Exploring Undervalued Small Caps With Insider Action In Hong Kong July 2024

As global markets navigate through a period of subtle shifts and quiet trading, the Hong Kong small-cap sector presents intriguing possibilities. Amidst broader market tranquility, identifying undervalued small caps with recent insider actions could offer unique opportunities for discerning investors.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Wasion Holdings | 12.2x | 0.9x | 27.88% | ★★★★☆☆ |

Xtep International Holdings | 11.0x | 0.8x | 42.36% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 8.0x | 0.7x | -22.53% | ★★★★☆☆ |

Nissin Foods | 15.0x | 1.3x | 39.02% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.8x | 0.1x | -1.57% | ★★★★☆☆ |

Transport International Holdings | 11.4x | 0.6x | 44.98% | ★★★★☆☆ |

Giordano International | 8.7x | 0.8x | 35.98% | ★★★☆☆☆ |

China Leon Inspection Holding | 10.5x | 0.8x | 22.72% | ★★★☆☆☆ |

Shenzhen International Holdings | 7.9x | 0.7x | 15.78% | ★★★☆☆☆ |

China Lesso Group Holdings | 3.8x | 0.3x | -35.86% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

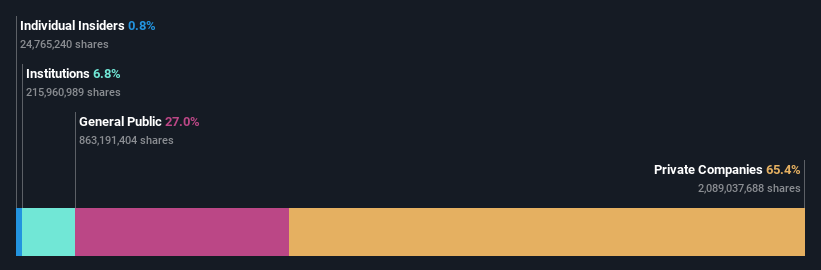

Overview: Kinetic Development Group is a company primarily engaged in property development, with a market capitalization of approximately CN¥1.23 billion.

Operations: The company's gross profit margin increased from 9.05% in September 2013 to 59.07% in July 2024, reflecting significant improvements in cost management relative to revenue, which grew from CN¥102.90 million to CN¥4745.07 million over the same period. This financial trend highlights a robust enhancement in operational efficiency and pricing strategy over time, leading to progressively higher profitability margins despite fluctuating operating expenses and net income figures throughout the periods observed.

PE: 4.3x

Kinetic Development Group, a lesser-known entity in Hong Kong's financial landscape, recently signaled insider confidence with substantial share purchases. This move aligns with the firm's robust dividend adjustments and strategic bylaw amendments, reflecting a proactive management approach. Despite relying solely on external borrowing—a higher risk funding strategy—the company maintains its operational momentum, as evidenced by the special dividend declared and upcoming Q1 2024 earnings report expected on May 31. These elements collectively suggest Kinetic Development Group is positioned for intriguing future prospects within its sector.

Transport International Holdings

Simply Wall St Value Rating: ★★★★☆☆

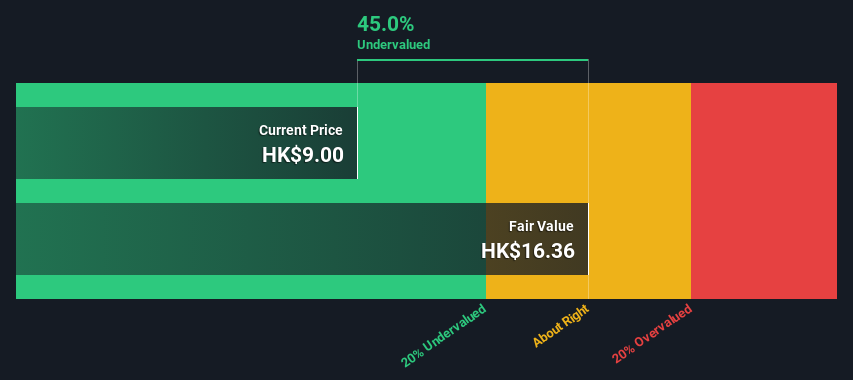

Overview: Transport International Holdings operates primarily in franchised bus operations, with additional interests in property holdings and development, achieving a market cap of approximately HK$5.07 billion.

Operations: Franchised Bus Operation is the primary revenue contributor for the company, generating HK$7.57 billion, with Property Holdings and Development adding a smaller portion at approximately HK$87.36 million. The company's Gross Profit Margin has shown an increasing trend over recent periods, reaching 0.28 in the latest report.

PE: 11.4x

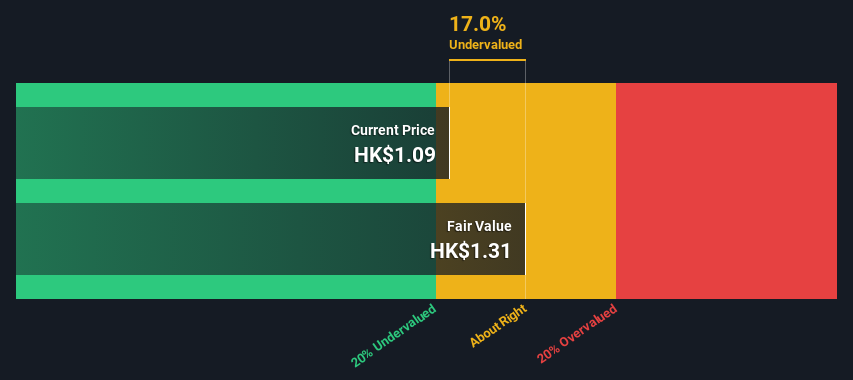

Transport International Holdings, a lesser-known entity in Hong Kong's bustling market, recently demonstrated insider confidence with a significant purchase by Winnie J. Ng, who acquired 124,000 shares for HK$1.11 million. This move on June 20 reflects optimism amidst a challenging backdrop where earnings have dipped annually over the past five years. Despite this, the company maintains a solid stance with no customer deposits and liabilities solely through external borrowing—indicative of its operational strategy. Moreover, recent executive shifts promise fresh perspectives at the helm, potentially steering future growth avenues.

Sany Heavy Equipment International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sany Heavy Equipment International Holdings is a company specializing in the manufacture and sale of heavy machinery and equipment, with a market capitalization of approximately CN¥5.76 billion.

Operations: The company's gross profit margin has seen a fluctuating trend over the observed periods, peaking at 0.35% in late 2013 and showing various ups and downs through to mid-2024 where it stood at approximately 0.27%. This variability reflects changes in cost of goods sold relative to revenue, which ranged from CN¥1.46 billion to CN¥14.83 billion during the same timeframe.

PE: 8.0x

Sany Heavy Equipment International Holdings recently affirmed a dividend of HK$0.19 per share, reflecting steady financial stewardship amid a slight dip in Q1 earnings to CNY 515.67 million from last year's CNY 650.26 million. With sales at CNY 5,129.58 million and an anticipated earnings growth of nearly 22% annually, their strategic amendments to company bylaws hint at proactive governance adjustments. Insider confidence shines through recent substantial share purchases, underscoring belief in the company’s trajectory despite external funding risks.

Next Steps

Access the full spectrum of 17 Undervalued Small Caps With Insider Buying by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1277 SEHK:62 and SEHK:631.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance