Exploring Three UK Stocks With Estimated Intrinsic Discounts Ranging From 19.3% To 48.9%

Amidst a buoyant FTSE 100, which is poised for an uptick as Labour leads in the election polls, the UK's financial markets exhibit a robust outlook. In such a market environment, identifying stocks that appear undervalued relative to their intrinsic worth could present compelling opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kier Group (LSE:KIE) | £1.39 | £2.76 | 49.6% |

Halfords Group (LSE:HFD) | £1.51 | £2.81 | 46.3% |

WPP (LSE:WPP) | £7.404 | £14.03 | 47.2% |

Ibstock (LSE:IBST) | £1.722 | £3.38 | 49.1% |

LSL Property Services (LSE:LSL) | £3.33 | £6.50 | 48.7% |

Auction Technology Group (LSE:ATG) | £4.825 | £9.21 | 47.6% |

Ricardo (LSE:RCDO) | £4.90 | £9.52 | 48.5% |

Entain (LSE:ENT) | £6.342 | £12.29 | 48.4% |

Accsys Technologies (AIM:AXS) | £0.554 | £1.05 | 47.4% |

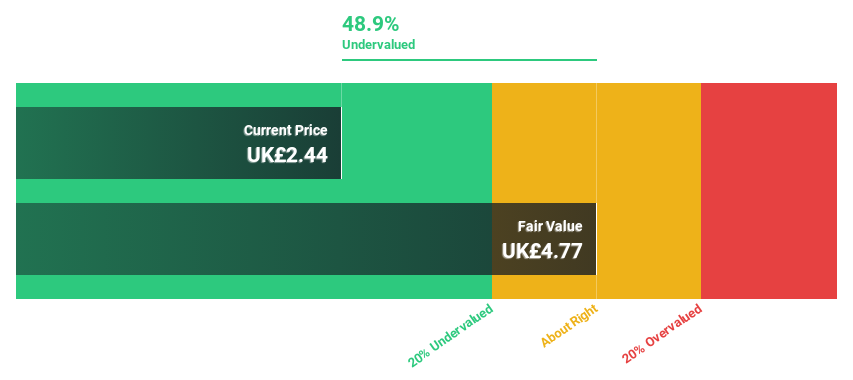

Nexxen International (AIM:NEXN) | £2.44 | £4.77 | 48.9% |

Let's explore several standout options from the results in the screener

Nexxen International

Overview: Nexxen International Ltd. is a company based in Israel that offers a comprehensive software platform facilitating connections between advertisers and publishers, with a market capitalization of approximately £338.11 million.

Operations: The company generates revenue primarily through its marketing services segment, totaling $334.69 million.

Estimated Discount To Fair Value: 48.9%

Nexxen International, currently trading at £2.44, is significantly undervalued by more than 20%, with a fair value estimated at £4.77. Despite slower revenue growth projections of 7.8% annually compared to the market's 20%, it outpaces the UK average of 3.5%. The company is on track to become profitable within three years, boasting an impressive earnings growth forecast of 117.92% per year. Recent strategic moves include reaffirming its full-year earnings guidance and active share buybacks totaling £19.99 million, enhancing shareholder value and financial stability.

Energean

Overview: Energean plc is a company focused on the exploration, production, and development of oil and gas, with a market capitalization of approximately £1.85 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production segment, totaling $1.42 billion.

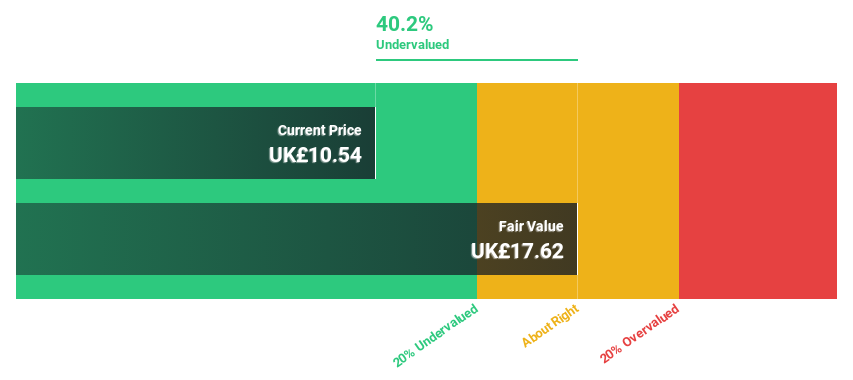

Estimated Discount To Fair Value: 29.6%

Energean, priced at £10.09, is valued below its fair value of £14.33 and shows a potential price increase of 38.7% according to analysts. Despite a dividend yield of 9.32%, it's poorly backed by earnings and cash flows, reflecting some financial risk amidst its debt levels. However, the company's earnings have surged by a very large margin over the past year and are expected to grow annually at 16.9%, outpacing the UK market forecast of 12.5%. Recent announcements include a stable quarterly dividend and positive production guidance for 2024, signaling operational growth.

TP ICAP Group

Overview: TP ICAP Group PLC is a global financial services firm offering intermediary services, trade execution, and data solutions with a market capitalization of approximately £1.60 billion.

Operations: TP ICAP Group's revenue is generated through four main segments: Liquidnet at £315 million, Global Broking at £1.26 billion, Parameta Solutions at £189 million, and Energy & Commodities at £458 million.

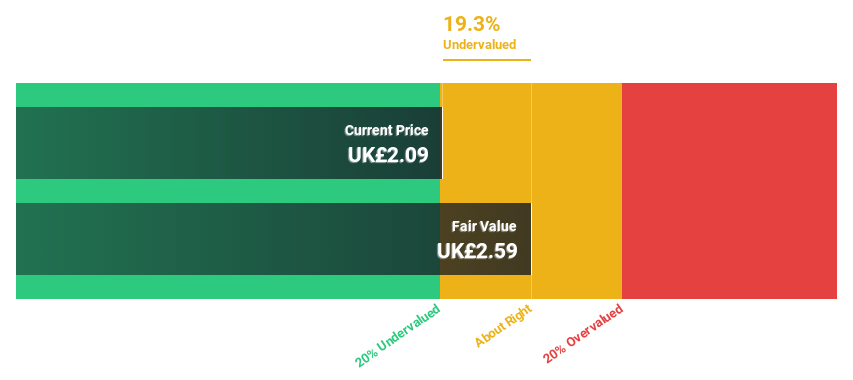

Estimated Discount To Fair Value: 19.3%

TP ICAP Group, trading at £2.09, is below the estimated fair value of £2.59, reflecting a modest undervaluation based on discounted cash flow analysis. Despite this, its dividend sustainability is questionable as it's not well covered by earnings. The company's earnings are expected to grow significantly at 25.6% annually over the next three years, outstripping UK market predictions of 12.5%. Recent activities include initiating a share buyback and appointing PricewaterhouseCoopers as auditors, alongside approving an increased final dividend.

Taking Advantage

Access the full spectrum of 62 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NEXN LSE:ENOG and LSE:TCAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance