Factors Likely to Determine the Fate of SLB in Q4 Earnings

SLB SLB is set to report fourth-quarter 2023 earnings on Jan 19, before the opening bell.

Let’s delve into the factors that are anticipated to have influenced this oilfield service player’s performance in the to-be-reported quarter. However, it is worth taking a look at SLB’s previous quarter’s performance first.

Highlights of Q3 Earnings & Surprise History

In the last reported quarter, the company’s earnings of 78 cents per share (excluding charges and credits) beat the Zacks Consensus Estimate by a penny, primarily driven by higher evaluation and stimulation activity in the international market.

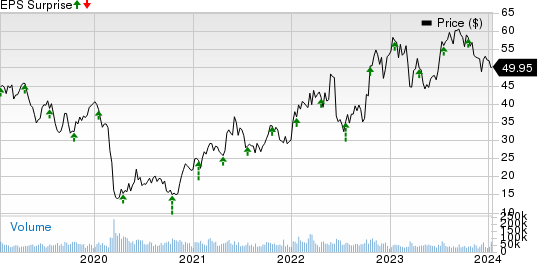

SLB’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 2.2%. This is depicted in the graph below:

SLB Limited Price and EPS Surprise

SLB price-eps-surprise | SLB Quote

Estimate Trend

The Zacks Consensus Estimate for SLB’s fourth-quarter earnings per share of 84 cents has witnessed no upward movement and two downward revisions over the past 30 days. The estimated figure suggests an 18.3% improvement from the prior-year reported number.

The Zacks Consensus Estimate for fourth-quarter revenues of $9 billion indicates a 14% increase from the year-ago reported figure.

Factors to Consider

The oil market showed a positive trend in the fourth quarter of 2023. According to data from the U.S. Energy Information Administration, the average prices per barrel of West Texas Intermediate crude in October, November and December were $85.64, $77.69 and $71.90, respectively. While these prices were not as high as that in the same period last year, they were still considered good and stable.

However, the natural gas market did not fare as well in the fourth quarter compared to the third quarter and the same quarter last year. This had an impact on the exploration and production activities of major energy companies, likely affecting the activities of SLB, a significant player in the energy sector.

The Zacks Consensus Estimate for pretax operating income for Digital Integration is pegged at $369 million, indicating a decline from the year-ago reported figure of $382 million. This is likely to have affected SLB’s performance in the to-be-reported quarter.

Earnings Whispers

Our proven model does not indicate an earnings beat for SLB this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: SLB’s Earnings ESP is -1.19%. This is because the Most Accurate Estimate is pegged at earnings of 83 cents per share, while the Zacks Consensus Estimate is pegged at 84 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks to Consider

Here are some firms that you may want to consider, as these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Phillips 66 PSX currently has an Earnings ESP of +0.31% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Phillips 66 is scheduled to release fourth-quarter earnings on Jan 31. The Zacks Consensus Estimate for PSX’s earnings is pegged at $2.55 per share, suggesting a 36.3% decline from the prior-year reported figure.

Exxon Mobil Corporation XOM has an Earnings ESP of +1.93% and presently sports a Zacks Rank #1.

ExxonMobil is scheduled to release fourth-quarter earnings on Feb 2. The Zacks Consensus Estimate for XOM’s earnings is pegged at $2.17 per share, suggesting a 36.2% decline from the prior-year reported figure.

BCE Inc. BCE currently has an Earnings ESP of +0.60% and a Zacks Rank #3.

BCE is scheduled to release fourth-quarter earnings on Feb 8. The Zacks Consensus Estimate for BCE’s earnings is pegged at 55 cents per share, suggesting a 3.8% increase from the prior-year reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

BCE, Inc. (BCE) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance