Exploring TSX Dividend Stocks In May 2024

The Canadian market has shown robust growth, with a 1.3% increase over the last week and a notable 9.1% rise over the past 12 months, alongside an optimistic forecast of annual earnings growth at 13%. In this context, identifying dividend stocks that offer stability and potential for consistent returns becomes particularly compelling.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.46% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.16% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.55% | ★★★★★☆ |

Savaria (TSX:SIS) | 3.01% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.53% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.29% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.91% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.55% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.02% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Alaris Equity Partners Income Trust

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Alaris Equity Partners Income Trust, a private equity firm, focuses on management buyouts, growth capital, and mature investments in lower to middle market companies with a market capitalization of approximately CA$766.19 million.

Operations: Alaris Equity Partners Income Trust does not have detailed revenue segments provided in the text.

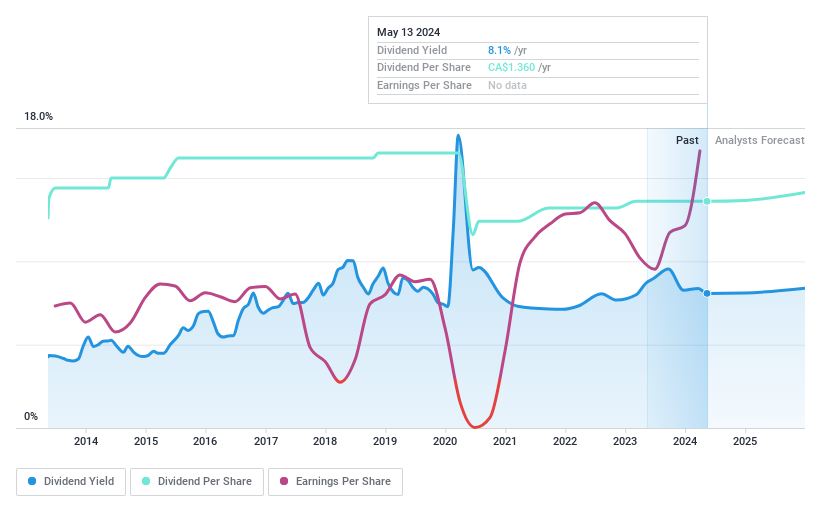

Dividend Yield: 8.1%

Alaris Equity Partners Income Trust, despite a volatile dividend history, offers a high yield of 8.08%, ranking in the top 25% in its market. The dividends are supported by both earnings and cash flows with payout ratios of 29.9% and 77.8% respectively, indicating sustainability from its operational finances. Recent financials show significant growth with Q1 net income rising to CAD 73.77 million from CAD 5.55 million year-over-year, driven by strategic asset redemptions like the Brown & Settle Investments yielding CAD 42.2 million in returns. However, earnings are projected to decline annually by about 45% over the next three years, suggesting potential future challenges for maintaining dividend levels.

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services to healthcare institutions, hotels, and other commercial organizations, with a market capitalization of approximately CA$370.61 million.

Operations: K-Bro Linen Inc. generates its revenue by providing essential laundry and linen services across two primary geographical segments: Canada and the United Kingdom.

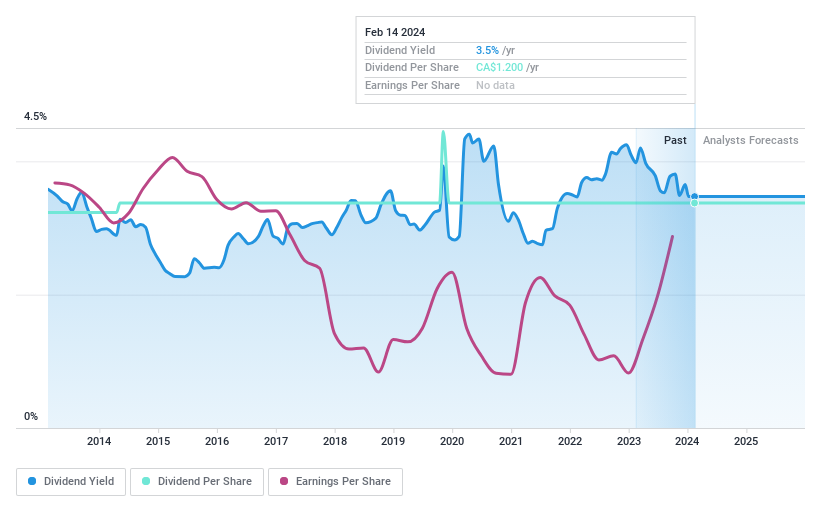

Dividend Yield: 3.4%

K-Bro Linen maintains a consistent dividend yield of 3.39%, supported by a stable 10-year history and a reasonable payout ratio of 73.2%. Its dividends are well covered by both earnings and cash flows, with cash payout ratios at 38.5%. Despite trading at 62.5% below its estimated fair value and expectations of an earnings growth rate of 18.06% per year, its dividend yield remains modest compared to the top Canadian payers. Recent financials indicate slight dips in net income and EPS, but continued commitment to dividends is evident from recent affirmations and stable quarterly payouts of CAD$0.10 per share.

Toronto-Dominion Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services across Canada, the United States, and other international markets, boasting a market capitalization of approximately CA$136.16 billion.

Operations: Toronto-Dominion Bank generates revenue through its U.S. Retail segment with CA$13.11 billion, Canadian Personal and Commercial Banking at CA$17.17 billion, Wealth Management and Insurance totaling CA$11.50 billion, and Wholesale Banking which contributes CA$6.15 billion.

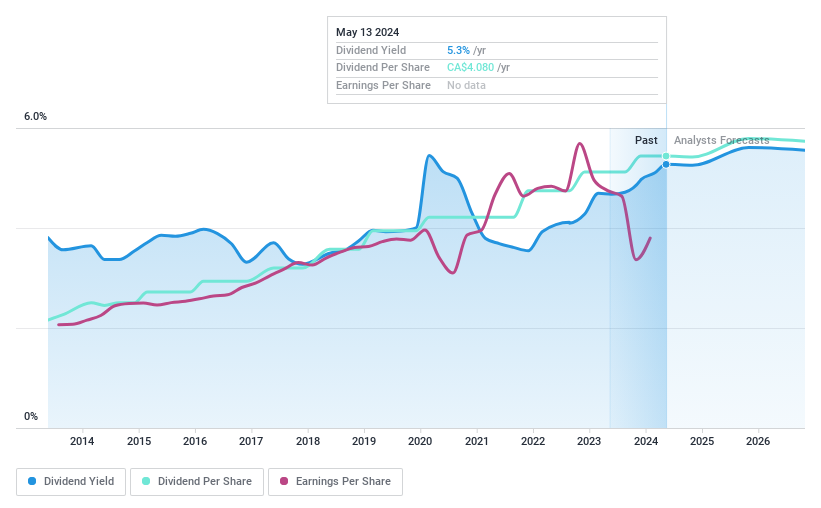

Dividend Yield: 5.3%

Toronto-Dominion Bank, involved in a recent legal settlement, will pay CAD 250,000 regarding allegations of price fixing in the SSA Bond market from 2005 to 2015. Concurrently, TD has been active in the fixed-income market, launching multiple senior unsecured notes with varying terms and rates. These offerings could impact the bank's financial flexibility and attractiveness as a dividend stock. Despite these challenges, TD maintains its commitment to dividends as evidenced by its latest declaration on February 29, 2024—CAD $1.02 per share for Q2. The bank's approach balances between addressing legal issues and sustaining shareholder returns through consistent dividend payments.

Turning Ideas Into Actions

Unlock our comprehensive list of 31 Top TSX Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AD.UNTSX:KBL and TSX:TD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance