Exploring Three TSX Dividend Stocks For Your Investment Portfolio

As global markets navigate through the complexities of artificial intelligence growth and shifting economic indicators, Canadian investors might find stability and potential income in dividend-paying stocks. Given the broader market's tilt towards diversification and resilience, dividend stocks could serve as a prudent part of an investment portfolio in these dynamic times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.61% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.91% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.74% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.76% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.62% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.60% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.05% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.72% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.81% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

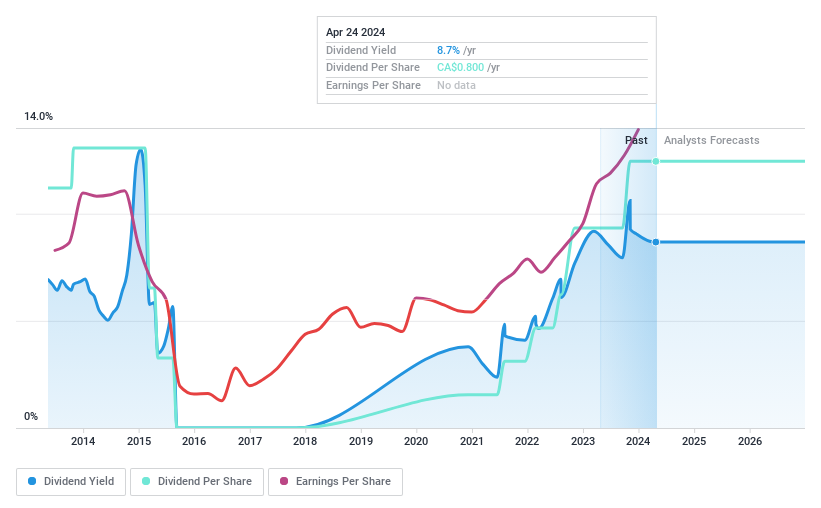

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. specializes in horizontal and directional drilling services, renting performance drilling motors, and selling motor equipment and parts to the oil and natural gas sectors across Canada, the United States, Albania, the Middle East, and other international markets, with a market capitalization of approximately CA$439.74 million.

Operations: PHX Energy Services Corp. generates CA$656.44 million from its horizontal oil and natural gas well drilling services.

Dividend Yield: 8.6%

PHX Energy Services offers a high dividend yield at 8.64%, ranking in the top 25% of Canadian dividend payers. However, its dividend sustainability is questionable with a cash payout ratio of 139.1%, indicating dividends are not well covered by cash flows. Additionally, while the company's dividends have increased over the past decade, they've also been marked by volatility and unreliability. Trading at 58.6% below estimated fair value suggests potential undervaluation despite recent earnings declines and significant insider selling over the last quarter.

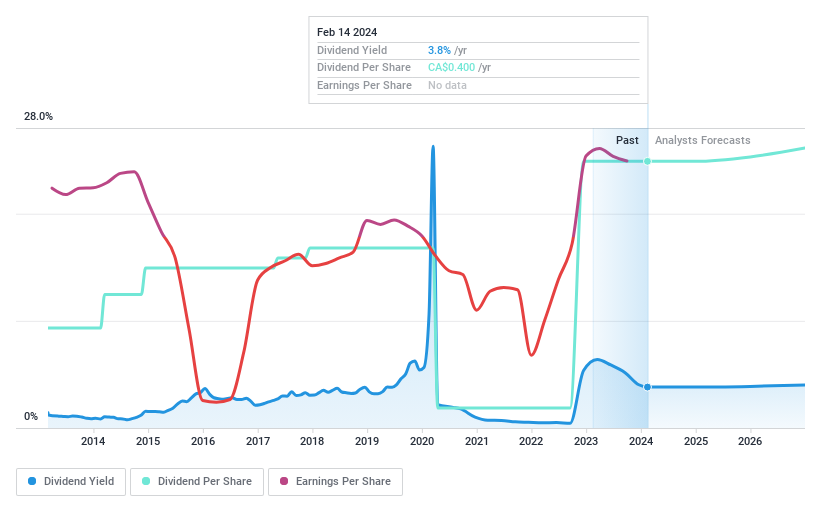

Secure Energy Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily in Canada and the United States, with a market capitalization of CA$2.99 billion.

Operations: Secure Energy Services Inc. generates revenue through two primary segments: Energy Infrastructure, which brought in CA$7.81 billion, and Environmental Waste Management (EWM), which contributed CA$1.09 billion.

Dividend Yield: 3.5%

Secure Energy Services maintains a low payout ratio of 20.6%, ensuring dividends are well-covered by earnings, with a consistent increase over the past decade. Although its dividend yield of 3.51% is below the market's top quartile, it remains attractive due to stability and reliability. Recent share buyback programs underline confidence in financial health, despite forecasts predicting an average earnings decline of 32.9% annually over the next three years. The company's strategic debt refinancing further supports long-term financial stability.

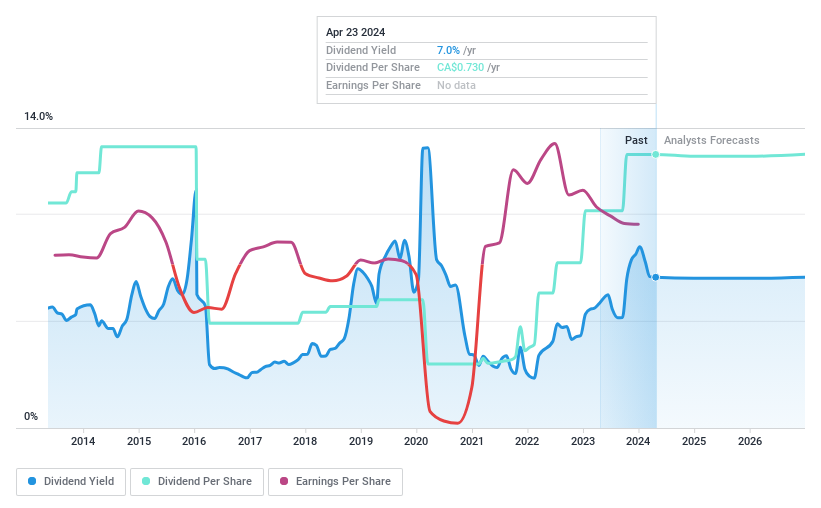

Whitecap Resources

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company that specializes in acquiring, developing, and producing oil and gas assets in Western Canada, with a market capitalization of approximately CA$6.33 billion.

Operations: Whitecap Resources Inc. generates its revenue primarily from the exploration and production of oil and gas, totaling approximately CA$3.23 billion.

Dividend Yield: 6.9%

Whitecap Resources offers a robust dividend yield of 6.91%, ranking in the top 25% of Canadian dividend payers. Its dividends are well-supported with a payout ratio of 56.1% and a cash payout ratio of 82%, indicating sustainability from both earnings and cash flow perspectives. Despite this, profit margins have declined to 21.3% from last year's 33.5%. Recent initiatives include affirming monthly dividends and launching a significant share buyback program, signaling strong corporate confidence even as profitability pressures exist.

Summing It All Up

Access the full spectrum of 31 Top TSX Dividend Stocks by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:PHX TSX:SES and TSX:WCP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance