Exploring Undervalued Small Caps With Insider Actions In June 2024

Amidst a generally sluggish sector performance on the Australian market, with only the energy sector showing positive momentum today, small-cap stocks continue to navigate a challenging landscape. The ASX200's slight uptick today offers a glimmer of hope for potential opportunities within this volatile segment. In such an environment, identifying undervalued small caps can hinge on thorough analysis and insider actions that may signal unrecognized value or upcoming strategic moves.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.1x | 2.6x | 46.55% | ★★★★★★ |

Tabcorp Holdings | NA | 0.6x | 33.66% | ★★★★★★ |

Codan | 25.9x | 3.8x | 29.47% | ★★★★☆☆ |

Dicker Data | 20.9x | 0.8x | 1.05% | ★★★★☆☆ |

Eagers Automotive | 9.5x | 0.3x | 29.42% | ★★★★☆☆ |

Fiducian Group | 17.6x | 3.1x | 7.37% | ★★★☆☆☆ |

Tasmea | 14.0x | 0.9x | 14.37% | ★★★☆☆☆ |

Coventry Group | 293.5x | 0.4x | -31.56% | ★★★☆☆☆ |

Lynch Group Holdings | NA | 0.4x | -15.11% | ★★★☆☆☆ |

Star Entertainment Group | NA | 0.8x | -6.95% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

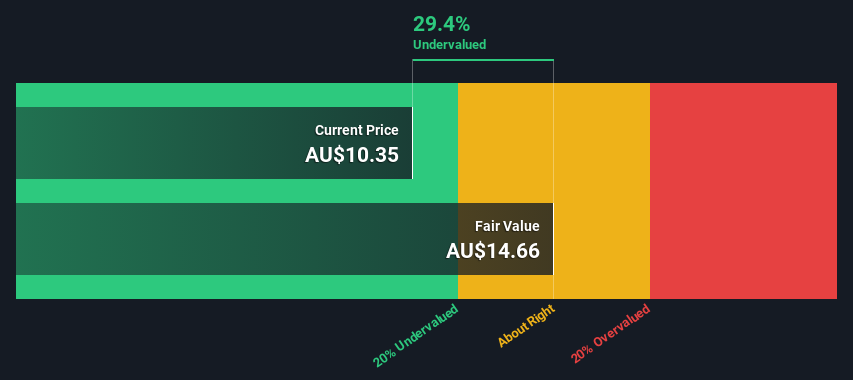

Eagers Automotive

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates primarily in car retailing, with a minor involvement in property management.

Operations: Car Retailing generates the majority of revenue, contributing A$9.85 billion, with a notable gross profit margin of 18.60% as of the latest reporting period. This segment's cost structure is primarily driven by Cost of Goods Sold (COGS), which recently amounted to A$8.03 billion, reflecting significant operational scale and market presence in automotive retailing.

PE: 9.5x

Recently, Nicholas Politis demonstrated insider confidence in Eagers Automotive by acquiring A$2.09 million worth of shares, signaling strong belief in the company's prospects. This move aligns with the firm's aggressive strategy for growth, including a new share repurchase program announced on June 11, aiming to buy back 10% of its issued capital by mid-2025. Despite a challenging financial stance with high debt levels and reliance on external borrowing, Eagers Automotive is actively pursuing mergers and acquisitions to bolster its revenue stream, projected to increase annually by 5.57%. This strategic direction is underscored by their continuous search for accretive M&A opportunities to enhance shareholder value.

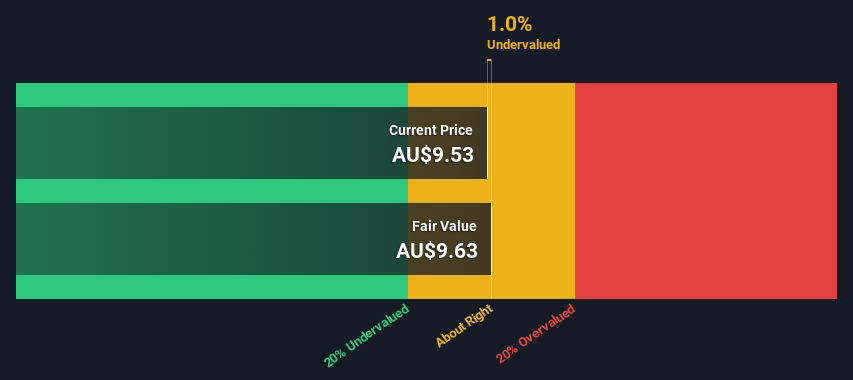

Dicker Data

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is an Australian company specializing in the wholesale distribution of computer peripherals, with a market capitalization of approximately A$2.27 billion.

Operations: In the most recent fiscal period, Wholesale - Computer Peripherals generated A$2.27 billion in revenue, with a gross profit of A$322.61 million, reflecting a gross profit margin of 14.23%. The net income for this period stood at A$82.15 million, translating to a net income margin of approximately 3.62%.

PE: 20.9x

Dicker Data, a notable player in the tech distribution sector, recently saw significant insider confidence with David Dicker purchasing 58,165 shares for A$703,674 on May 13. This move underscores strong belief in the company's prospects amidst its financial landscape marked by high debt yet robust earnings growth forecast at 7.94% annually. With an upcoming AGM to discuss key financial and governance issues, the firm continues to attract attention for its strategic direction and potential growth trajectory in a challenging market environment.

Dive into the specifics of Dicker Data here with our thorough valuation report.

Examine Dicker Data's past performance report to understand how it has performed in the past.

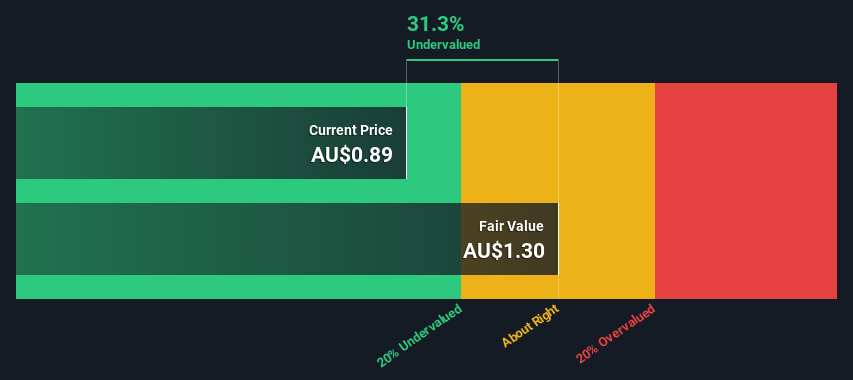

SRG Global

Simply Wall St Value Rating: ★★★★☆☆

Overview: SRG Global is a diversified company specializing in mining services, asset maintenance, and engineering and construction.

Operations: Mining Services, Asset Maintenance, and Engineering and Construction are the primary revenue streams for the company, generating A$143.32 million, A$412.46 million, and A$383.86 million respectively. The gross profit margin has shown an upward trend over recent periods, reaching 0.59% in the latest data available from 2024-06-12.

PE: 18.3x

Recently, SRG Global's leadership demonstrated insider confidence, with Chairman Peter McMorrow acquiring A$155K worth of shares. This move underscores the trust in the company’s potential despite its reliance on external borrowing—a riskier funding method. At a recent industry conference, SRG highlighted initiatives likely to propel an 18% annual earnings growth. These elements suggest SRG Global is positioned intriguingly for those eyeing underestimated entities in Australia's dynamic market landscape.

Get an in-depth perspective on SRG Global's performance by reading our valuation report here.

Review our historical performance report to gain insights into SRG Global's's past performance.

Next Steps

Click this link to deep-dive into the 27 companies within our Undervalued ASX Small Caps With Insider Buying screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:DDR and ASX:SRG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance