Factors Deciding Nikola's (NKLA) Fate This Earnings Season

Nikola Corporation’s NKLA second-quarter 2022 results are scheduled to be out on Aug 4, before the opening bell. The Zacks Consensus Estimate for the quarter’s loss is pegged at 27 cents per share on revenues of $16 million. The loss estimate has remained unchanged over the past 60 days. The projection suggests a year-over-year deterioration of 35%.

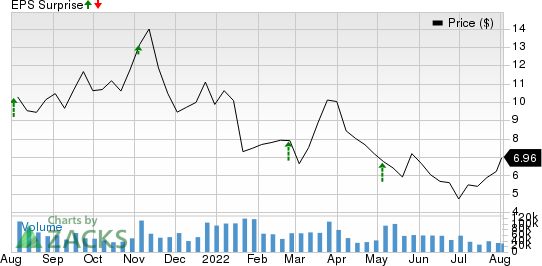

In the last reported quarter, Nikola incurred a loss per share of 21 cents, narrower than the Zacks Consensus Estimate of a loss of 27 cents. Over the preceding four quarters, Nikola surpassed the Zacks Consensus Estimate on all occasions, with the average being 21%. This is depicted in the chart below:

Nikola Corporation Price and EPS Surprise

Nikola Corporation price-eps-surprise | Nikola Corporation Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Nikola this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Earnings ESP: Nikola has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is on par with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Nikola currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

While NKLA hit a major milestone in December with the delivery of its first two Nikola Tre battery-electric vehicle (BEV) pilot trucks to Total Transportation Services Inc., the EV startup is yet to generate revenues. Nikola commenced the BEV truck series commercial production at its Coolidge, AZ factory in March 2022 and deliveries are expected to have commenced in the second quarter of 2022. This is likely to aid upcoming results. But since Nikola expects to deliver 300-500 BEV trucks largely in the second half of 2022, we expect it to record meaningful revenues in the latter half of the year only. Also, given that Nikola is still in the nascent stage, its fate depends on how its pilot trucks are received by customers.

Additionally, NKLA has been burning cash, which might have affected its second-quarter bottom line. Elevated spending in a bid to develop and test state-of-the-art technologies and add new sales and service locations might have put the firm’s second-quarter margins under pressure. In the last reported quarter, Nikola spent $74 million on R&D activities, reflecting a yearly uptick of 35.2%. SG&A expenses flared up 18% year over year to $77.2 million in the first quarter of 2022. Escalation of operating expenses is expected to have continued in the to-be-reported quarter.

Upcoming Peer Releases

Workhorse Group WKHS:Our proven model does not conclusively predict an earnings beat for Workhorse this time around. The EV maker has an Earnings ESP of 0.00% and a Zacks Rank #3. The company is set to report second-quarter 2022 earnings on Aug 9.

The Zacks Consensus Estimate for Workhorse’s to-be-reported quarter’s loss and revenues is pegged at 13 cents a share and $0.1 million, respectively. In the last reported quarter, WKHS incurred a loss of 15 cents a share, wider than the Zacks Consensus Estimate of a loss of 12 cents.

Rivian Automotive RIVN: Our proven model conclusively predicts an earnings beat for Rivian this time around. The EV upstart has an Earnings ESP of +9.58% and a Zacks Rank #3. The company is set to report second-quarter 2022 earnings on Aug 11.

The Zacks Consensus Estimate for Rivian’s to-be-reported quarter’s loss and revenues is pegged at $1.67 per share and $337.7 million, respectively. In the last reported quarter, RIVN incurred a loss of $1.43 a share, narrower than the Zacks Consensus Estimate of a loss of $1.50.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Workhorse Group, Inc. (WKHS) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance