Exploring Three High Growth Hong Kong Companies With Substantial Insider Ownership

Amid a backdrop of global economic fluctuations, the Hong Kong market has demonstrated resilience, with the Hang Seng Index recently experiencing a notable uptick. This context sets an intriguing stage for examining growth companies in Hong Kong that boast high insider ownership—a factor often associated with strong corporate governance and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 74% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 26% | 83.9% |

Here we highlight a subset of our preferred stocks from the screener.

J&T Global Express

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited operates in the express delivery sector primarily within Southeast Asia and China, with a market capitalization of approximately HK$67.24 billion.

Operations: The firm's primary revenue of HK$8.85 billion is generated from its air freight transportation services.

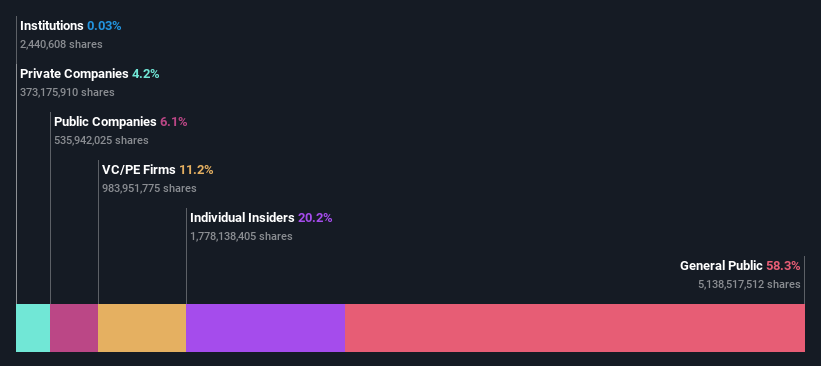

Insider Ownership: 20.2%

J&T Global Express, a notable player in Hong Kong's logistics sector, has demonstrated robust growth with a 21.8% revenue increase over the past year. Despite its high revenue forecast of 15.5% annually, which outpaces the local market's 8%, its profitability is only expected to materialize in the next three years. The company also reported a significant rise in parcel volume to HK$5.03 billion this quarter from HK$3.39 billion, reflecting operational expansion and market penetration despite a highly volatile share price recently.

Dongyue Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company, focusing on the manufacture and distribution of polymers, organic silicone, refrigerants, and other chemical products primarily in the People's Republic of China and internationally, with a market capitalization of approximately HK$15.13 billion.

Operations: The company generates revenue primarily from three segments: polymers (CN¥4.55 billion), refrigerants (CN¥5.48 billion), and organic silicone (CN¥4.86 billion).

Insider Ownership: 15.4%

Dongyue Group, while facing a significant downturn in net income and sales this past year, still shows potential with expected earnings growth outpacing the Hong Kong market. Insider changes and a reduced dividend reflect some instability. However, the company's projected revenue growth remains above market averages, suggesting resilience amidst challenges. These factors make Dongyue a mixed prospect within the high insider ownership landscape of growth companies in Hong Kong.

Techtronic Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited, with a market capitalization of HK$204.56 billion, operates globally in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products primarily in North America and Europe.

Operations: The company's revenue is primarily derived from power equipment, generating $12.79 billion, and floorcare and cleaning products, contributing $0.97 billion.

Insider Ownership: 25.3%

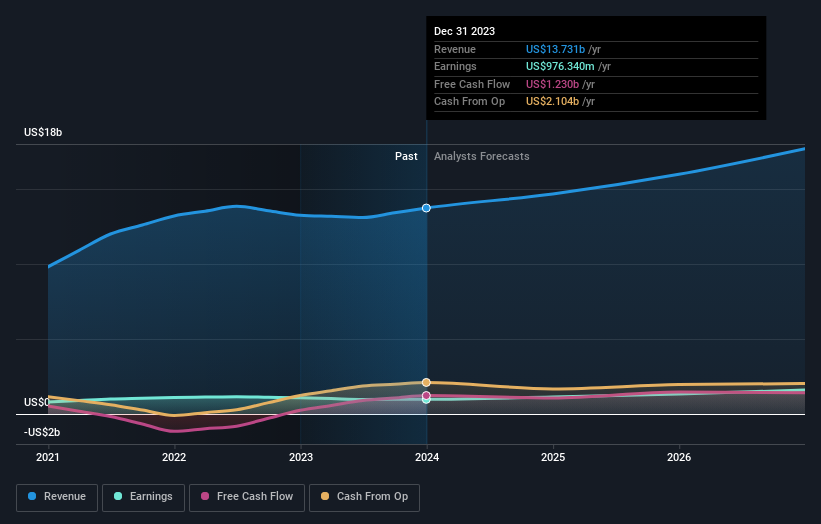

Techtronic Industries, a notable player in Hong Kong's growth company sector with high insider ownership, has shown a mixed financial performance recently. In 2023, the company reported a slight dip in net income to US$976.34 million from US$1,077.15 million the previous year despite an increase in sales to US$13.73 billion. Looking ahead, earnings are expected to grow by 15.9% annually, outpacing the local market forecast of 11.9%. However, insider buying activity has not been substantial over the past three months, reflecting possible caution among insiders about immediate growth prospects.

Summing It All Up

Get an in-depth perspective on all 51 Fast Growing SEHK Companies With High Insider Ownership by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1519 SEHK:189 and SEHK:669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance