F5 Networks (FFIV) Q3 Earnings & Revenues Beat Estimates

F5 Networks FFIV reported strong third-quarter fiscal 2022 results, wherein both the top and bottom lines surpassed the respective Zacks Consensus Estimate.

The Seattle-based company’s non-GAAP earnings of $2.57 per share beat the Zacks Consensus Estimate of $2.23. Although the bottom line declined 6.9% from the year-ago quarter’s $2.76 per share, the figure came in way higher than management’s guided range of $2.18-$2.30 per share.

During the reported quarter, F5 Networks witnessed a 3.5% surge in its revenues amid a global chip shortage scenario in the semiconductor industry. The company’s non-GAAP revenues were $674.5 million, which surpassed the Zacks Consensus Estimate of $667.4 million. The top line came in higher than $670 million — the mid-point of the guided range of $660-$680 million.

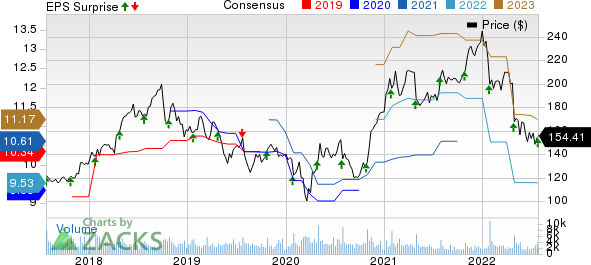

F5, Inc. Price, Consensus and EPS Surprise

F5, Inc. price-consensus-eps-surprise-chart | F5, Inc. Quote

Top Line in Detail

Product revenues (48.4% of total revenues), which comprise Software and Systems sub-divisions, increased 5% year on year to $326.5 million. Software sales jumped 38% year over year to $179 million, accounting for approximately 54.9% of the total Product revenues. However, System revenues slumped 18% to $148 million, making up the remaining 45.4% of the total Product revenues. This downside was due to the ongoing global chip shortage.

Global Service revenues (51.6% of total revenues) grew 2% to $348 million.

F5 Networks registered sales growth across the Americas and APAC regions, witnessing a year-over-year increase of 5% and 15%, respectively. Meanwhile, the company registered a 7% decrease in sales growth from the EMEA region. Revenue contributions from the Americas, EMEA and APAC regions were 57%, 23% and 19%, respectively.

Customer-wise, Enterprises, Service providers and Government represented 70%, 18% and 12% of product bookings, respectively.

Margins

GAAP and non-GAAP gross margins contracted 80 and 90 basis points (bps) to 80.6% and 83.2%., respectively.

GAAP and non-GAAP operating expenses went up by 0.5% and 5.1%, respectively, to $436.3 million and $367.1 million. F5 Networks’ GAAP operating margin expanded 110 bps to 15.9%, while non-GAAP operating margin contracted 170 bps to 28.8%.

Balance Sheet & Cash Flow

F5 Networks exited the June-ended quarter with cash and short-term investments of $738.4 million compared with the previous quarter’s $887.1 million.

During the fiscal third quarter, the company generated $71 million of operating cash flow compared with $127 million reported in the previous quarter. The operating cash flow remained under pressure due to strong multi-year subscription sales, which impacted the cash collection process.

In the first nine months of fiscal 2022, F5 Networks operating cash flow totaled $288.3 million.

F5 Networks repurchased shares worth $250 million during the quarter reported.

Guidance

F5 Networks projects non-GAAP revenues in the $680-$700 million (mid-point of $690 million) and non-GAAP earnings per share in the $2.45-$2.57 band (mid-point of $2.51) for third-quarter fiscal 2022.

For fiscal 2022, F5 Networks did not provide any outlook for total revenue growth, but it provided guidance for global services revenue growth, which is estimated to be in the 1.5-2% band. The company expects an increase in software sales to remain in line with its prior guidance of 35-40%.

Zacks Rank & Stocks to Consider

F5 currently carries a Zacks Rank #3 (Hold). Shares of FFIV have slumped 19.8% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Axcelis Technologies ACLS, Keysight Technologies KEYS and Baidu BIDU. While Axcelis flaunts a Zacks Rank #1 (Strong Buy), Keysight and Baidu each carry a Zacks Rank of 2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axcelis' second-quarter 2022 earnings has been revised 6 cents northward to $1.00 per share over the past 90 days. For 2022, earnings estimates have moved a penny north to $4.38 per share in the past 30 days.

Axcelis' earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 23.5%. Shares of ACLS have soared 78.8% in the past year.

The Zacks Consensus Estimate for Keysight's third-quarter fiscal 2022 earnings has been revised upward by a penny to $1.79 per share over the past 30 days. For 2023, earnings estimates have moved 3 cents north to $7.17 per share in the past 30 days.

Keysight’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 8%. Shares of KEYS have fallen 4.3% in the past year.

The Zacks Consensus Estimate for Baidu's second-quarter 2022 earnings has been revised 4 cents upward to $1.63 per share over the past seven days. For 2022, earnings estimates have moved 3 cents north to $7.88 per share in the past seven days.

Baidu's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 52.9%. Shares of BIDU have decreased 11.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

F5, Inc. (FFIV) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance