Exploring Three Undervalued Small Caps With Insider Action In Australia

Despite a flat performance over the last week, the Australian market has shown robust growth, up 9.8% over the past year with earnings expected to grow by 13% annually. In this context, identifying undervalued small-cap stocks with insider buying can be a promising approach for investors seeking opportunities in a growing market.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.5x | 2.7x | 47.43% | ★★★★★★ |

Nick Scali | 13.8x | 2.6x | 45.17% | ★★★★★★ |

RAM Essential Services Property Fund | NA | 5.7x | 40.00% | ★★★★★☆ |

Healius | NA | 0.6x | 42.81% | ★★★★★☆ |

Elders | 21.4x | 0.5x | 47.24% | ★★★★☆☆ |

Eagers Automotive | 9.4x | 0.3x | 35.11% | ★★★★☆☆ |

Codan | 29.1x | 4.3x | 27.07% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.7x | 19.80% | ★★★★☆☆ |

Dicker Data | 22.8x | 0.8x | -3.66% | ★★★☆☆☆ |

Coventry Group | 280.4x | 0.4x | -15.58% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

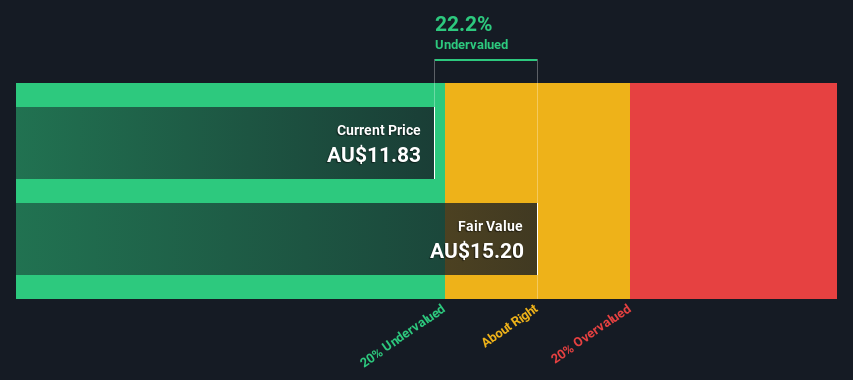

Codan

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications, metal detection, and other electronic technologies, with a market capitalization of approximately A$1.07 billion.

Operations: Communications and Metal Detection are the primary revenue drivers, generating A$291.50 million and A$212.20 million respectively. The company's gross profit margin has shown a trend around 55% to 57% over recent periods, reflecting its cost management in relation to revenue generation from these segments.

PE: 29.1x

Codan, a notable player in the technology sector, recently saw insider confidence bolstered as they acquired shares, signaling strong belief in the company's trajectory. With earnings projected to grow by 16.2% annually, this firm exemplifies potential within Australia's underappreciated market segments. Despite relying solely on external borrowing—a higher risk funding source—Codan maintains a compelling position with its strategic focus and insider investments underscoring its promising outlook.

Delve into the full analysis valuation report here for a deeper understanding of Codan.

Assess Codan's past performance with our detailed historical performance reports.

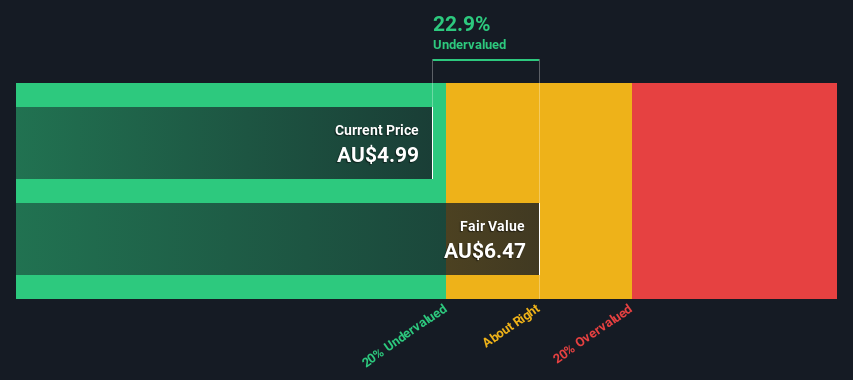

Dicker Data

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is an Australian company specializing in the wholesale distribution of computer peripherals, with a market capitalization of approximately A$2.27 billion.

Operations: The gross profit margin of Wholesale - Computer Peripherals increased from 8.48% in 2013 to 14.23% by the end of 2023, reflecting a growing efficiency in managing cost of goods sold relative to revenue, which stood at A$2.27 billion for both initial and final recorded periods. This sector achieved a net income margin increase from approximately 2.07% to over 3.62% over the same period, indicating improved profitability after accounting for all operational expenses and costs.

PE: 22.8x

Recently, Dicker Data's insiders demonstrated their belief in the company's prospects by acquiring shares, signaling insider confidence. With earnings forecasted to grow nearly 8% annually, this reflects positively on its financial health despite a high reliance on external borrowing. The firm also sustained its shareholder commitment by declaring a regular dividend recently. These elements suggest that Dicker Data might be an overlooked opportunity within Australia’s smaller listed companies, poised for potential growth.

Get an in-depth perspective on Dicker Data's performance by reading our valuation report here.

Gain insights into Dicker Data's historical performance by reviewing our past performance report.

Kelsian Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kelsian Group operates in providing transportation services including bus operations in Australia and internationally, as well as marine and tourism services, with a market capitalization of approximately A$1.02 billion.

Operations: Australian Bus, International Bus, and Marine and Tourism segments collectively generated A$1.72 billion in revenue. Gross profit margin has shown a trend of variability over the periods reviewed, with a recent figure standing at 25.44%.

PE: 45.4x

Kelsian Group, a notable player in its sector, recently showcased at the Macquarie Australia Conference, signaling strategic visibility. Despite relying solely on external borrowing—a riskier funding strategy—insiders have shown confidence through recent share purchases. With a profit margin dip to 1.7% from last year's 3.8%, the company still anticipates a robust earnings growth of around 26% annually. This insider activity and growth projection may suggest an appealing entry point for those eyeing underappreciated assets in the Australian market.

Dive into the specifics of Kelsian Group here with our thorough valuation report.

Review our historical performance report to gain insights into Kelsian Group's's past performance.

Make It Happen

Dive into all 24 of the Undervalued ASX Small Caps With Insider Buying we have identified here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:DDR and ASX:KLS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance