Exploring Undiscovered German Stocks with Potential in July 2024

Amidst a backdrop of rising trade tensions and fluctuating economic indicators across Europe, Germany's DAX index has notably declined by 3.07%. This shifting market landscape prompts a closer examination of potential opportunities within the realm of lesser-known German stocks, which may harbor untapped potential in these turbulent times. A good stock in this context is one that demonstrates resilience and the capacity to leverage current economic conditions for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

IVU Traffic Technologies | NA | 9.22% | 5.72% | ★★★★★★ |

Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

centrotherm international | 20.54% | 8.23% | 54.11% | ★★★★★☆ |

BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

EUWAX

Simply Wall St Value Rating: ★★★★☆☆

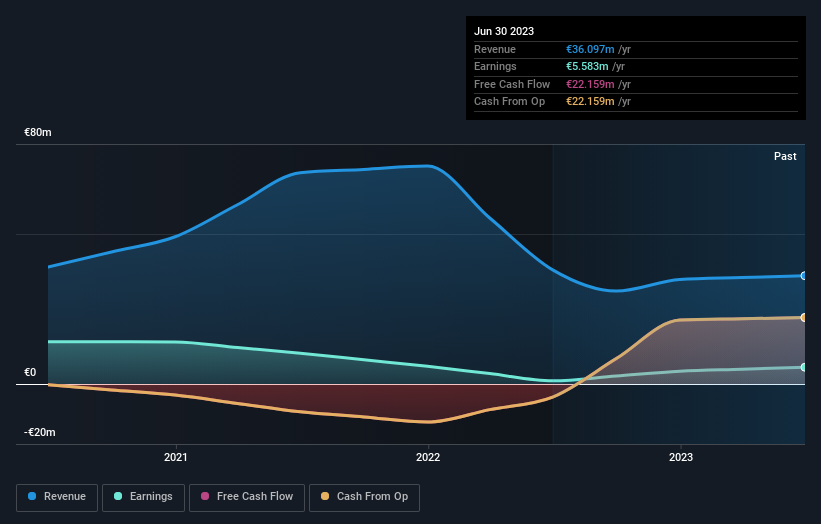

Overview: EUWAX Aktiengesellschaft serves as a liquidity provider in Germany, with a market capitalization of €241.02 million.

Operations: The company generates its revenue primarily through brokerage services, as evidenced by a consistent revenue stream of €36.10 million. It maintains a high gross profit margin, consistently near 100%, indicating efficient control over cost of goods sold and strong pricing strategies.

EUWAX, a lesser-known gem in Germany's financial sector, has demonstrated robust growth with earnings soaring by 433.3% last year, outpacing the industry's average of 7.9%. Despite a revenue dip of 5.1%, its financial health is solid, holding more cash than debt and showcasing high-quality earnings. However, latest financial data being over six months old and an increased debt-to-equity ratio from 3.4% to 4.7% over five years warrants cautious optimism for future prospects.

Take a closer look at EUWAX's potential here in our health report.

Review our historical performance report to gain insights into EUWAX's's past performance.

Mensch und Maschine Software

Simply Wall St Value Rating: ★★★★★★

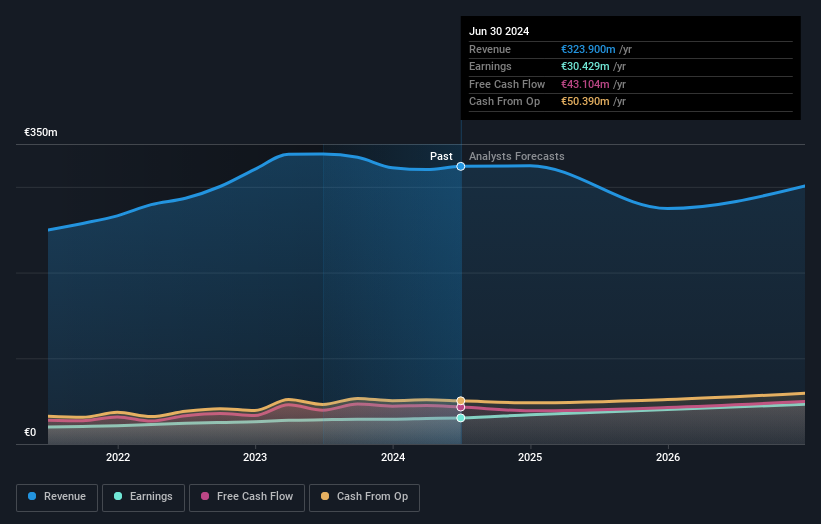

Overview: Mensch und Maschine Software SE specializes in providing CAD/CAM/CAE, product data management, and building information modeling/management solutions across Germany and globally, with a market capitalization of approximately €992.39 million.

Operations: Mensch und Maschine Software SE generates revenue through two main segments: M+M Software and M+M Digitization, with the latter contributing significantly more at €216.19 million compared to €107.71 million from software sales. The company's business model involves substantial operating expenses, which have been consistently rising in line with revenue growth, reflecting ongoing investments in business operations and possibly marketing efforts as indicated by specific sales and marketing expenses recorded each period.

Mensch und Maschine Software SE, a lesser-known yet promising entity in the German market, has demonstrated robust financial health and growth potential. Trading at 30.7% below its estimated fair value, the company's earnings are poised for a 13.58% annual growth. With a significant reduction in its debt-to-equity ratio from 42.8% to 15.5% over five years and earnings growth of 7.6% last year outpacing the software industry's decline of 14%, MUM stands out for its operational efficiency and market resilience. Recent figures underscore this trend, with second-quarter sales rising to €75 million from €71 million a year earlier, alongside an increase in net income to €7 million from €6 million.

RHÖN-KLINIKUM

Simply Wall St Value Rating: ★★★★★☆

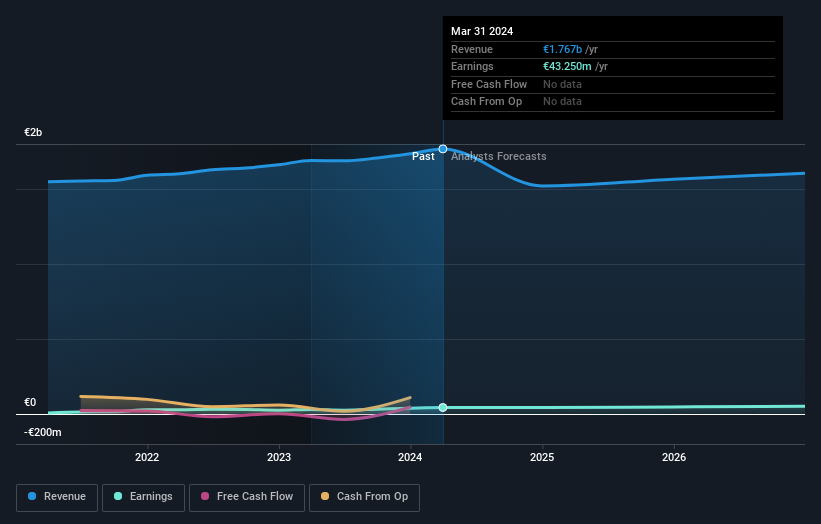

Overview: RHÖN-KLINIKUM Aktiengesellschaft operates in Germany, providing a range of healthcare services including in-patient, semi-patient, and outpatient care, with a market capitalization of approximately €809.96 million.

Operations: RHÖN-KLINIKUM operates in the healthcare sector, primarily generating revenue through patient care services, as indicated by consistent gross profit margins averaging around 12% to 14% over multiple periods. The company's cost structure is heavily influenced by its cost of goods sold (COGS), which typically represents a significant portion of revenue, with operating expenses and depreciation & amortization also constituting major recurring costs.

RHÖN-KLINIKUM, a notable player in the healthcare sector, reported robust first-quarter earnings with revenue up to €455.77 million from €423.14 million last year and net income rising to €10.8 million. This growth of 42.3% surpasses the industry's decline of 2.2%, highlighting its competitive edge. Trading at 32.7% below its estimated fair value and with more cash than debt, RHÖN-KLINIKUM is positioned well financially, supporting a positive outlook for future performance as it continues to outpace sector trends.

Navigate through the intricacies of RHÖN-KLINIKUM with our comprehensive health report here.

Gain insights into RHÖN-KLINIKUM's past trends and performance with our Past report.

Summing It All Up

Access the full spectrum of 39 German Undiscovered Gems With Strong Fundamentals by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:EUX XTRA:MUM and XTRA:RHK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com