Exploring Top Dividend Stocks In May 2024

As of May 2024, the United States market shows a stable outlook with the Utilities sector experiencing a notable gain of 3.3%, and an overall annual increase of 26%. In this environment, choosing dividend stocks that not only offer regular income but also have potential for earnings growth becomes particularly compelling.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.09% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.96% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.06% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.96% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.84% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.88% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.81% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.39% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 5.22% | ★★★★★☆ |

Union Bankshares (NasdaqGM:UNB) | 5.68% | ★★★★★☆ |

Click here to see the full list of 201 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

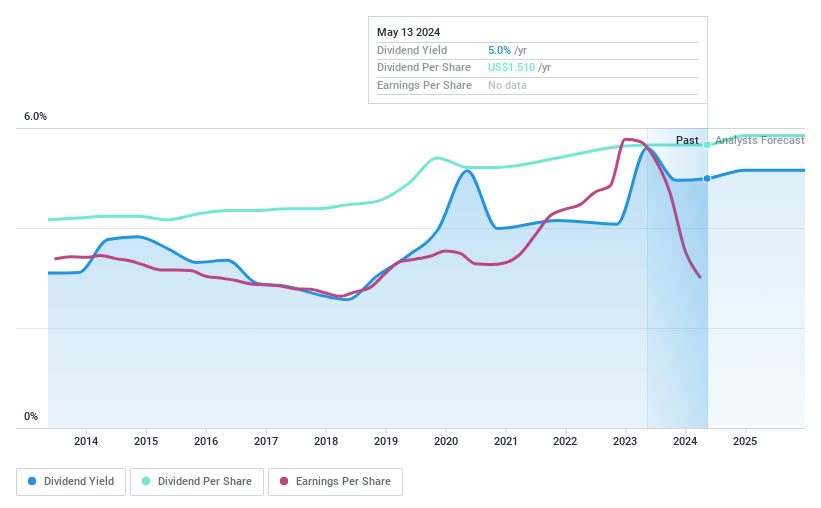

National Bankshares

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bankshares, Inc., serving as the bank holding company for the National Bank of Blacksburg, offers retail and commercial banking products and services to a diverse clientele including individuals, businesses, non-profits, and local governments; it has a market capitalization of approximately $178.35 million.

Operations: National Bankshares, Inc. provides a range of banking products and services primarily to individuals, businesses, non-profits, and local government entities.

Dividend Yield: 5%

National Bankshares reported a decrease in net interest income and net income for Q1 2024, with earnings per share dropping from US$0.77 to US$0.37. Despite recent earnings declines, the company maintains a strong dividend profile, offering a high yield of 4.99%, which is above the market average. Dividend payments have been consistent and growing over the past decade, supported by a reasonable payout ratio of 66.7%. However, profit margins have contracted from last year's 43.1% to 29.5%.

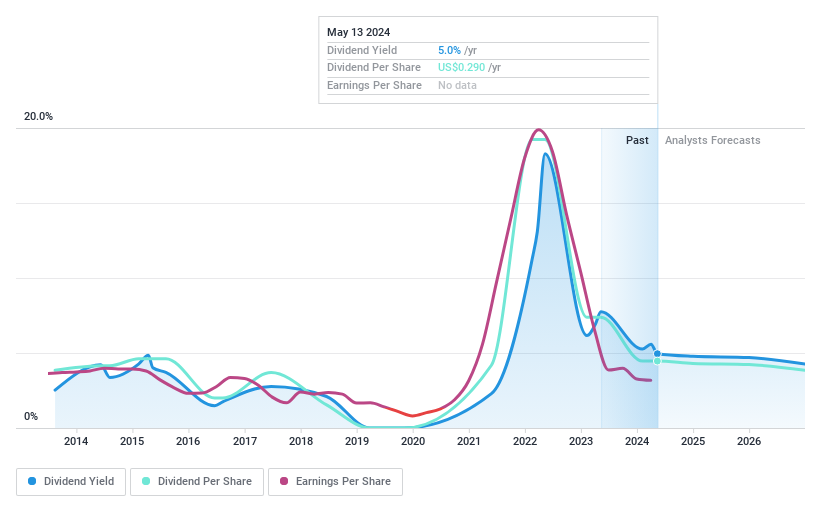

Himax Technologies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that offers display imaging processing technologies across various regions including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market capitalization of approximately $1.02 billion.

Operations: Himax Technologies, Inc. operates primarily in the display imaging processing technology sector across multiple regions such as China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Dividend Yield: 5%

Himax Technologies reported a decrease in quarterly sales and net income, with revenues falling to US$207.55 million from US$244.2 million year-over-year, and net income dropping to US$12.5 million from US$14.93 million. Despite these declines, the company expects an 8% to 13% sequential increase in revenue for Q2 2024. The dividend was set at 29 cents per ADS for 2023, payable in July, reflecting a cautious approach amid financial fluctuations and a high payout ratio of 100%, indicating potential sustainability concerns despite reasonable cash flow coverage at a cash payout ratio of 42.3%.

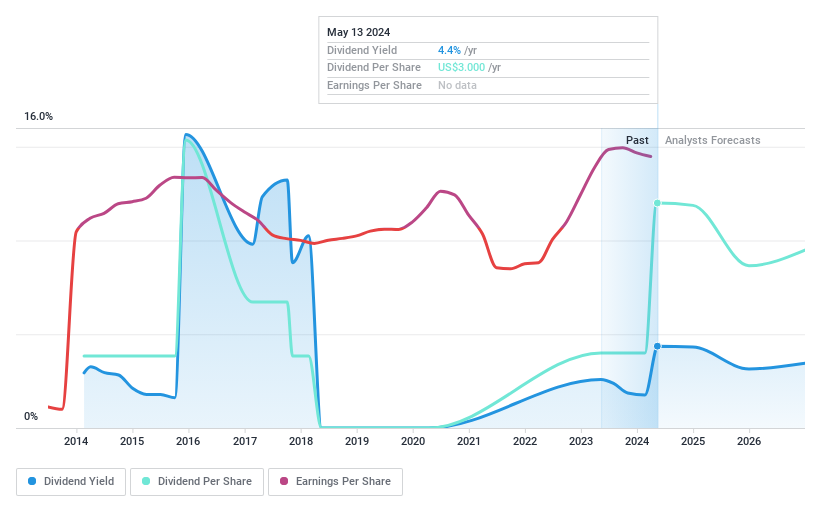

Teekay Tankers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. operates globally, offering crude oil and marine transportation services with a market capitalization of approximately $2.35 billion.

Operations: Teekay Tankers Ltd. generates its revenue primarily from tanker services, amounting to approximately $1.31 billion.

Dividend Yield: 4.4%

Teekay Tankers recently reported a decrease in quarterly revenue to US$338.34 million and net income to US$144.77 million, alongside earnings per share dropping from US$4.97 to US$4.23. Despite this downturn, the company declared a special dividend of US$2.00 and maintained its regular dividend at US$0.25 per share, highlighting a commitment to shareholder returns even amidst financial fluctuations. The firm's dividends are well-covered by earnings with a low payout ratio of 7%, though its historical dividend performance has been marked by volatility and inconsistency over the past decade.

Summing It All Up

Gain an insight into the universe of 201 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:NKSH NasdaqGS:HIMX and NYSE:TNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance