Factors to Know Ahead of Schlumberger's (SLB) Q2 Earnings

Schlumberger Limited SLB is expected to report second-quarter 2019 earnings on Jul 19, before the opening bell.

In the last reported quarter, the company’s earnings of 30 cents per share met the Zacks Consensus Estimate, courtesy of contributions from Integrated Drilling Services projects in Saudi Arabia, India and Mexico.

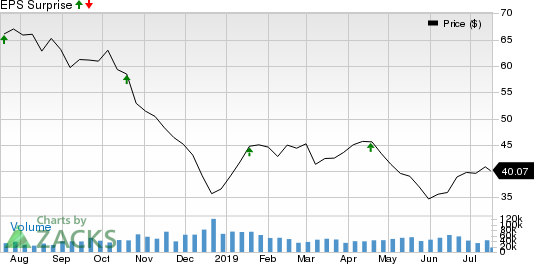

As far as earnings surprises are concerned, the Houston, TX-based company is on a firm footing, as it did not miss the Zacks Consensus Estimate in the last four quarters, with the average positive surprise being 1.2%. This is depicted in the graph below:

Schlumberger Limited Price and EPS Surprise

Schlumberger Limited price-eps-surprise | Schlumberger Limited Quote

Investors expect this provider of technical products and services to drillers of oil and gas wells to continue winning ways by surpassing earnings estimates this time around as well. However, that might not be the case here, as you will see below. Let’s see how things are shaping up prior to the announcement.

Which Way are Estimates Headed?

Let’s look at the estimate revision trend to get a clear picture of what analysts expect from the company prior to the earnings release.

The Zacks Consensus Estimate of 35 cents for second-quarter earnings has been stable over the past 30 days. It indicates a decline of almost 18.6% from the year-ago quarter.

Further, the Zacks Consensus Estimate for revenues of $8.12 billion suggests a 2.2% drop from the prior-year quarter.

Factors to Consider

With U.S. explorers and producers spending conservatively owing to volatile crude prices, Schlumberger is expected to generate lower revenues from oilfield service operations, since it helps upstream energy players to efficiently set up oil wells. Moreover, pipeline constraints in the prolific Permian Basin and declining well productivity could hurt crude production volumes. These factors are being reflected in the Zacks Consensus Estimate for two of the company’s major business segments.

The Zacks Consensus Estimate for the Reservoir Characterization segment’s earnings before tax stands at $332 million, lower than $350 million in the prior-year quarter. Moreover, for the Production unit, the Zacks Consensus Estimate for earnings is pegged at $226 million, down from $316 million in the prior-year quarter.

However, the Zacks Consensus Estimate for the Drilling segment’s earnings before tax stands at $327 million, higher than $289 million in the prior-year quarter.

Earnings Whispers

Our proven model does not conclusively predict a beat for Schlumberger this earnings season. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Most Accurate and Zacks Consensus Estimate stand at 35 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Schlumberger currently carries a Zacks Rank #3 (Hold), which increases the predictive power of ESP. But we need to have a positive Earnings ESP to be confident of a positive surprise.

Meanwhile, we caution against Sell-rated stocks (#4 or 5) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

While earnings beat looks uncertain for Schlumberger, here are some companies from the energy space that you may want to consider on the basis of our model, which shows that these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

ConocoPhillips COP has an Earnings ESP of +3.31% and a Zacks Rank of 3. The company is slated to announce second-quarter 2019 earnings on Jul 30. You can see the complete list of today’s Zacks #1 Rank stocks here.

TransCanada Corporation TRP is set to report second-quarter 2019 earnings on Aug 1. The stock has an Earnings ESP of +3.36% and a Zacks #3.

Royal Dutch Shell plc RDS.A has an Earnings ESP of +1.22% and is a #3 Ranked player. The company is anticipated to release second-quarter 2019 earnings on Aug 1.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

TransCanada Corporation (TRP) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance