Exploring Three SEHK Growth Companies With High Insider Ownership

Amid a backdrop of global economic fluctuations, the Hong Kong market has shown resilience, with the Hang Seng Index recently experiencing a notable uptick. This positive momentum underscores the potential value of investing in growth companies within this market, particularly those with high insider ownership which often signals strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 74% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 26.4% | 83.9% |

Let's review some notable picks from our screened stocks.

Kingdee International Software Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited operates as an investment holding company specializing in enterprise resource planning, with a market capitalization of approximately HK$32.87 billion.

Operations: The company generates revenue primarily from two segments: Cloud Service Business, which contributes approximately CN¥4.50 billion, and ERP Business, adding around CN¥1.17 billion.

Insider Ownership: 19.7%

Earnings Growth Forecast: 46.1% p.a.

Kingdee International Software Group is poised for notable growth, with revenue expected to increase by 14.3% annually, outpacing the Hong Kong market's 8.1%. Although its return on equity is projected at a modest 6.2%, analysts are optimistic about a substantial price increase of 50.7%. The company has recently amended its articles of association, signaling strategic adjustments possibly linked to its focus on subscription and AI-driven services, which anticipate a revenue CAGR of 15% to 20% over the next three years.

CanSino Biologics

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company based in the People's Republic of China that focuses on developing, manufacturing, and commercializing vaccines, with a market capitalization of approximately HK$9.34 billion.

Operations: The company generates revenue primarily through its research and development of vaccine products for human use, totaling CN¥370.81 million.

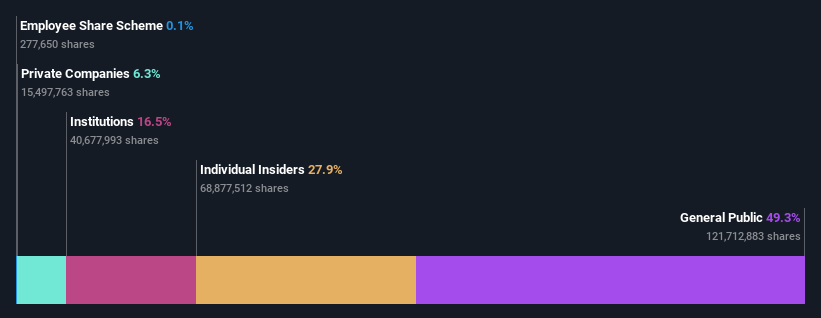

Insider Ownership: 27.9%

Earnings Growth Forecast: 124.6% p.a.

CanSino Biologics is trading at 89.3% below its estimated fair value, with significant growth potential as earnings are expected to surge by 124.55% annually. Despite a recent net loss of CNY 170.1 million, revenue grew to CNY 114.28 million from CNY 100.55 million year-over-year, showcasing resilience and expansion capabilities. The company's innovative strides in vaccine development, including approvals for clinical trials and positive preliminary trial results, underscore its progressive product pipeline and potential market impact despite a forecasted low return on equity of 5.1%.

Bairong

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bairong Inc. operates as a cloud-based AI turnkey services provider in China, with a market capitalization of approximately HK$4.99 billion.

Operations: The company generates revenue primarily from data processing services, totaling CN¥2.68 billion.

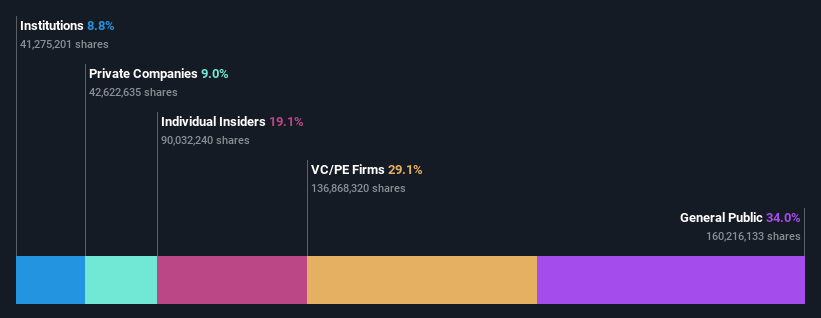

Insider Ownership: 19.1%

Earnings Growth Forecast: 21.4% p.a.

Bairong Inc. is positioned below its estimated fair value by 34.3%, with analysts predicting a substantial price increase of 73.2%. The company has demonstrated robust growth, with earnings rising by 42.1% last year and expected to grow at 21.45% annually, outpacing the Hong Kong market's average. Revenue forecasts also exceed market trends, though growth rates are under the high-growth threshold of 20%. Recent executive shifts could impact operations, following the resignation of Ms. Xie and appointment of Mr. Zhang Shaofeng as an Authorised Representative.

Next Steps

Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Fast Growing SEHK Companies With High Insider Ownership.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:268 SEHK:6185 and SEHK:6608.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance