Exploring Three Top Dividend Stocks On The Tokyo Stock Exchange With Yields Up To 3.7%

Amidst a backdrop of fluctuating global markets, Japanese equities have experienced a retreat from recent highs, influenced by interventions aimed at stabilizing the yen. This dynamic market environment underscores the appeal of dividend stocks, which can offer investors potential stability and steady returns in uncertain times.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.73% | ★★★★★★ |

Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.44% | ★★★★★★ |

Globeride (TSE:7990) | 3.76% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.30% | ★★★★★★ |

Nissin (TSE:9066) | 4.38% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.50% | ★★★★★★ |

Innotech (TSE:9880) | 4.04% | ★★★★★★ |

Click here to see the full list of 385 stocks from our Top Japanese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Persol HoldingsLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Persol Holdings Co., Ltd. operates globally, offering human resource services under the PERSOL brand, with a market capitalization of approximately ¥588.16 billion.

Operations: Persol Holdings Co., Ltd. generates revenue through various segments including Career (¥128.28 billion), Technology (¥102.38 billion), Asia Pacific (¥412.77 billion), and Staffing excluding BPO (¥575.80 billion).

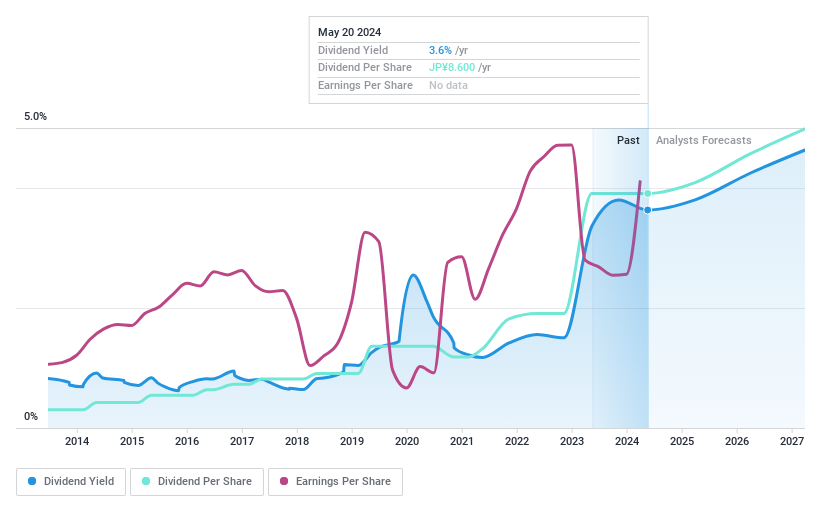

Dividend Yield: 3.5%

Persol HoldingsLtd's dividend yield stands at 3.47%, ranking in the top 25% of Japanese dividend payers. Despite a volatile history with dividends over the past decade, recent earnings growth of 45.6% and forecasts of an annual increase of 12.02% suggest potential stability ahead. Dividends are well-supported by both earnings, with a payout ratio of 65.1%, and cash flows, with a cash payout ratio at 32.8%. The firm has also committed to enhancing shareholder returns through a significant share buyback program totaling ¥20 billion, aiming to repurchase up to 5.41% of its shares by March 2025, demonstrating confidence in its financial health and commitment to returning value to shareholders.

Bewith

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bewith, Inc. operates in Japan, offering contact and call center services as well as business process outsourcing (BPO) solutions that leverage digital technologies, with a market capitalization of approximately ¥29.29 billion.

Operations: Bewith, Inc. generates ¥38.25 billion in revenue from its digital technology-driven contact and call center operations, along with business process outsourcing services.

Dividend Yield: 3.7%

Bewith, Inc. has recently increased its dividend from JPY 49.00 to JPY 53.00 per share and anticipates a further rise to JPY 77.00 next fiscal year, reflecting a positive trend despite its short dividend history of two years. The company's dividends appear sustainable with a payout ratio of 40.4% and are supported by earnings growth projections of 18.48% annually and strong cash flow coverage at a cash payout ratio of 57%. Trading at significant undervaluation, Bewith offers good relative value in the market.

Click here to discover the nuances of Bewith with our detailed analytical dividend report.

The valuation report we've compiled suggests that Bewith's current price could be quite moderate.

Business Brain Showa-Ota

Simply Wall St Dividend Rating: ★★★★★★

Overview: Business Brain Showa-Ota Inc., a company based in Japan, specializes in consulting and system development solutions with a market capitalization of approximately ¥26.28 billion.

Operations: Business Brain Showa-Ota Inc. generates its revenue primarily from consulting and system development solutions in Japan.

Dividend Yield: 3.4%

Business Brain Showa-Ota Inc. offers a solid dividend yield of 3.44%, placing it in the top 25% of Japanese dividend payers. Its dividends are well-supported with a low payout ratio of 5.1% and cash payout ratio of 33%, ensuring sustainability and coverage by both earnings and cash flows. The stock trades at a 32.9% discount to its estimated fair value, enhancing its attractiveness as an investment option despite the company's significant earnings growth of 669.6% over the past year, suggesting robust financial health and potential for continued dividend reliability and growth.

Next Steps

Unlock our comprehensive list of 385 Top Japanese Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2181 TSE:9216 and TSE:9658.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com