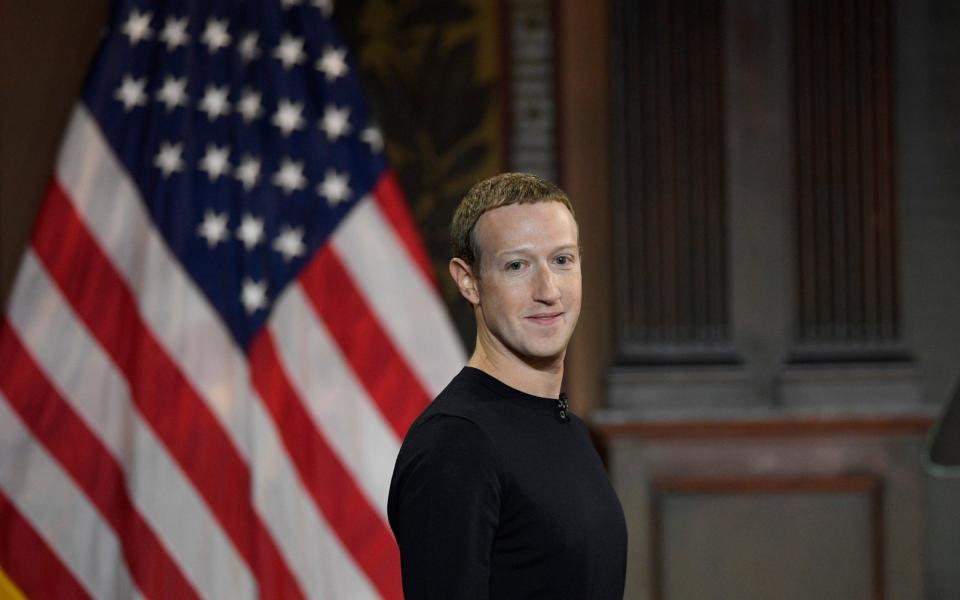

Facebook shares hit an all-time high as Mark Zuckerberg signals he's done apologising

Facebook's shares have finally recovered from its long period of scandal and turbulence, returning to their highest level since July 2018.

Shares in the social media giant reached a height of $219.87 (£168.34) in Friday's trading, having closed at $218.30 the previous night, making the company worth around $622bn.

Facebook suffered the largest ever loss of value in one day for any company in US market history in July, when slower than expected user growth wiped more than $120bn from its stock overnight.

Since then, the company has been repeatedly buffeted by aftershocks of the 2018 Cambridge Analytica, including a $5bn fine from US trade regulators which roughly halved its profit for the three months ending in March 2019.

But shares in Facebook actually rose after both Facebook's warning of the penalty and its eventual imposition, indicating that investors have not been deterred by the firm's travails. The company remains a commercial juggernaut, holding position as the world's sixth most valuable public corporation as of the end of December.

It comes after Facebook's chief executive, Mark Zuckerberg, broke from his tradition of setting annual challenges for himself by outlining a plan for the next decade which firmly eschewed any further defensive action and focused instead on blue-sky projects.

Describing his plan to refocus Facebook on private, small-scale communication, he said: "The internet gave us the superpower of being able to connect with anyone, anywhere.... but being part of such a large community creates its own challenges and makes us crave intimacy.

"For the next decade, some of the most important social infrastructure will help us reconstruct all kinds of smaller communities to give us that sense of intimacy again. This is one of the areas of innovation I'm most excited about."

Other sections of his post focused on Facebook's new Oversight Board, which will serve as a limited court of appeal for users who feel that their posts have been wrongly removed from Facebook's services, and on the rise of virtual reality, which Mr Zuckerberg said could bridge the gap between urban and rural communities and arrest "ballooning" house prices.

"Today, many people feel like they have to move to cities because that's where the jobs are," he said. "But there isn't enough housing in many cities, so housing costs are skyrocketing while quality of living is decreasing.

"Imagine if you could live anywhere you chose and access any job anywhere else. If we deliver on what we're building, this should be much closer to reality by 2030."

It was a marked contrast to his personal challenges for 2017, when he pledged to go on a listening tour across America, 2018, when he promised to "fix" Facebook's problems, and 2019, when he launched a series of public discussions with some of Facebook's more moderate critics.

The post's forward-looking tone suggests that Mr Zuckerberg considers Facebook to have put its scandals behind it – a narrative that may be tested in the coming US presidential election, in which candidates and foreign states will push the boundaries of what they can get away with on social networks.

Entirely absent, however, was Libra, Facebook's attempt at creating a digital currency, which has become mired in opposition from politicians and regulators across the world who fear it will undermine the sovereign power of central banks.

Facebook has attempted to downplay its role in the project, setting up an independent Libra Association to govern it. In testimony to the US Senate last October, Mr Zuckerberg even said that the currency might move forward without Facebook if the Association took decisions he was not comfortable with.

Investors appear confident that Facebook will be able to continue growing as it begins to extract more money from sister services such as Instagram and WhatsApp, which have previously played second fiddle to the main app's advertising juggernaut.

The company signaled last year that it expects the "deceleration" in its revenue growth to become "much less pronounced" in 2020.

Yahoo Finance

Yahoo Finance