Exploring Undervalued Opportunities: Three Euronext Amsterdam Stocks With Intrinsic Discounts Ranging From 45.9% to 48.7%

Amidst a backdrop of political uncertainty and fluctuating market conditions across Europe, the Netherlands' stock market presents unique opportunities for investors seeking value. This article explores three undervalued stocks on Euronext Amsterdam, highlighting their potential in a landscape where intrinsic discounts range from 45.9% to 48.7%. In such an environment, identifying stocks with solid fundamentals and discounted valuations could be particularly prudent for those looking to invest wisely.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

Name | Current Price | Fair Value (Est) | Discount (Est) |

Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

PostNL (ENXTAM:PNL) | €1.382 | €2.68 | 48.4% |

Arcadis (ENXTAM:ARCAD) | €58.85 | €114.69 | 48.7% |

Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

InPost (ENXTAM:INPST) | €16.77 | €30.98 | 45.9% |

Ctac (ENXTAM:CTAC) | €3.09 | €3.81 | 18.9% |

Alfen (ENXTAM:ALFEN) | €33.07 | €40.18 | 17.7% |

Underneath we present a selection of stocks filtered out by our screen

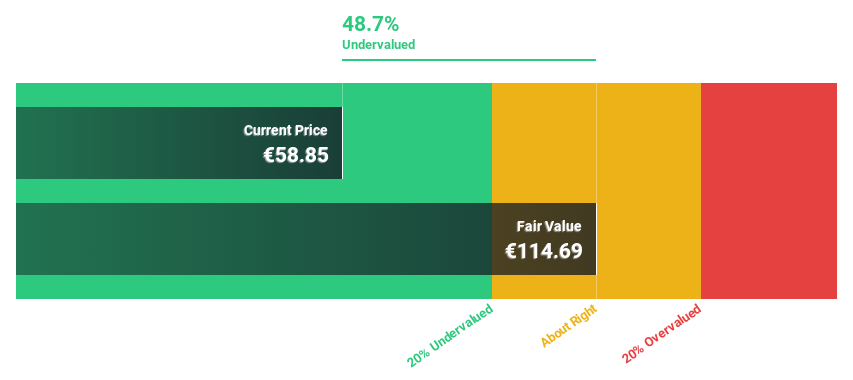

Arcadis

Overview: Arcadis NV is a global company providing design, engineering, and consultancy services for natural and built assets across The Americas, Europe, the Middle East, and Asia Pacific, with a market capitalization of approximately €5.29 billion.

Operations: Arcadis generates revenue through various segments, with €1.94 billion from Places, €978.80 million from Mobility, €1.96 billion from Resilience, and €122.50 million from Intelligence.

Estimated Discount To Fair Value: 48.7%

Arcadis, trading at €58.7, is significantly undervalued based on its discounted cash flow (DCF) with a fair value estimated at €114.65, reflecting a 48.8% undervaluation. Despite this, revenue growth projections are modest at 1.6% annually, lagging behind the Dutch market forecast of 9.5%. Additionally, high debt levels and significant insider selling over the past three months may raise concerns about its financial stability and management's confidence in the company's future performance.

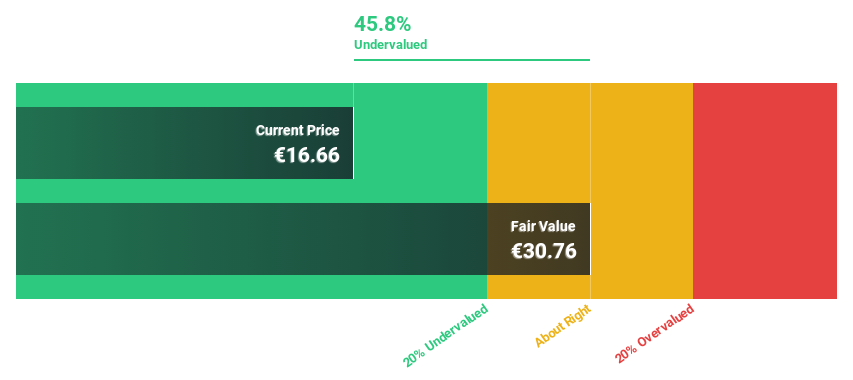

InPost

Overview: InPost S.A. operates as an out-of-home e-commerce enablement platform in Europe, offering parcel locker services with a market capitalization of approximately €8.38 billion.

Operations: The company generates revenue primarily through its Segment Adjustment and International - Mondial Relay, with figures reported at PLN 6.35 billion and PLN 2.92 billion respectively.

Estimated Discount To Fair Value: 45.9%

InPost, priced at €16.77, appears undervalued with a DCF-derived fair value of €30.98, indicating a 45.9% discount. The company's revenue and earnings growth outpace the Dutch market, with earnings expected to increase by 26.65% annually over three years and recent quarterly reports showing robust year-over-year gains in sales and net income. However, its high debt level remains a concern for financial stability amidst this growth trajectory.

The growth report we've compiled suggests that InPost's future prospects could be on the up.

Click here to discover the nuances of InPost with our detailed financial health report.

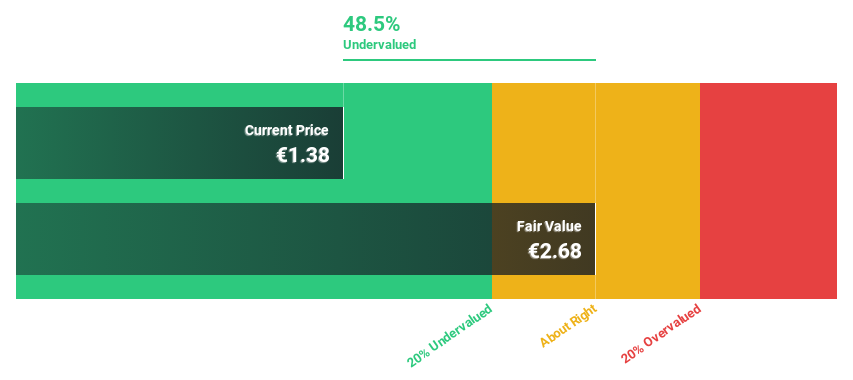

PostNL

Overview: PostNL N.V. operates as a postal and logistics service provider in the Netherlands, other parts of Europe, and internationally, with a market capitalization of approximately €0.69 billion.

Operations: PostNL's revenue is primarily derived from its Packages and Mail in The Netherlands segments, generating €2.25 billion and €1.35 billion respectively.

Estimated Discount To Fair Value: 48.4%

PostNL, trading at €1.38, is significantly undervalued with an estimated fair value of €2.68, reflecting a substantial discount. Despite a high debt load and recent shareholder dilution, the company's earnings are poised for robust growth at 24.2% annually over the next three years—outpacing the Dutch market average. However, its revenue growth forecast of 3.4% lags behind market expectations. Additionally, PostNL recently raised €298.67 million through sustainability-linked bonds to potentially enhance its financial flexibility.

Next Steps

Click this link to deep-dive into the 7 companies within our Undervalued Euronext Amsterdam Stocks Based On Cash Flows screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ARCAD ENXTAM:INPST and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance