Exploring Three Dividend Stocks In Hong Kong For Your Portfolio

As global markets navigate through fluctuating economic signals, Hong Kong's Hang Seng Index has shown remarkable resilience with a significant surge. This vibrant backdrop sets an intriguing stage for investors considering dividend stocks as a potentially stabilizing addition to their portfolios. In this context, understanding the fundamentals of dividend-paying stocks becomes crucial, especially in a market environment where steady income streams are highly valued amidst broader volatility.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 8.53% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.39% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.44% | ★★★★★★ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.66% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.90% | ★★★★★☆ |

Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.04% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.96% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.75% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

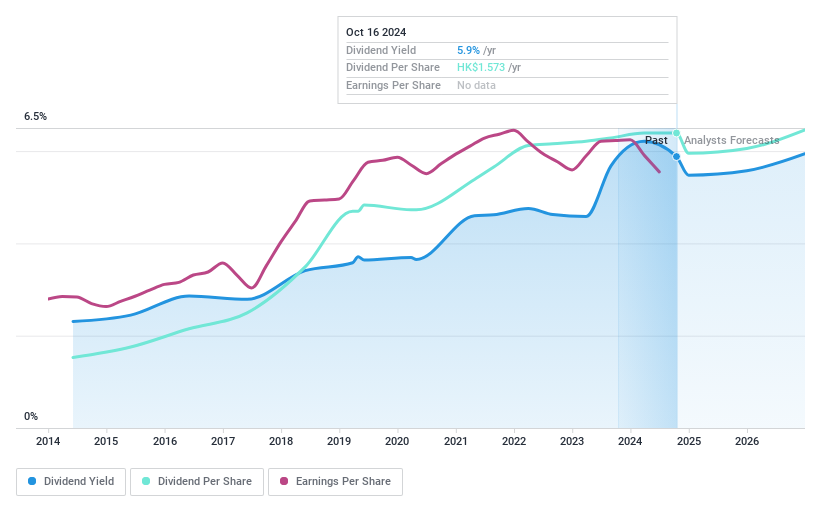

China Resources Land

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Resources Land Limited operates as an investment holding company, focusing on property investment, development, and management across the People's Republic of China, with a market capitalization of approximately HK$203.94 billion.

Operations: China Resources Land Limited generates revenue primarily through its development property business at CN¥212.34 billion, followed by its investment property business at CN¥23.07 billion, eco-system elementary business at CN¥17.11 billion, and asset-light management business at CN¥13.59 billion.

Dividend Yield: 5.4%

China Resources Land Limited recently proposed a dividend of RMB 1.243 per share, reflecting a stable payout history over the last decade. Despite a significant year-on-year decline in sales and contracted gross floor area as of March 2024, the company maintains healthy dividend coverage with earnings covering dividends at 32.8% and cash flows at 22.3%. The firm's financial position shows some challenges with debt not well covered by operating cash flow, yet it trades at an attractive valuation, approximately 56% below estimated fair value.

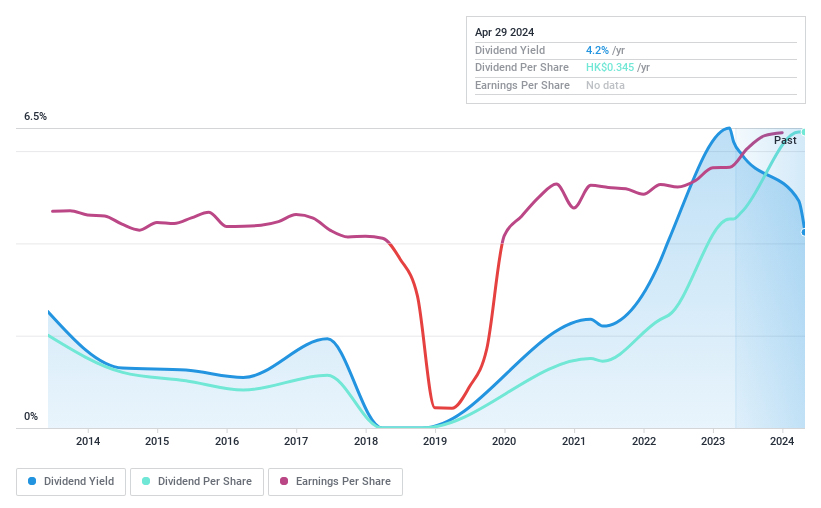

First Tractor

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited specializes in the research, development, manufacture, and sale of agricultural and power machinery along with related spare parts globally, with a market capitalization of approximately HK$17.41 billion.

Operations: First Tractor Company Limited generates revenue primarily from the manufacture and sale of agricultural machinery, power machinery, and related spare parts.

Dividend Yield: 4.2%

First Tractor Company Limited reported a solid increase in quarterly and annual earnings, with net income rising to CNY 599.4 million in Q1 2024 from CNY 485.73 million the previous year, and annual net income improving significantly to CNY 997.02 million. Despite this growth, the company's dividend yield of 4.24% remains below the top quartile of Hong Kong dividend stocks at 8.07%. The dividends are sustainably covered by both earnings and cash flows, with payout ratios at 36% and 34.5% respectively, indicating a stable financial capacity for continued payouts despite a history of volatility in dividend payments over the past decade.

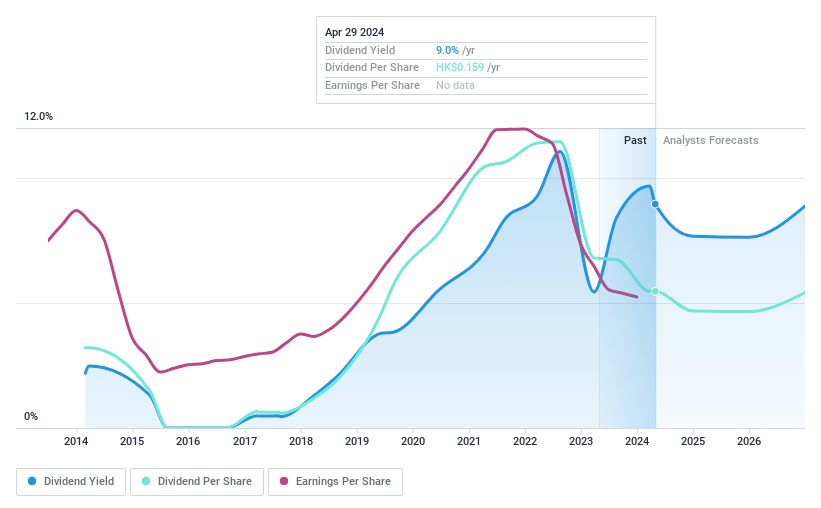

China Overseas Grand Oceans Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Ltd. operates as an investment holding company, focusing on real estate development and leasing in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$6.34 billion.

Operations: China Overseas Grand Oceans Group Ltd. generates CN¥56.08 billion from property investment and development, and CN¥0.24 billion from property leasing.

Dividend Yield: 9%

China Overseas Grand Oceans Group Limited faces challenges with a notable year-on-year decrease in property contracted sales and GFA as of March 2024, reflecting a downturn in operational performance. Despite these setbacks, the company maintains an attractive dividend yield at 8.96%, ranking it in the top 25% of Hong Kong dividend payers. However, recent cuts to its final ordinary dividend to HK$0.11 per share signal potential concerns about sustainability amidst declining earnings and sales figures reported for FY 2023. The dividends are well-covered by both earnings and cash flows, with payout ratios indicating sound financial management despite high debt levels.

Seize The Opportunity

Delve into our full catalog of 74 Top Dividend Stocks here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1109SEHK:38SEHK:81.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance