Exploring Undervalued Small Caps With Insider Action In Hong Kong July 2024

Amidst a backdrop of global economic shifts and localized market dynamics, the Hong Kong stock market has shown resilience with the Hang Seng Index gaining modestly during a holiday-shortened week. This context sets an intriguing stage for exploring undervalued small-cap stocks in Hong Kong, particularly those with recent insider actions that might signal unrecognized potential under current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

China Overseas Grand Oceans Group | 2.7x | 0.1x | 3.96% | ★★★★★☆ |

Wasion Holdings | 11.3x | 0.8x | 32.87% | ★★★★☆☆ |

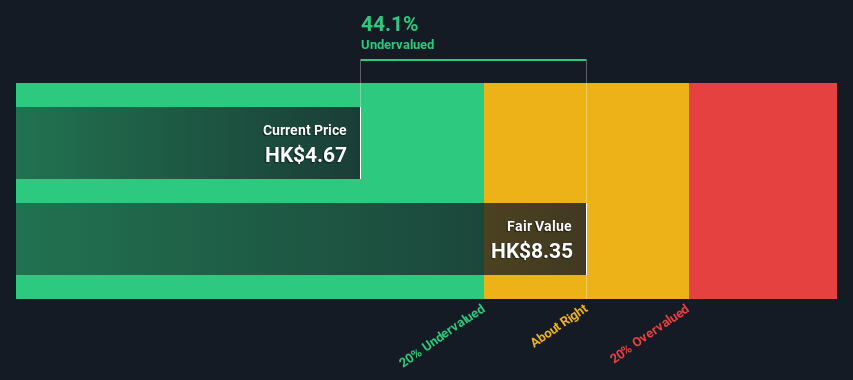

Xtep International Holdings | 10.7x | 0.8x | 44.08% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 7.8x | 0.7x | -21.00% | ★★★★☆☆ |

Nissin Foods | 14.5x | 1.3x | 40.78% | ★★★★☆☆ |

Ever Sunshine Services Group | 5.7x | 0.4x | 17.08% | ★★★★☆☆ |

Kinetic Development Group | 4.0x | 1.7x | 20.10% | ★★★★☆☆ |

China Leon Inspection Holding | 9.4x | 0.7x | 30.54% | ★★★★☆☆ |

Transport International Holdings | 11.7x | 0.6x | 43.85% | ★★★★☆☆ |

Giordano International | 8.4x | 0.7x | 38.02% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Xtep International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xtep International Holdings is a Chinese company specializing in the design, development, manufacturing, and marketing of sports products including footwear and apparel, with a market capitalization of approximately CN¥7.93 billion.

Operations: The company generates the majority of its revenue from the Mass Market segment, amounting to CN¥11.95 billion, with additional income streams from Fashion Sports and Professional Sports segments totaling CN¥1.60 billion and CN¥0.80 billion respectively. The Gross Profit Margin observed an upward trend, increasing from 40.29% to 42.17% over the analyzed periods, reflecting improved operational efficiency in cost management relative to sales revenue generated.

PE: 10.7x

Recently, Xtep International Holdings demonstrated insider confidence with Shui Po Ding acquiring 2 million shares for HK$14.15 million, signaling strong belief in the company's value. This move coincides with an executive reshuffle enhancing focus on financial strategy and growth areas. Additionally, the firm's earnings are projected to grow by 14% annually, complemented by a recent dividend increase to HK$0.08 per share, reinforcing its financial health and commitment to shareholder returns amidst strategic adjustments in governance and leadership roles.

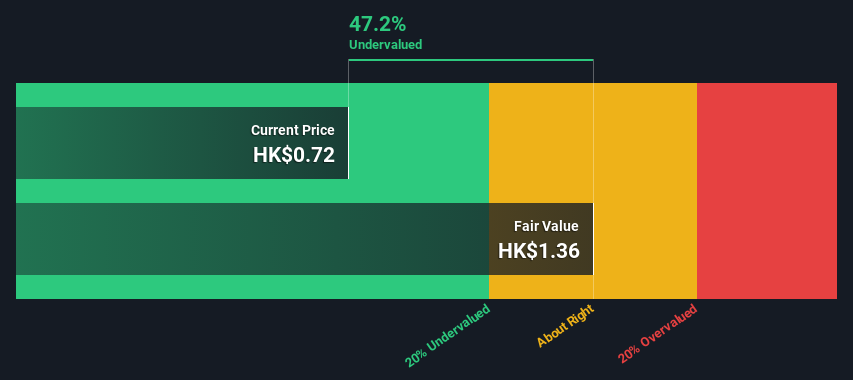

Comba Telecom Systems Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, primarily to operators, with a market capitalization of approximately HK$1.39 billion.

Operations: The company generates significant revenue from wireless telecommunications network system equipment and services, amounting to HK$5.82 billion, compared to HK$157.83 million from operator telecommunication services. Its gross profit margin has shown an upward trend, increasing to 28.23% by the end of the reporting period, reflecting a gradual improvement in profitability over time without consistent growth every year.

PE: 295.3x

Recently, Comba Telecom Systems Holdings demonstrated insider confidence as Tung Ling Fok acquired 1.83 million shares, signaling a strong belief in the company's prospects. This move aligns with their presentation at MWC Shanghai 2024, emphasizing strategic initiatives and market positioning. Despite a challenging year with profit margins dropping to 0.1% from last year’s 3%, due to significant one-off items, the firm remains reliant on external borrowing for funding. Looking ahead, no share repurchases have been made since the announcement of their authorization on June 3rd, reflecting a cautious approach in capital management amidst financial adjustments.

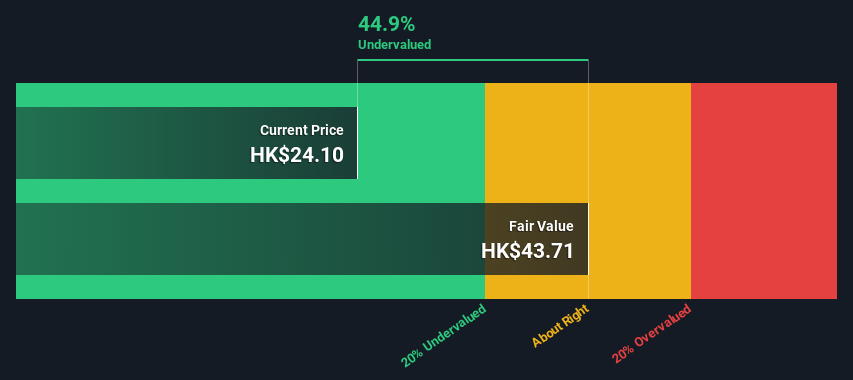

Ferretti

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: The entity generated €1229.13 million from the design, construction, and marketing of yachts and recreational boats, achieving a gross profit of €455.82 million with a gross profit margin of 37.08%. Operating expenses for the period amounted to €358.24 million.

PE: 11.6x

Ferretti, a lesser-known yet promising entity in Hong Kong's market, recently confirmed its 2024 revenue forecast to range between €1.22 billion and €1.24 billion, signaling a growth of up to 11.6%. With earnings anticipated to climb by 12.46% annually, the company's robust financial health is underscored by a high level of non-cash earnings and reliance on external borrowing for funding—reflecting a strategic yet higher-risk financing approach. Insider confidence was evident as they recently purchased shares, underscoring their belief in the firm’s potential amidst its dividend increase announcement in April 2024. This blend of financial strength and insider activity paints Ferretti as an intriguing prospect for those eyeing undervalued opportunities.

Dive into the specifics of Ferretti here with our thorough valuation report.

Explore historical data to track Ferretti's performance over time in our Past section.

Summing It All Up

Embark on your investment journey to our 20 Undervalued Small Caps With Insider Buying selection here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1368 SEHK:2342 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance