Facebook, Fed, and cars — What you need to know on Wednesday

Welcome to November!

There are just two months left in 2017 and the start of November should bring investors one of the newsiest days of the year.

In the morning we’ll get data on private payrolls from ADP, manufacturing activity in the U.S. from Markit Economics and the Institute for Supply Management, and throughout the day auto sales for the month will roll in.

On the earnings side, results from Facebook (FB) will be the highlight, with the social media giant expected to report earnings per share of $1.28 on revenue of $9.84 billion. Monthly active users should total 2.04 billion at the end of the third quarter. Options pricing indicates that stock will move 5.2% after earnings and shares of the company have gained after six of the last 12 earnings announcements, according to data from Bloomberg.

Also on the earnings calendar investors will get results from Allstate (ALL), MetLife (MET), Symantec (SYMC), Prudential (PRU), Qualcomm (QCOM), Allergan (AGN), and Molson Coors (TAP) among others.

Facebook will also be in the headlines. The company, along with Google and Twitter, will for a second day testify before lawmakers on Capitol Hill to address the company’s role in the 2016 presidential election. All three companies will speak before the Senate and House Intelligence committees after appearing in front of the Senate Judiciary subcommittee on Tuesday.

And don’t forget about the Federal Reserve.

The central bank will release its latest monetary policy decision on Wednesday afternoon, though markets largely expect this to be a non-event with the Fed’s benchmark interest rate target range holding steady between 1%-1.25%.

Current market pricing indicates traders see a 98% chance the Fed raises rates at its December 13 meeting, according to the CME Group.

And away from markets, late Tuesday at least eight people were killed after a man drove a truck down a big path in Manhattan in what New York mayor Bill de Blasio called “an act of terror.”

Boomers gaining confidence, millennials flailing

On Tuesday, we noted that consumer confidence is at a 17-year high in the U.S.

The Conference Board’s latest reading, released Tuesday morning, confirmed last Friday’s release from the University of Michigan that shows signs of positive sentiment with regards to the economy pretty much everywhere you look.

Except, that is, when you break it down by age.

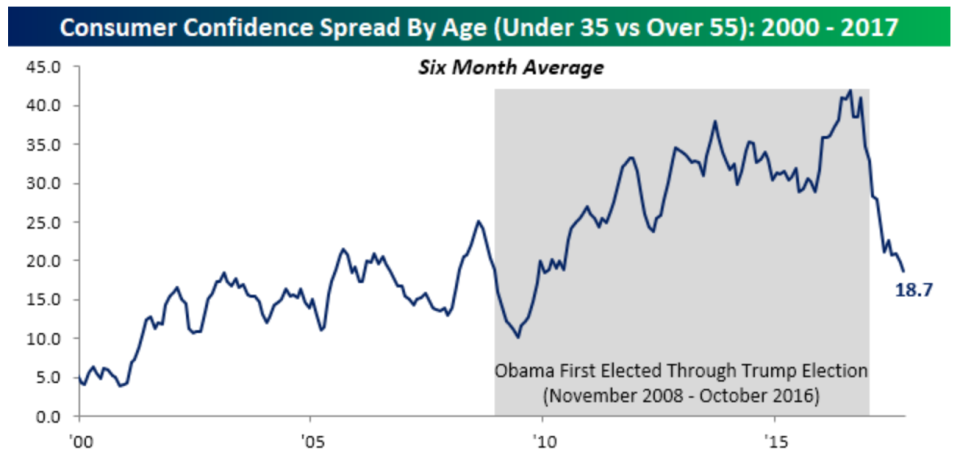

The folks over at Bespoke Investment Group noted Tuesday that when you break down the Conference Board’s report by age cohort, those under 35 are losing confidence relative to those who are 55 and older. In October, confidence among those under 35 fell below that for those 35-54 by the most on record.

“So what is behind the convergence in confidence levels by age?” Bespoke asked in a post published Tuesday.

“There are a number of possible reasons, but one of them looks to be political.

“Younger consumers tend to lean more democratic in their political views, while older consumers are usually more conservative, and this idea is borne out in the data… From the time Obama was first elected right up until Trump’s election last November, confidence among younger consumers steadily increased. Since Trump was elected, however, the spread has fallen off a cliff.”

So what we know is that young people feel a bit worse right now than older Americans. What this chart means for markets is less clear.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance