Exploring Undervalued Stocks on the Japanese Exchange in June 2024

Amidst a landscape of mixed performances across global markets, Japan's stock market presents a nuanced picture with the Nikkei 225 Index showing modest gains while the broader TOPIX Index has declined slightly. This contrasting movement within Japan’s indices highlights potential areas for identifying undervalued stocks that may offer attractive opportunities for investors. In such an environment, discerning investors might find value in stocks that are poised to benefit from current economic conditions and market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥469.00 | ¥896.41 | 47.7% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1885.00 | ¥3564.60 | 47.1% |

Hodogaya Chemical (TSE:4112) | ¥5840.00 | ¥11439.04 | 48.9% |

OSAKA Titanium technologiesLtd (TSE:5726) | ¥2833.00 | ¥5557.65 | 49% |

Cyber Security Cloud (TSE:4493) | ¥2114.00 | ¥4102.76 | 48.5% |

Gift Holdings (TSE:9279) | ¥2719.00 | ¥5129.03 | 47% |

Members (TSE:2130) | ¥889.00 | ¥1718.81 | 48.3% |

NIHON CHOUZAILtd (TSE:3341) | ¥1427.00 | ¥2758.65 | 48.3% |

Macromill (TSE:3978) | ¥890.00 | ¥1684.23 | 47.2% |

freee K.K (TSE:4478) | ¥2250.00 | ¥4456.38 | 49.5% |

Here's a peek at a few of the choices from the screener

Sumco

Overview: Sumco Corporation, with a market cap of ¥820.54 billion, specializes in manufacturing and selling silicon wafers for the semiconductor industry across various global markets including Japan, the United States, China, Taiwan, and Korea.

Operations: The company generates its revenue by manufacturing and selling silicon wafers primarily in Japan, the United States, China, Taiwan, and Korea.

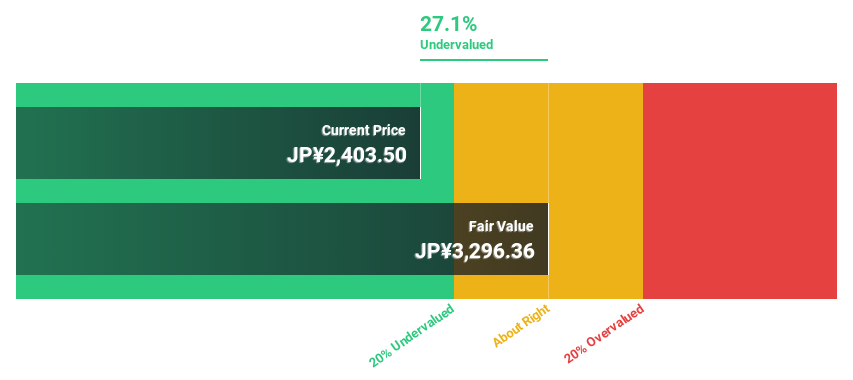

Estimated Discount To Fair Value: 27.1%

Sumco, priced at ¥2403.5, trades 27.1% below its estimated fair value of ¥3296.36, highlighting potential undervaluation based on discounted cash flow analysis. Despite a recent dividend cut with an interim set at JPY 10 per share for FY 2024, the company's financial outlook remains robust with expected revenue and earnings growth outpacing the Japanese market at 9.4% and 24.4% per year respectively. However, its profit margins have declined from last year’s 20.6% to current 7.6%, and the low coverage of dividends by cash flows suggests caution regarding dividend sustainability.

CyberAgent

Overview: CyberAgent, Inc. operates primarily in Japan, focusing on media, internet advertising, game development, and investment businesses with a market capitalization of approximately ¥489.22 billion.

Operations: The company's revenue is derived from media, internet advertising, and game development sectors.

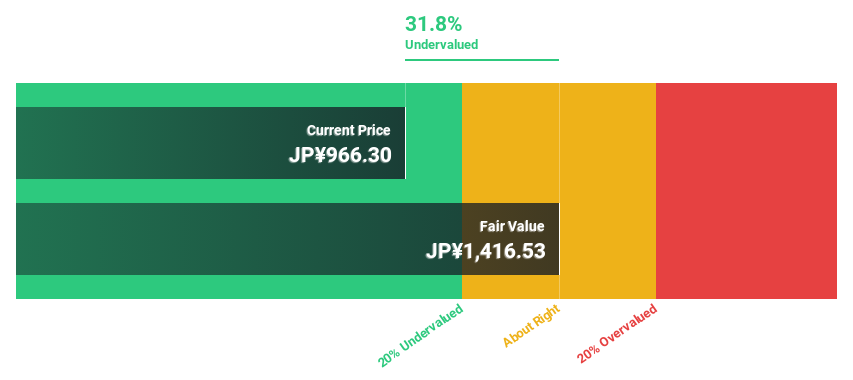

Estimated Discount To Fair Value: 31.8%

CyberAgent, with a forecasted revenue growth of 6.5% per year, is positioned to outpace the Japanese market's average of 4.1%. The company's earnings are expected to increase significantly over the next three years, although its Return on Equity is predicted to remain low at 14.2%. Recent financial results have been affected by one-off items, suggesting that while the growth prospects are promising based on cash flows, investors should be cautious of potential volatility in earnings quality.

The analysis detailed in our CyberAgent growth report hints at robust future financial performance.

Unlock comprehensive insights into our analysis of CyberAgent stock in this financial health report.

LITALICO

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market capitalization of approximately ¥64.34 billion.

Operations: The company generates revenue primarily through its Employment Support Business (¥10.59 billion), Child Welfare Business (¥9.55 billion), and Platform Business (¥3.90 billion).

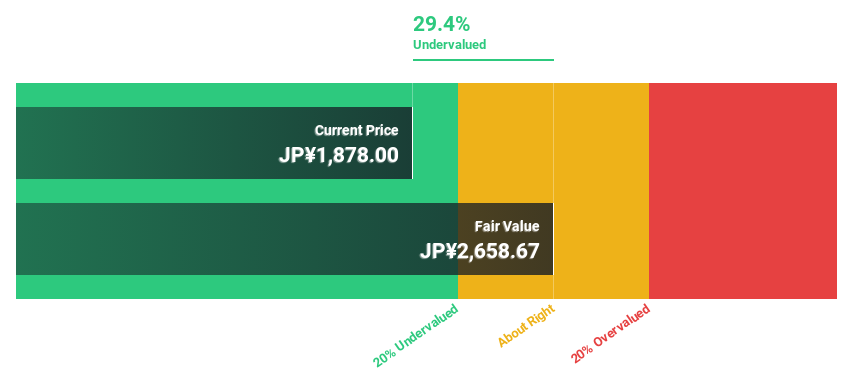

Estimated Discount To Fair Value: 29.4%

LITALICO Inc. is anticipated to see a revenue increase of 13.8% annually, surpassing the Japanese market's average growth rate of 4.1%. While its earnings growth at 12.6% per year also exceeds the market forecast of 8.8%, it does not qualify as significantly high. The company's Return on Equity is expected to be robust at 24.2% in three years. Recently, LITALICO raised its dividend to JPY 8 per share and provided positive earnings guidance for FY2025, projecting sales of JPY 35 billion and an operating profit of JPY 4.5 billion.

Turning Ideas Into Actions

Embark on your investment journey to our 101 Undervalued Japanese Stocks Based On Cash Flows selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3436 TSE:4751 and TSE:7366.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance