Exploring Undervalued Small Caps With Insider Actions In Australia July 2024

The Australian market has shown robust growth, rising 1.4% over the past week and achieving a 10% increase over the last year, with earnings projected to grow by 13% annually. In this context, identifying undervalued small-cap stocks that are also seeing insider buying can be particularly compelling for investors looking for potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.0x | 2.6x | 48.95% | ★★★★★★ |

Nick Scali | 13.5x | 2.5x | 46.09% | ★★★★★★ |

Healius | NA | 0.6x | 42.99% | ★★★★★☆ |

Eagers Automotive | 9.4x | 0.3x | 35.09% | ★★★★☆☆ |

Elders | 21.3x | 0.5x | 47.37% | ★★★★☆☆ |

Codan | 29.7x | 4.4x | 25.62% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.7x | 19.77% | ★★★★☆☆ |

RAM Essential Services Property Fund | NA | 5.8x | 39.73% | ★★★★☆☆ |

Dicker Data | 23.1x | 0.8x | -4.60% | ★★★☆☆☆ |

Coventry Group | 278.9x | 0.4x | -14.74% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

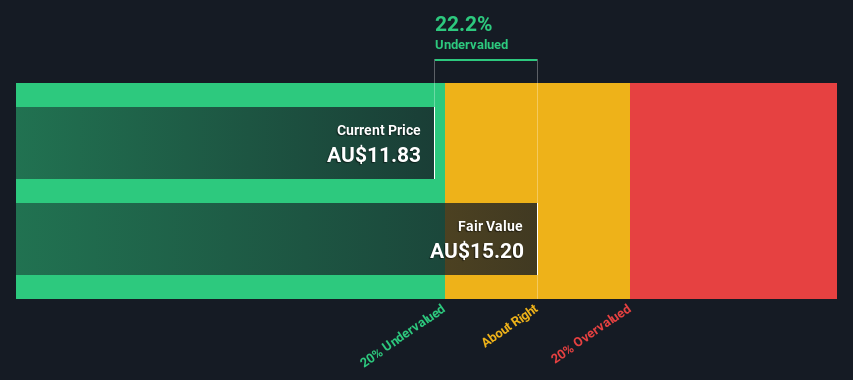

Codan

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications, metal detection, and other electronic technologies, with a market capitalization of approximately A$1.08 billion.

Operations: The company generates its revenue primarily from Communications and Metal Detection, contributing A$291.50 million and A$212.20 million respectively. Over recent periods, it has reported a gross profit margin of approximately 54.42%, reflecting the cost efficiency of its operations relative to its revenue generation capabilities.

PE: 29.7x

Reflecting its potential, Codan has seen insider confidence with recent share purchases by insiders, signaling a strong belief in the company's prospects. Despite relying entirely on external borrowing, which presents a higher risk funding model, Codan is poised for growth with earnings expected to increase by 16% annually. This outlook suggests that the company might be undervalued, offering an intriguing opportunity for those looking at lesser-known entities with substantial upside potential.

Click to explore a detailed breakdown of our findings in Codan's valuation report.

Evaluate Codan's historical performance by accessing our past performance report.

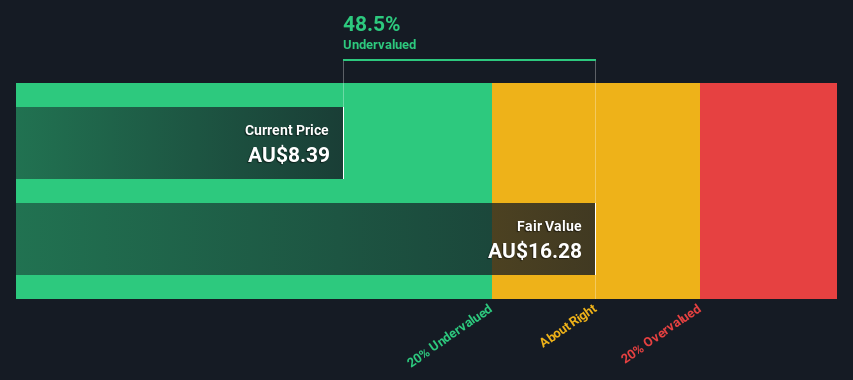

Dicker Data

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor of computer peripherals, operating primarily in the technology sector with a market capitalization of approximately A$2.27 billion.

Operations: Wholesale of computer peripherals generated A$2.27 billion in revenue, with a notable gross profit margin of 14.23% as of the latest reporting period. This segment has experienced an increasing trend in gross profit margins over recent years, reflecting improved operational efficiency or product mix adjustments.

PE: 23.1x

Dicker Data's appeal in the realm of undervalued entities is underscored by its strategic financial maneuvers and insider confidence, highlighted by recent purchases from insiders, signaling belief in the company's prospects. Despite a reliance on external borrowing—its sole funding source—Dicker Data maintains a robust growth forecast with earnings expected to rise nearly 8% annually. The company also supports shareholder returns, as evidenced by its upcoming cash dividend of A$0.11 set for distribution mid-May 2024. This blend of financial health and insider activity paints Dicker Data as a noteworthy contender for those eyeing potential in lesser-known markets.

Get an in-depth perspective on Dicker Data's performance by reading our valuation report here.

Understand Dicker Data's track record by examining our Past report.

Elders

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an Australian company involved in providing a range of services including branch network operations, wholesale products, feed and processing services, and corporate services, with a market capitalization of approximately A$1.47 billion.

Operations: The company generates the majority of its revenue from its Branch Network segment, which brought in A$2.54 billion, supplemented by smaller contributions from Wholesale Products and Feed and Processing Services totaling A$341.19 million and A$120.14 million respectively. Over recent periods, the Gross Profit Margin has shown variability but remains significant, illustrating a range between 17% to 22%.

PE: 21.3x

Elders Limited, reflecting a strategic stance in the agricultural sector, recently re-affirmed its earnings guidance with an expected EBIT of A$120 million to A$140 million for FY 2024. Despite a dip in half-year sales and net income, insider confidence is evident as they recently purchased shares, signaling belief in the company's resilience and growth prospects. Adding to its robust leadership, Damien Frawley's appointment as a non-executive director enhances governance and industry expertise. This mix of financial caution and strategic optimism positions Elders intriguingly for observant investors.

Take a closer look at Elders' potential here in our valuation report.

Assess Elders' past performance with our detailed historical performance reports.

Summing It All Up

Click through to start exploring the rest of the 19 Undervalued ASX Small Caps With Insider Buying now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:DDR and ASX:ELD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance