Exploring Three TSX Stocks With Intrinsic Value Discounts Ranging From 14.9% To 36.9%

As the U.S. presidential campaign unfolds, key economic issues such as government debt and trade policies are at the forefront, influencing market sentiments and potentially impacting global markets, including Canada's TSX. In this climate of mild uncertainty and fiscal considerations, identifying stocks that appear undervalued relative to their intrinsic value could offer investors a prudent opportunity to engage with the market.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$187.53 | CA$312.55 | 40% |

B2Gold (TSX:BTO) | CA$4.16 | CA$8.04 | 48.3% |

Trisura Group (TSX:TSU) | CA$42.91 | CA$80.18 | 46.5% |

Decisive Dividend (TSXV:DE) | CA$7.04 | CA$11.75 | 40.1% |

Kraken Robotics (TSXV:PNG) | CA$1.16 | CA$2.23 | 48% |

Kinaxis (TSX:KXS) | CA$166.01 | CA$263.02 | 36.9% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Amerigo Resources (TSX:ARG) | CA$1.66 | CA$2.72 | 39% |

Green Thumb Industries (CNSX:GTII) | CA$16.12 | CA$28.33 | 43.1% |

Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's explore several standout options from the results in the screener.

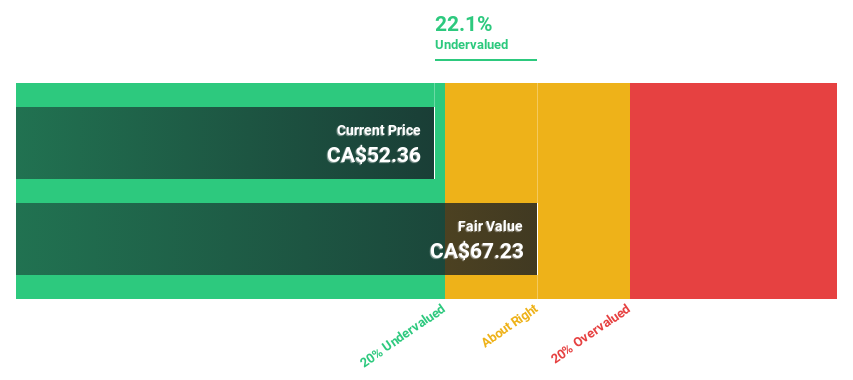

Brookfield Asset Management

Overview: Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services, with a market capitalization of approximately CA$24.19 billion.

Operations: The firm specializes in alternative asset management, primarily focusing on real estate investments.

Estimated Discount To Fair Value: 14.9%

Brookfield Asset Management, currently trading at CA$56.9, is perceived as undervalued against a fair value estimate of CA$66.82. Despite its dividend yield of 3.66% being poorly covered by earnings and free cash flows, the company shows robust forecasted earnings growth at 74.4% annually—significantly outpacing the Canadian market projection of 14.6%. This financial profile is bolstered by anticipated revenue increases of 61.8% per year, further highlighting its potential undervaluation based on discounted cash flow analysis.

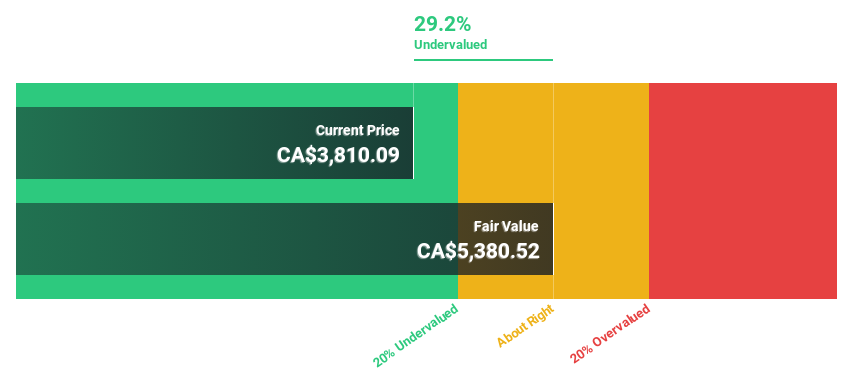

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe, with a market capitalization of CA$89.02 billion.

Operations: The company generates CA$8.84 billion from its software and programming segment.

Estimated Discount To Fair Value: 25%

Constellation Software, priced at CA$4187.08, is trading 25% below its estimated fair value of CA$5581.74, signaling potential undervaluation based on discounted cash flow analysis. Recent executive shifts and the launch of Omegro suggest strategic enhancements that may support its robust forecasted earnings growth of 24.43% annually and revenue growth at 16.1% per year—both exceeding Canadian market averages. However, it carries a high level of debt which could temper its financial agility.

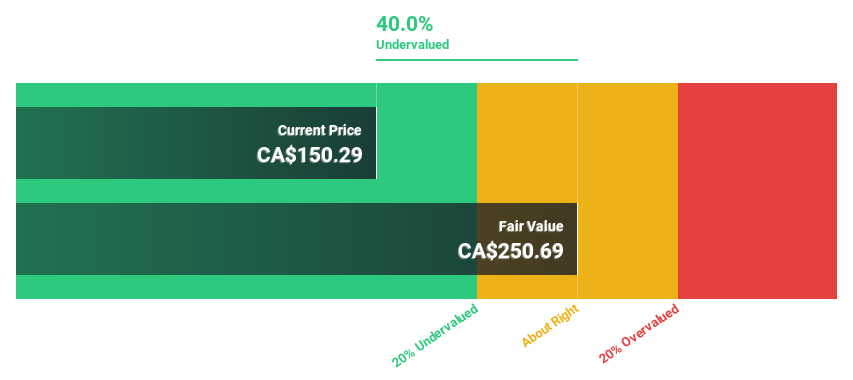

Kinaxis

Overview: Kinaxis Inc. offers cloud-based subscription software to enhance supply chain operations across the United States, Europe, Asia, and Canada, with a market capitalization of approximately CA$4.73 billion.

Operations: The company generates CA$445.21 million in revenue from its software and programming segment.

Estimated Discount To Fair Value: 36.9%

Kinaxis, priced at CA$166.01, is identified as undervalued by over 20%, with a fair value estimate of CA$263.02 based on discounted cash flow analysis. It's poised for robust growth with earnings forecasted to increase by 51.1% annually, outpacing the Canadian market significantly. Recent strategic partnerships and product launches like the Maestro platform enhance its competitive edge in supply chain management, despite recent insider selling which could raise concerns among investors.

Next Steps

Get an in-depth perspective on all 20 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BAM TSX:CSU and TSX:KXS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com