Exploring UK Stocks Estimated To Be Below Fair Value In July 2024

As the FTSE 100 continues to show resilience with a second consecutive weekly gain amidst global economic uncertainties, investors are closely monitoring opportunities within the UK market. In this context, identifying stocks that are estimated to be below their fair value can be particularly compelling, especially when considering potential shifts in economic policies and market sentiment reflected in recent financial news.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Begbies Traynor Group (AIM:BEG) | £1.005 | £2.00 | 49.6% |

WPP (LSE:WPP) | £7.308 | £14.08 | 48.1% |

LSL Property Services (LSE:LSL) | £3.37 | £6.49 | 48.1% |

Loungers (AIM:LGRS) | £2.82 | £5.53 | 49% |

Velocity Composites (AIM:VEL) | £0.41 | £0.80 | 48.8% |

Elementis (LSE:ELM) | £1.53 | £3.02 | 49.3% |

Accsys Technologies (AIM:AXS) | £0.541 | £1.06 | 49% |

Ricardo (LSE:RCDO) | £4.98 | £9.53 | 47.8% |

Hostelworld Group (LSE:HSW) | £1.54 | £2.97 | 48.2% |

M&C Saatchi (AIM:SAA) | £2.05 | £3.99 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Elementis

Overview: Elementis plc is a specialty chemical company based in the United Kingdom, with operations across Europe, North America, and internationally, boasting a market capitalization of approximately £0.90 billion.

Operations: The company's revenue is divided among several key segments, with Coatings (including Energy) generating $367.60 million, Personal Care contributing $209.30 million, and Talc bringing in $136.50 million.

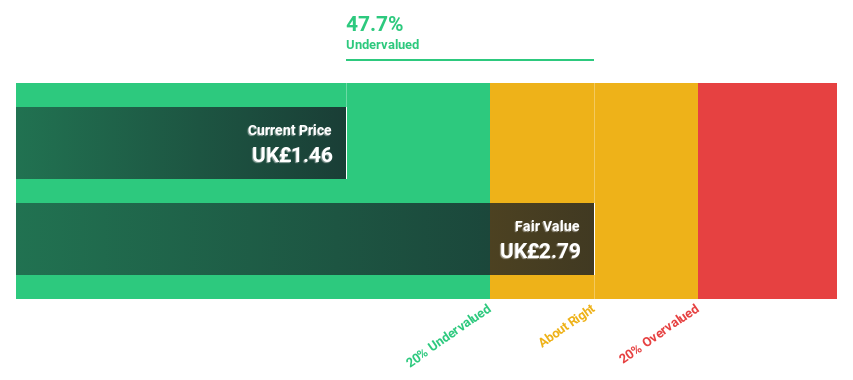

Estimated Discount To Fair Value: 49.3%

Elementis, priced at £1.53, is significantly undervalued based on discounted cash flows, with a fair value of £3.02. Despite trading 49.3% below this estimate, the company's earnings are expected to grow by 28.56% annually over the next three years—outpacing the UK market's forecasted 12.5%. However, its revenue growth is slower at 3.7% per year and recent investor activism highlights concerns about management and strategic direction, with calls for operational changes including leadership adjustments and business divestitures to enhance shareholder value.

The analysis detailed in our Elementis growth report hints at robust future financial performance.

Take a closer look at Elementis' balance sheet health here in our report.

Liontrust Asset Management

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market capitalization of approximately £421.15 million.

Operations: The primary revenue source for the firm comes from its investment management services, generating £197.89 million.

Estimated Discount To Fair Value: 40%

Liontrust Asset Management, trading at £6.59, appears undervalued with a fair value estimated at £10.98 based on discounted cash flows. Despite recent financial struggles—including a net loss of £3.49 million and a revenue drop to £197.89 million—the company is expected to return to profitability in three years with robust growth projections in earnings (50.56% annually). However, its dividend sustainability is questionable as it's not well-covered by earnings or free cash flows, reflecting potential risk for income-focused investors.

Trainline

Overview: Trainline Plc operates as an independent platform offering rail and coach ticket sales across the UK and internationally, with a market capitalization of approximately £1.52 billion.

Operations: Trainline Plc generates revenue through three primary segments: Trainline Solutions at £134.76 million, International Consumer at £53.16 million, and United Kingdom Consumer at £208.80 million.

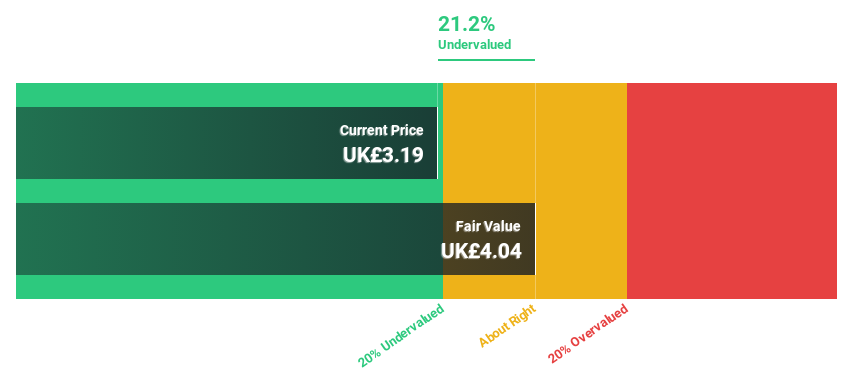

Estimated Discount To Fair Value: 19.1%

Trainline Plc, priced at £3.39, is seen as undervalued compared to our fair value estimate of £4.19. With a 19.1% undervaluation and analysts expecting a 22.9% price increase, its financial outlook is positive despite slower revenue growth projections (6.6% annually) compared to the market (20%). However, earnings are expected to grow robustly by 21.7% annually over the next three years, outpacing the UK market's average of 12.5%.

Our growth report here indicates Trainline may be poised for an improving outlook.

Dive into the specifics of Trainline here with our thorough financial health report.

Key Takeaways

Delve into our full catalog of 65 Undervalued UK Stocks Based On Cash Flows here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:ELMLSE:LIOLSE:TRN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com