Facebook Audience Network is paying off in spades (FB)

BII

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

Developers who have run mobile app-install ads on Facebook Audience Network (FAN) have seen some strong results, according to a new study by Nanigans, a Facebook Marketing Partner.

FAN lets brands spread their ad campaigns to consumers outside of Facebook by automatically tweaking ads to new native, interstitial, and banner ad formats.

Facebook originally focused on providing mobile app inventory, but FAN recently expanded to encompass mobile websites in the first quarter of 2016. And since that time, brands have succeeded in ways on par or better than what they have achieved through their regular Facebook campaigns.

App marketers who use FAN have noted a 26% increase in app-installs over ads served through Facebook's native ads during Q1 2016. The Nanigans report analyzed results from the 30 mobile app install advertisers that spend the most money within its network during the three-month period ended March 31.

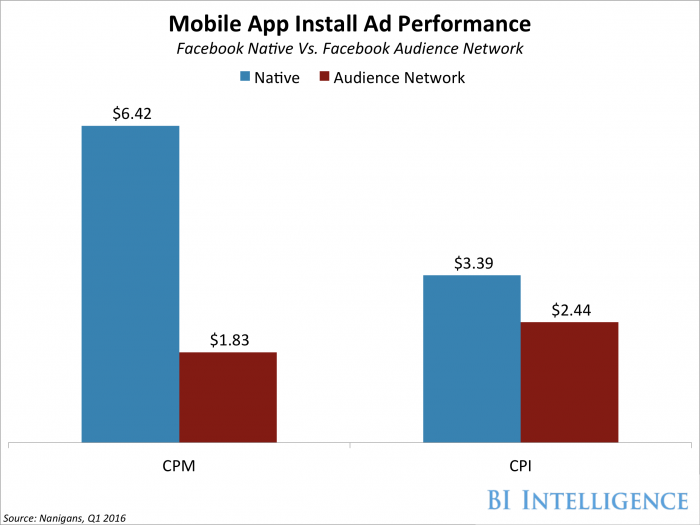

According to the study, app-install ads served via FAN had a 65% higher click-through rate (1.4%) compared to native ads on Facebook (0.8%). Cost per thousand impressions for FAN app-install ads were 72% lower than Facebook native ads. And finally, cost-per-install for FAN ads were 28% lower than Facebook native ads.

FAN provides brands with a far wider audience to reach now that proven audiences on Facebook have become saturated with app-install ads.

Cutting through the noise of an overcrowded app market is critical for any app developer looking to build a viable user base. There are now well over 3 million apps available across the world’s five largest app stores. Delivering the right product to the right audience at the right time in this environment is imperative to the success of any app.

The challenge of marketing an app effectively has made app-install ads — an ad unit that directs users to download a mobile app — an essential tool for developers seeking to stand out in the Google Play and Apple app stores. This is why it's not surprising that more marketers are using paid channels to drive downloads than ever before. In fact, over 80% of respondents in a survey of the top 100 grossing mobile app developers noted they plan on increasing their spend on app-install ads in 2015.

Will McKitterick, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on mobile app-install ads that looks at the revenues from app-install ads and how they're expected to grow over the next five years. It also looks at the performance of app-install ads and how these metrics are expected to change over time.

Furthermore, the report examines the top app-install ad products and pricing models offered by the leading advertising platforms, including Facebook, Twitter, Yahoo, and Google, as well as newer app-install formats from Instagram and Snapchat. Looking to the future, the report examines how companies are shifting their app-install ad spend to new formats, as well as the new tools they're using to improve optimization and ad effectiveness.

Here are some key takeaways from the report:

Mobile app-install ads — ad units that direct users to download a mobile app — are an essential tool for developers, and they account for a major share of mobile ad spend. We estimate 25% of total US mobile ad revenue was generated by app-install ads in 2015.

A combination of new developers entering the space and rising ad budgets will drive increased spending in years to come. US app-install ad revenue will grow to over $7 billion by year-end 2020, according to BI Intelligence estimates.

Mobile app install advertisers have traditionally invested heavily in display and interstitial ads, but are moving to mobile video and native install formats. 86% of developers currently use in-feed video app-install ads, and video ads are seen as the most effective app-install format.

As formats like video rise in popularity, older formats are losing their appeal for install campaigns. Static nonnative ads are widely used but are not seen as effective. Free app networks and offer walls have also fallen out of favor.

Ad platforms are now developing innovative new install formats to earn even more revenue from these lucrative ad units. New approaches, including deep linking and app streaming, are more contextualized and interactive than older ad formats.

In full, the report:

Forecasts app-install ad spending in the US through 2020.

Explores which app-install ad formats developers believe are most effective.

Discusses what the most popular platforms and ad networks are doing to attract ad spending.

Investigates new tools for marketing apps, including deep linking and app streaming.

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the fast-moving world of mobile app-install ads.

See Also:

Yahoo Finance

Yahoo Finance