Exploring Undervalued Stocks On KRX: Medy-Tox And Two Others That May Be Trading Below Value Estimates

The South Korean market has shown modest growth over the past year, increasing by 6.5%, with a stable performance in the last week and expectations of significant earnings growth in the near future. In this context, identifying stocks that may be undervalued presents an opportunity for investors to potentially benefit from companies poised for upward revaluation amidst these promising economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Iljin ElectricLtd (KOSE:A103590) | ₩28400.00 | ₩55805.48 | 49.1% |

Caregen (KOSDAQ:A214370) | ₩23700.00 | ₩44549.16 | 46.8% |

Revu (KOSDAQ:A443250) | ₩10700.00 | ₩20682.89 | 48.3% |

Anapass (KOSDAQ:A123860) | ₩27700.00 | ₩48758.49 | 43.2% |

NEXTIN (KOSDAQ:A348210) | ₩63800.00 | ₩109556.59 | 41.8% |

KidariStudio (KOSE:A020120) | ₩4185.00 | ₩7315.35 | 42.8% |

Medy-Tox (KOSDAQ:A086900) | ₩159500.00 | ₩300018.30 | 46.8% |

Genomictree (KOSDAQ:A228760) | ₩22800.00 | ₩38889.40 | 41.4% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

SK Biopharmaceuticals (KOSE:A326030) | ₩83000.00 | ₩149772.41 | 44.6% |

Here we highlight a subset of our preferred stocks from the screener.

Medy-Tox

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea, with a market capitalization of approximately ₩1.07 billion.

Operations: The firm specializes in biopharmaceuticals and is valued at around ₩1.07 billion.

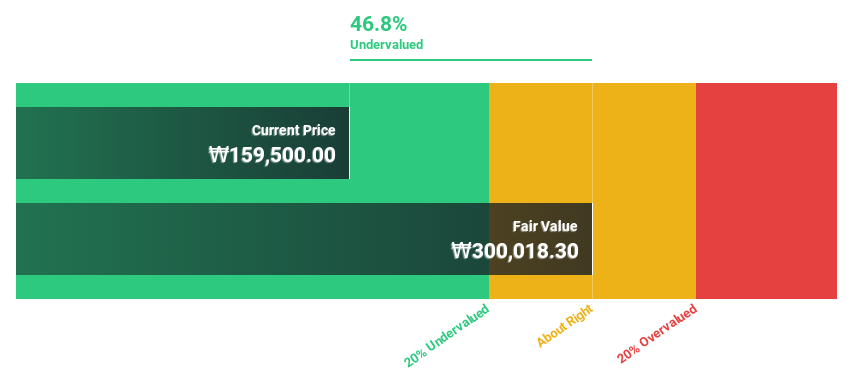

Estimated Discount To Fair Value: 46.8%

Medy-Tox, currently priced at ₩159,500, is trading significantly below its estimated fair value of ₩300,018.30. Despite recent financial setbacks with a shift from net income to a net loss as reported in Q1 2024, the company is anticipated to see robust earnings growth of 68.3% annually over the next three years. Although revenue growth projections are modest at 12.4% per year and return on equity is expected to remain low at 11.7%, the stock's substantial discount suggests potential for revaluation if forecasted profit gains materialize.

ISC

Overview: ISC Co., Ltd. is a global company that develops, manufactures, and sells semiconductor test sockets, with a market capitalization of approximately ₩1.23 billion.

Operations: The firm operates internationally, focusing on the development, manufacturing, and sales of semiconductor test sockets.

Estimated Discount To Fair Value: 22%

ISC Co., Ltd. reported a significant increase in net income to KRW 15.79 billion in Q1 2024 from KRW 11.04 billion the previous year, with sales declining to KRW 873.51 million from KRW 2.20 billion. Despite lower profit margins and shareholder dilution over the past year, ISC is trading at ₩60,200, well below its fair value estimate of ₩77,213. Analysts expect an impressive revenue growth rate of 22.7% annually and forecast earnings to grow by 44% per year, outpacing the Korean market's average.

According our earnings growth report, there's an indication that ISC might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of ISC.

NEXTIN

Overview: NEXTIN, Inc. is a South Korean company that specializes in producing defect inspection and metrology systems for the semiconductor and display industries, with a market capitalization of approximately ₩654.92 billion.

Operations: The company generates ₩103.59 billion from its semiconductor equipment and services segment.

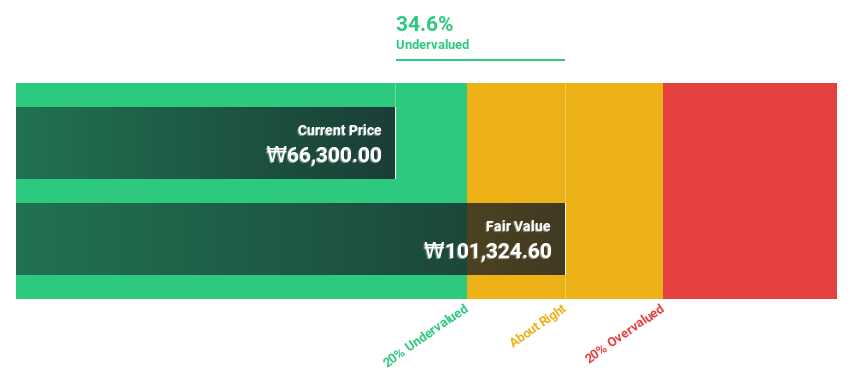

Estimated Discount To Fair Value: 41.8%

NEXTIN, Inc., with a recent private placement and stake acquisition by KCGI Co., Ltd., shows a robust financial position. As of the end of 2023, it reported revenues of KRW 87.93 billion and net income of KRW 30.93 billion, demonstrating high-quality earnings with significant non-cash components. Despite trading at ₩63,800—41.8% below its estimated fair value of ₩109,556.59—NEXTIN is poised for substantial growth with expected revenue increases outpacing the Korean market average and forecasted earnings growth above 20% annually over the next three years.

The analysis detailed in our NEXTIN growth report hints at robust future financial performance.

Navigate through the intricacies of NEXTIN with our comprehensive financial health report here.

Turning Ideas Into Actions

Embark on your investment journey to our 38 Undervalued KRX Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A086900KOSDAQ:A095340KOSDAQ:A348210.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com