Exploring Three SEHK Growth Companies With High Insider Ownership

Amidst a backdrop of fluctuating global markets, Hong Kong's Hang Seng Index recently showcased a robust gain of 3.11%, signaling a positive sentiment in the region. This uptick provides an intriguing context for examining growth companies with high insider ownership on the SEHK, as such firms often benefit from aligned interests between shareholders and management, potentially enhancing stability and confidence in challenging economic climates.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 34.3% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Beijing Airdoc Technology (SEHK:2251) | 26.7% | 83.9% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 76.2% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Underneath we present a selection of stocks filtered out by our screen.

Biocytogen Pharmaceuticals (Beijing)

Simply Wall St Growth Rating: ★★★★★☆

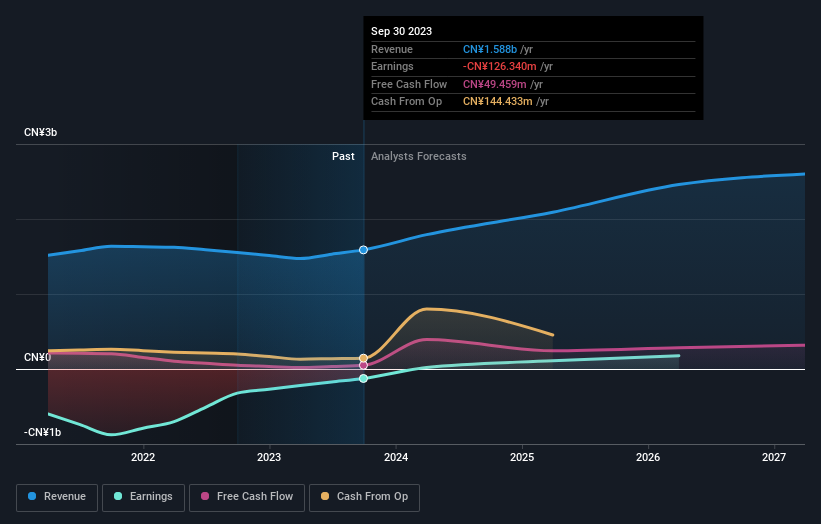

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology firm focused on the research and development of antibody-based drugs, operating in the People’s Republic of China, the United States, and internationally, with a market capitalization of HK$3.83 billion.

Operations: Biocytogen Pharmaceuticals generates revenue primarily through the sale of animal models (CN¥293.68 million), pre-clinical pharmacology and efficacy evaluation services (CN¥193.40 million), antibody development (CN¥175.87 million), and gene editing services (CN¥74.33 million).

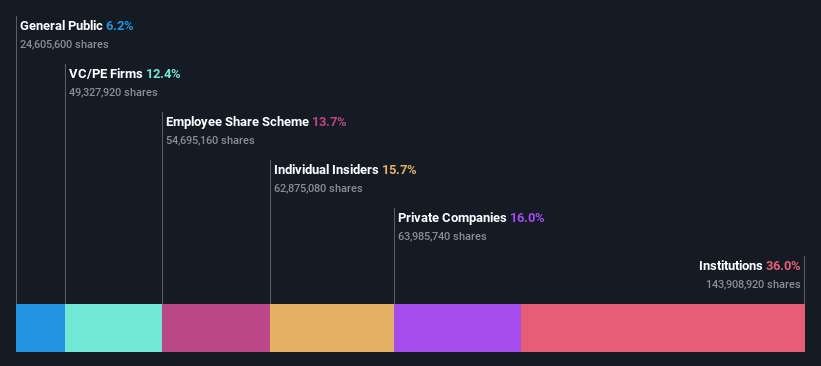

Insider Ownership: 15.7%

Biocytogen Pharmaceuticals (Beijing) demonstrates significant growth potential in Hong Kong's high insider ownership sector, with revenues increasing by 34.3% last year to CNY 716.91 million. Despite a net loss reduction from CNY 601.95 million to CNY 382.95 million, the company is expected to turn profitable within three years, outpacing average market predictions with a revenue growth forecast of 21.3% annually. Recent strategic alliances and licensing agreements, such as those with BioCopy AG and ABL Bio Inc., leverage Biocytogen’s innovative platforms for cancer therapy development, highlighting its commitment to expanding its biotechnological frontier.

Beauty Farm Medical and Health Industry

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beauty Farm Medical and Health Industry Inc. operates in the healthcare sector with a market capitalization of approximately HK$3.57 billion.

Operations: The company generates revenue primarily from three segments: Aesthetic Medical Services (CN¥850.36 million), Subhealth Medical Services (CN¥101.04 million), and Beauty and Wellness Services through both direct stores and franchisees (CN¥1.19 billion).

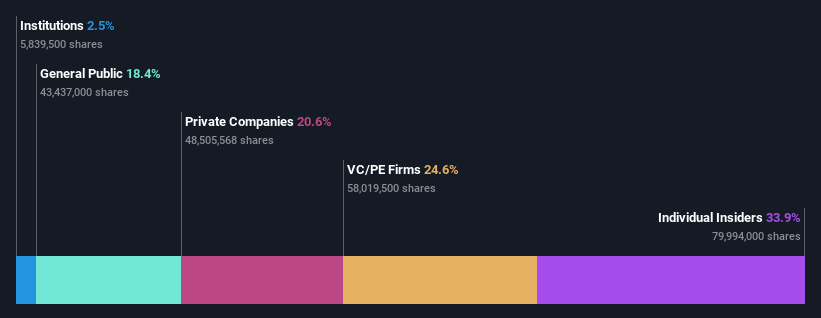

Insider Ownership: 33.9%

Beauty Farm Medical and Health Industry, a Hong Kong-based company, is trading significantly below its estimated fair value while showing promising growth prospects. Its revenue is expected to expand by 18.5% annually, surpassing the local market's average of 8%. Furthermore, earnings have surged by over 100% in the past year with projections indicating a robust annual increase of 22.8%, outstripping the market forecast of 12.2%. Despite these strengths, its dividend track record remains unstable. Recent financials reveal a substantial rise in sales and net income for the fiscal year ended December 31, 2023.

Arrail Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arrail Group Limited operates dental hospitals and clinics in China, with a market capitalization of approximately HK$2.85 billion.

Operations: The company generates revenue primarily through its two main segments: Arrail Dental, which brought in CN¥732.98 million, and Rytime Dental, contributing CN¥855.34 million.

Insider Ownership: 14.6%

Arrail Group, a Hong Kong-based entity, is poised for substantial growth with earnings expected to increase significantly. Despite trading 70.4% below its fair value, it shows potential with projected revenue growth at 12% annually—faster than the local market's 8%. However, its Return on Equity is anticipated to be modest at 7.7% in three years. Recent trends indicate more insider buying than selling, highlighting confidence from within despite a forecast of slower-than-ideal revenue acceleration.

Seize The Opportunity

Gain an insight into the universe of 52 Fast Growing SEHK Companies With High Insider Ownership by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:2315 SEHK:2373 and SEHK:6639.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance