Exploring Top Canadian Dividend Stocks For February 2024

In a period marked by remarkable consistency, the Canadian market has shown no significant change over the last week or even the past year. With earnings projected to grow by 11% annually in the coming years, investors may find particular value in dividend stocks that offer potential for steady income and growth opportunities amidst stable market conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.33% | ★★★★★☆ |

Manulife Financial (TSX:MFC) | 4.90% | ★★★★★☆ |

Richards Packaging Income Fund (TSX:RPI.UN) | 3.93% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.84% | ★★★★★☆ |

First National Financial (TSX:FN) | 5.98% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 4.63% | ★★★★★☆ |

North West (TSX:NWC) | 3.86% | ★★★★★☆ |

Savaria (TSX:SIS) | 3.14% | ★★★★★☆ |

Imperial Oil (TSX:IMO) | 2.81% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.60% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is a provider of diversified products and services to the oil and natural gas industry, with operations primarily in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$388.96 million.

Operations: Total Energy Services Inc. generates its revenue through four main segments: Well Servicing (CA$107.02 million), Contract Drilling Services (CA$281.82 million), Compression and Process Services (CA$415.88 million), and Rentals and Transportation Services (CA$85.41 million).

Dividend Yield: 3.3%

Total Energy Services, with a modest dividend yield of 3.27%, recently affirmed a quarterly dividend of CA$0.08 per share, payable on January 15, 2024. Despite a volatile dividend history over the past decade, current payouts are well-covered by both earnings and cash flows with payout ratios of 19.9% and 16.9%, respectively. Earnings have seen significant growth at a rate of 130.2% last year and are projected to grow by another 13.2% annually, providing some optimism for future stability in dividends despite past inconsistencies.

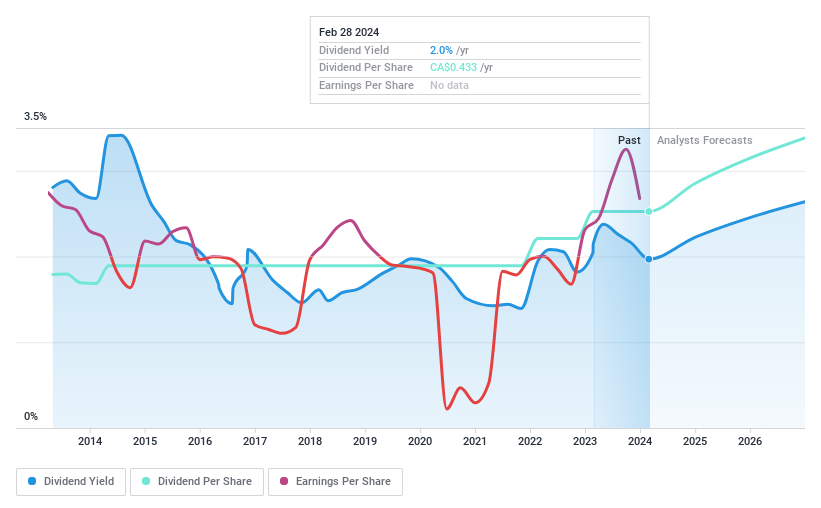

Primo Water (TSX:PRMW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Primo Water Corporation is a provider of water solutions, offering products and services for both residential and commercial customers, with a market capitalization of approximately CA$3.47 billion.

Operations: Primo Water Corporation's revenue is primarily generated from its North American segment, amounting to $1.77 billion.

Dividend Yield: 2%

Primo Water's dividend yield stands at 1.97%, lower than the top quartile of Canadian payers, yet it demonstrates a decade-long consistency in dividend growth and stability. The company is valued at 54.6% below our fair value estimate, with dividends well-supported by an earnings payout ratio of 80% and a cash payout ratio of 25.4%. Recent guidance anticipates revenues between US$1.84 billion to US$1.88 billion for the year, while Q4 results showed significant net income growth to US$177.6 million from last year's US$57.5 million, alongside a forthcoming dividend payment in March 2024.

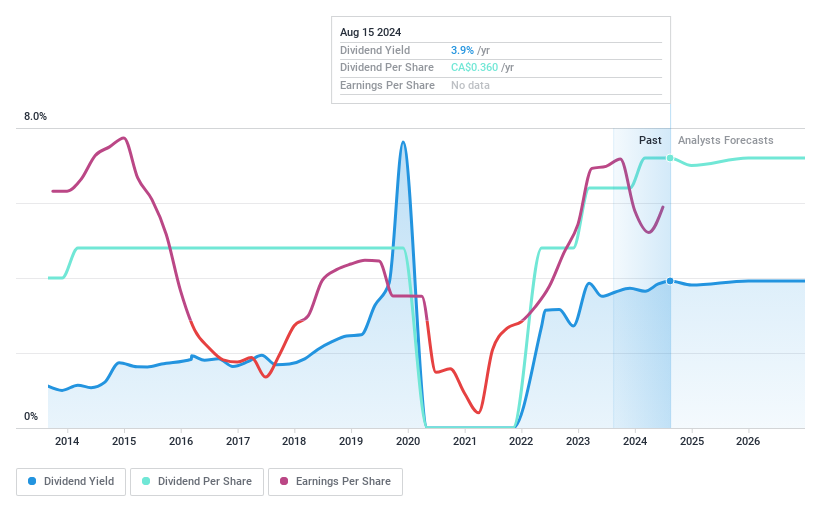

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products to remote communities and urban neighborhoods in northern Canada, Alaska, the South Pacific, and the Caribbean, with a market capitalization of approximately CA$1.91 billion.

Operations: The North West Company Inc. generates CA$2.46 billion in revenue primarily from the sale of food and everyday items to rural and urban markets across its international locations.

Dividend Yield: 3.9%

North West Company maintains a stable dividend history, with a 3.86% yield that's supported by earnings and cash flows, indicating sustainability. Despite trading below fair value estimates, its dividend yield is modest compared to Canada's top dividend payers. Recent financials show an uptick in sales to CA$616.91 million and net income rising to CA$37.23 million for Q3 2023; consistent performance may reassure investors despite the recent board resignation of long-time director Frank Coleman.

Next Steps

Click this link to deep-dive into the 17 companies within our Top Dividend Stocks screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance