Exploring Undervalued Small Caps With Insider Actions In United States July 2024

As the S&P 500 and Nasdaq reach record highs, buoyed by strong performances in tech stocks like Nvidia, the broader market sentiment appears optimistic. This positive momentum sets an intriguing backdrop for exploring undervalued small-cap stocks, which may present unique opportunities in such a flourishing economic environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Hanover Bancorp | 8.2x | 1.9x | 49.58% | ★★★★★☆ |

PCB Bancorp | 8.8x | 2.4x | 45.11% | ★★★★★☆ |

Titan Machinery | 3.6x | 0.1x | 30.08% | ★★★★★☆ |

Franklin Financial Services | 8.8x | 1.8x | 37.60% | ★★★★☆☆ |

Leggett & Platt | NA | 0.3x | 19.88% | ★★★★☆☆ |

Papa John's International | 18.7x | 0.7x | 39.38% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 17.34% | ★★★★☆☆ |

Citizens & Northern | 11.6x | 2.6x | 42.67% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -144.63% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Chimera Investment

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing, on a leveraged basis, in a diversified portfolio of mortgage assets with a market capitalization of approximately $1.08 billion.

Operations: The entity generates revenue primarily through investments in a diversified portfolio of mortgage assets, with a recent quarterly revenue reported at $291.99 million. It has maintained a gross profit margin of 89.09% while managing operating expenses totaling $54.35 million for the same period.

PE: 8.8x

Chimera Investment recently increased its quarterly dividend, signaling financial stability and shareholder confidence. Following a 1-for-3 reverse stock split, they effectively managed their share structure without diluting shareholder value significantly. Insider confidence is evident as they've completed substantial share repurchases, totaling $105.88 million since March 2020. Despite forecasts of a slight earnings decline over the next three years, robust Q1 results with net income more than doubling suggest resilience and potential for future growth.

PennyMac Mortgage Investment Trust

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PennyMac Mortgage Investment Trust is a specialty finance company that focuses on the production and investment in mortgage loans and mortgage-related assets, with a market capitalization of approximately $1.20 billion.

Operations: The company's gross profit margin has shown a notable increase over the past periods, reflecting a rise from 70.17% to 81.20%. This trend highlights an improving efficiency in managing the cost of goods sold relative to revenue, which peaked at $600.46 million in recent reporting.

PE: 8.6x

PennyMac Mortgage Investment Trust, recently added to the Russell 2000 Defensive Index, demonstrates a strategic financial maneuver with its new $355 million secured term notes, aimed at reducing costs by redeeming higher-rate notes. This move underscores management's adept handling of capital in a challenging environment marked by reliance on external borrowing. With earnings forecasted to grow annually by 5.76%, insider confidence is evident as they have recently purchased shares, signaling belief in the company’s trajectory despite its high debt levels.

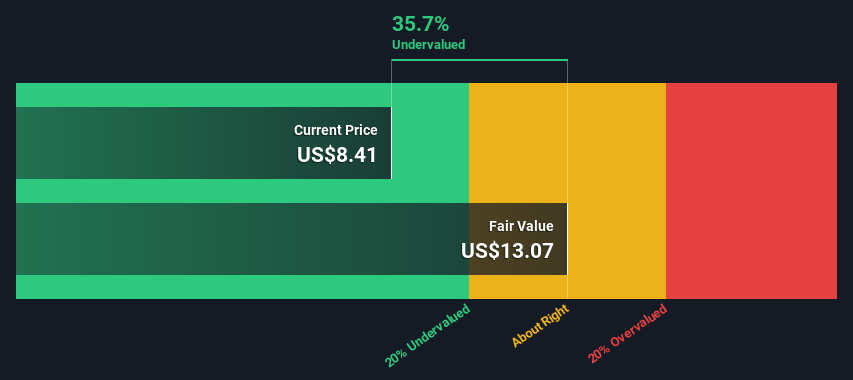

Ready Capital

Simply Wall St Value Rating: ★★★★★☆

Overview: Ready Capital is a real estate finance company that specializes in small business lending and lower middle market commercial real estate, with a market capitalization of approximately $1.07 billion.

Operations: The company's gross profit margin has shown a notable increase, rising from 9.58% in 2013 to an impressive 85.36% by mid-2024, reflecting significant efficiency in managing production costs relative to revenue. Over the same period, net income also demonstrated substantial growth, escalating from $0.80 million to $220.66 million, underscoring robust profitability and effective operational management.

PE: 6.6x

Despite a challenging quarter where Ready Capital reported a significant net loss of US$74.28 million, the firm demonstrated confidence in its future through substantial insider purchases and an aggressive share repurchase strategy, buying back 3.74 million shares for US$32.72 million recently. Their commitment is further underscored by steady dividend payouts, including a recent declaration for preferred and common stocks. This financial maneuvering suggests that insiders see current market prices as not reflective of the company’s intrinsic value or potential growth trajectory.

Get an in-depth perspective on Ready Capital's performance by reading our valuation report here.

Understand Ready Capital's track record by examining our Past report.

Key Takeaways

Explore the 62 names from our Undervalued US Small Caps With Insider Buying screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:CIM NYSE:PMT and NYSE:RC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance