Exploring Top Dividend Stocks For April 2024

Amid a landscape of shifting economic indicators and farmer sentiment, the United States market reflects a nuanced picture of optimism and caution as April 2024 unfolds. In this context, selecting dividend stocks with robust fundamentals and stable returns becomes even more critical for investors navigating these changing tides.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Premier Financial (NasdaqGS:PFC) | 6.33% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.50% | ★★★★★★ |

Lakeland Bancorp (NasdaqGS:LBAI) | 4.79% | ★★★★★★ |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.35% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.67% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.23% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.22% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.71% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.88% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.36% | ★★★★★★ |

Click here to see the full list of 273 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

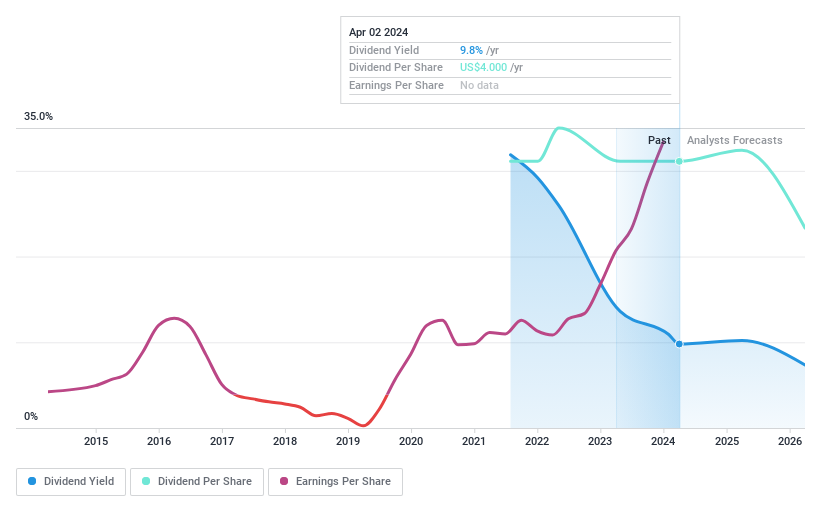

DorianG (NYSE:LPG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dorian LPG Ltd. operates globally, specializing in the transportation of liquefied petroleum gas (LPG) with its fleet of tankers, and has a market capitalization of approximately $1.66 billion.

Operations: Dorian LPG Ltd. generates its revenue primarily from the international transportation of LPG, amounting to $552.50 million.

Dividend Yield: 9.8%

DorianG's financial performance has shown significant growth with earnings increasing by 130.8% over the past year, and recent quarterly reports indicating a net income of US$99.97 million from revenue of US$163.06 million. Despite its high level of debt, the stock is trading at 23.6% below its estimated fair value, suggesting potential undervaluation. However, its dividend track record is unstable with no increase in payments since initiation three years ago and forecasts suggest earnings may decline by an average of 33.5% annually over the next three years. The dividend yield stands at a competitive 9.8%, but this comes with caution due to the unreliable history of payouts despite being covered by both earnings and cash flows (Payout Ratio: 52.8%, Cash Payout Ratio: 61.1%).

Click here and access our complete dividend analysis report to understand the dynamics of DorianG.

Our valuation report unveils the possibility DorianG's shares may be trading at a discount.

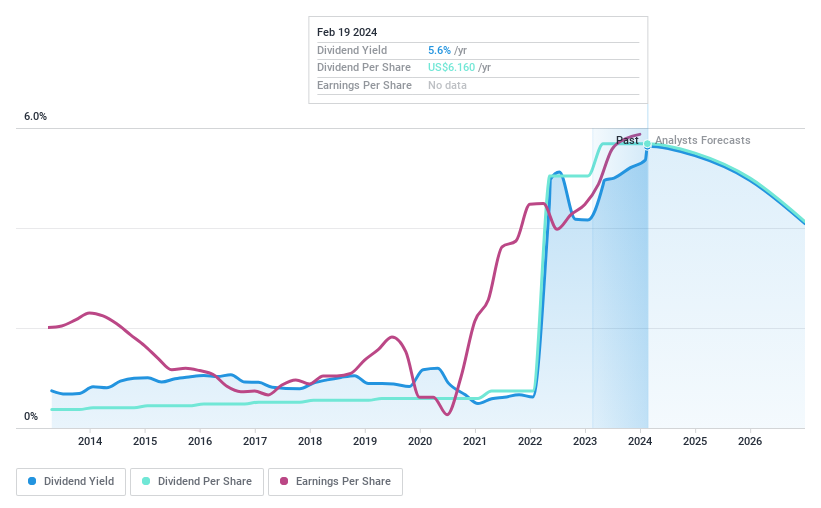

AGCO (NYSE:AGCO)

Simply Wall St Dividend Rating: ★★★★★★

Overview: AGCO Corporation, a global manufacturer and distributor of agricultural equipment and related replacement parts, has a market capitalization of approximately $8.99 billion.

Operations: AGCO Corporation generates its revenue from several geographical segments, with contributions of $3.75 billion from North America, $2.23 billion from South America, $7.54 billion from Europe/Middle East, and $0.89 billion from Asia/Pacific/Africa.

Dividend Yield: 5.1%

AGCO's recent fixed-income offerings totaling nearly US$1.1 billion and its steady dividend payments, highlighted by a quarterly dividend of $0.29 per share, underscore its commitment to returning value to shareholders. The company's dividends have shown stability over the past decade, with a notable yield that places it in the top 25% of US dividend payers. Despite this attractive yield, AGCO faces challenges with an expected average earnings decline of 5.4% per year over the next three years. However, its dividends appear sustainable with a low payout ratio (7.1%) and are well-covered by earnings and cash flows (Cash Payout Ratio: 78.6%), suggesting careful financial management amidst growth concerns.

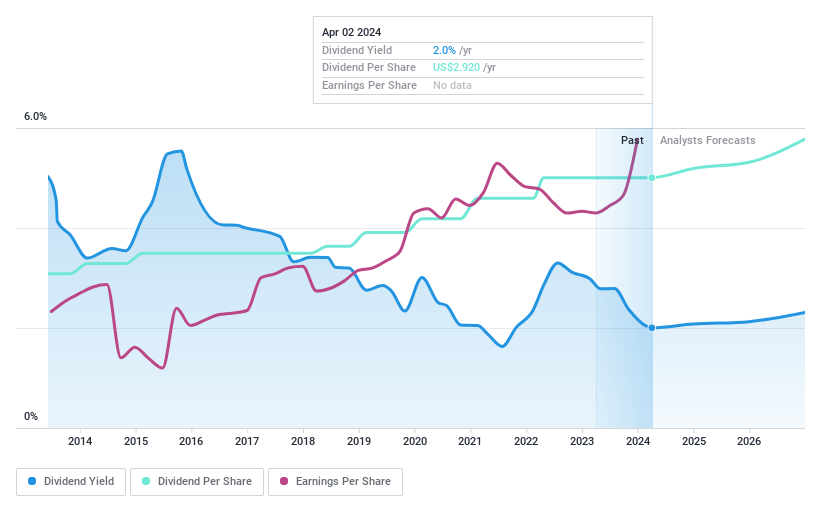

Garmin (NYSE:GRMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Garmin Ltd. is a global company that specializes in the design, development, manufacture, marketing, and distribution of various wireless devices, with a market capitalization of approximately $28.26 billion.

Operations: Garmin Ltd.'s revenue is diversified across several segments, notably generating $0.92 billion from Marine, $1.34 billion from Fitness, $1.70 billion from Outdoor, $0.42 billion from Auto OEM, and $0.85 billion from Aviation.

Dividend Yield: 2%

Garmin Ltd. demonstrates a commitment to shareholder returns, evidenced by its dividend payments with a payout ratio of 43.3% and cash payout ratio of 47.4%, indicating sustainability from both earnings and cash flow perspectives. Despite a relatively low dividend yield of 2% compared to the top US payers, Garmin's dividends have grown steadily over the past decade, underscoring reliability without significant insider selling recently. This stability is further supported by substantial recent earnings growth (32.5% over the past year) and an optimistic revenue forecast for 2024, projecting a 10% increase to approximately US$5.75 billion, alongside strategic product advancements in aviation and weather radar technologies aimed at enhancing safety and reducing pilot workload.

Take a closer look at Garmin's potential here in our dividend report.

Upon reviewing our latest valuation report, Garmin's share price might be too optimistic.

Summing It All Up

Explore the 273 names from our Top Dividend Stocks screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance