F5 Networks (FFIV) Q1 Earnings Top Mark, Revenues Rise Y/Y

F5 Networks Inc. FFIV reported first-quarter fiscal 2020 Non-GAAP earnings per share of $2.55, beating the Zacks Consensus Estimate of $2.43 but decreasing 5.6% year over year.

Revenues rose 5% year over year to $569.3 million and also surpassed the Zacks Consensus Estimate of $566 million, driven by solid software growth.

Robust customer demand for security use cases including WAF and SSLO as well as ongoing ELA traction fueled growth in Software.

Quarterly Details

Products revenues (41% of total revenues) during the quarter totaled $265 million, up 0.3% year over year. Lumpiness in some large deals was an overhang on product revenues. Realignment of the North American sales organization induced to a pause in short-term momentum.

Software soared 50% year over year and represented 28% of product revenues. This upside can be attributed to the growing adoption of the Enterprise License Agreement (ELA) and annual subscriptions among customers.

Systems revenues of $170 million, representing 72% of product revenues, declined 11% on a year-over-year basis due to continued transition of customers to software-based solutions.

Services revenues (59%) increased 8% to $335 million. Improvements to the tools and processes that the company’s team uses to identify and secure renewals are among the key catalysts. Further, healthy services attached in renewal rates to software sold as perpetual or as subscriptions including NGINX-related sales, are tailwinds. Moreover, increase in consulting services demand associated with the rising software sales is an upside.

Region wise, on a year-over-year basis, revenues from the Americas reflecting 53% of the total count grew 3%. APAC revenues rose 8% and represented 20% of the total top line. EMEA climbed 5% and accounted for 20% of total revenues.

Going by the verticals, Enterprise, Service providers and Government (including 7% from the U.S. Federal) depicted 65%, 16% and 19% of the total product bookings, respectively.

The company’s distributor Ingram Micro translated to 16% of the company’s revenues. Westcon accounted for 11% and Arrow contributed 10% to the total revenue base.

Non-GAAP gross margin was 81% and non-GAAP operating margin was 33.8%.

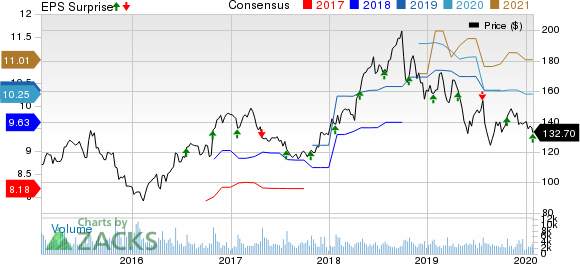

F5 Networks, Inc. Price, Consensus and EPS Surprise

F5 Networks, Inc. price-consensus-eps-surprise-chart | F5 Networks, Inc. Quote

Balance Sheet & Cash Flow

F5 Networks exited the quarter with cash, cash equivalents and short-term investments of approximately $1.16 billion compared with $972.3 million in the prior quarter.

Long-term liabilities were $795.4 million compared with $523.3 million in the previous quarter.

The company reported cash flow of $144 million from operations compared with $206 million in the sequential quarter.

Outlook

For second-quarter fiscal 2020, F5 Networks expects revenues in the range of $580-$590 million. The Zacks Consensus Estimate for revenues is pegged at $571.5 million.

The company anticipates non-GAAP earnings per share in the band of $2.14-$2.16. The Zacks Consensus Estimate stands at $2.43.

The company expects to incur operating expenses of $325-$337 million, implying the addition of Shape.

Management remains optimistic that surging demand for the multi-cloud application services will be a key driver. Moreover, strong demand for software solutions is a tailwind. Rising traction from subscription and ELA offerings is a tailwind.

In the fiscal second quarter, the company anticipates software growth to reaccelerate the above 50% uptrend witnessed in the earlier quarter even before any contribution recorded from Shape.

Moreover, F5 Networks and NGINX’s first combined solution, Controller 3.0, is expected to increase the total addressable market and deal sizes by spending more use cases across DevOps and Super-NetOps customer profiles.

For 2020, the company projects 60-70% software growth including benefits drawn from Shape Security.

Zacks Rank and Stocks to Consider

Currently, F5 has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Perficient PRFT, Synopsys, Inc. SNPS and ManTech International Corporation MANT, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Perficient, Synopsys and ManTech is currently pegged at 11.75%, 12.76% and 8%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

F5 Networks, Inc. (FFIV) : Free Stock Analysis Report

ManTech International Corporation (MANT) : Free Stock Analysis Report

Perficient, Inc. (PRFT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance