization of approximately A$428.02 million.

Operations: The company generates revenue primarily through its smelting operations, which brought in A$388.84 million, and its marketing and trading activities, which accounted for A$602.07 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 29.8% p.a.

OM Holdings, an Australian growth company with high insider ownership, faces mixed financial dynamics. Despite a lower year-over-year sales and net income in 2023—A$589.24 million from A$856.55 million and A$18.14 million from A$67.84 million respectively—the company is set for significant earnings growth at 29.8% annually over the next three years, outperforming the market average of 13.5%. However, its return on equity is expected to remain low at 8.8%, and interest coverage issues persist alongside challenges from one-off financial items impacting results.

Click to explore a detailed breakdown of our findings in OM Holdings' earnings growth report.

Upon reviewing our latest valuation report, OM Holdings' share price might be too optimistic.

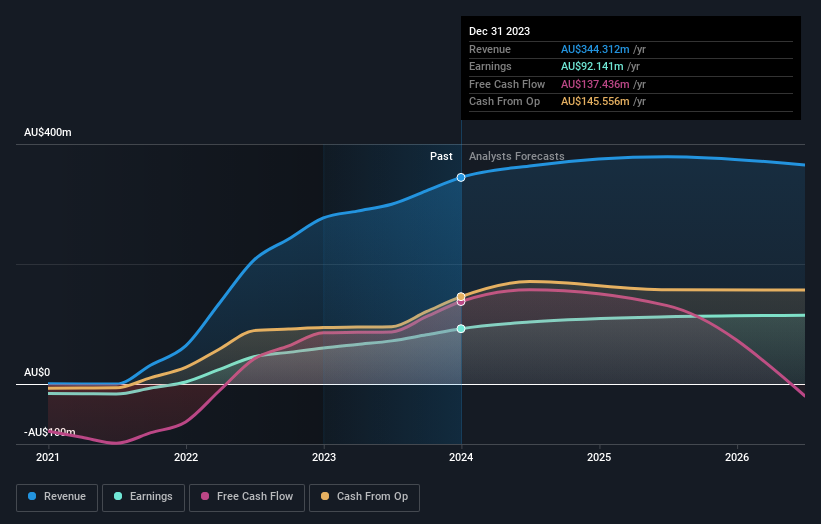

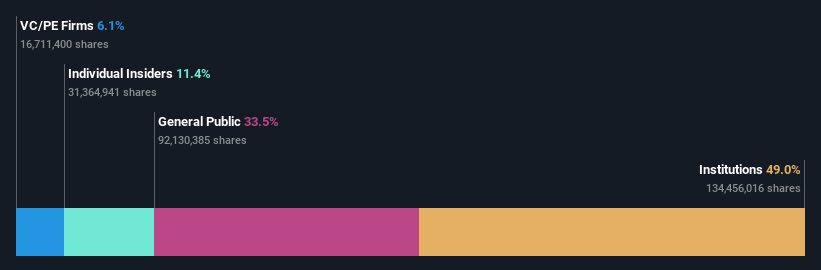

SiteMinder

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited is a company that develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers both in Australia and internationally, with a market capitalization of approximately A$1.46 billion.

Operations: The company generates its revenue primarily through software and programming services, totaling approximately A$171.70 million.

Insider Ownership: 11.4%

Earnings Growth Forecast: 69.4% p.a.

SiteMinder, a growth-focused Australian company with significant insider ownership, is trading at 39.9% below its estimated fair value. Despite recent losses—A$14.86 million for the half year ending December 2023—it's on a path to profitability within three years, supported by strong earnings growth of 69.39% per year and revenue increases of 19.7% annually, outpacing the Australian market's average of 5%. Additionally, SiteMinder was recently added to the S&P/ASX 200 Index, reflecting its growing industry stature.

Unlock comprehensive insights into our analysis of SiteMinder stock in this growth report.

The valuation report we've compiled suggests that SiteMinder's current price could be inflated.

Where To Now?

Reveal the 89 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:OMH and ASX:SDR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance