Factors That Make Marsh & McLennan (MMC) Stock A Lucrative Bet

Marsh & McLennan Companies, Inc. MMC is currently aided by strong segmental performances, new business generation, continuous pursuit of buyouts and a strong financial position.

Zacks Rank & Price Rally

Marsh & McLennan currently carries a Zacks Rank #2 (Buy).

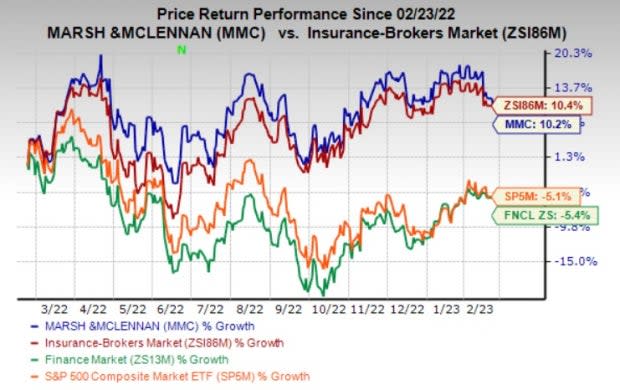

The stock has gained 10.2% in a year compared with the industry’s 10.4% growth. The Zacks Finance sector and the S&P 500 composite have declined 5.4% and 5.1%, respectively, in the said time frame.

Image Source: Zacks Investment Research

Favorable Style Score

MMC carries an impressive VGM Score of B. VGM Score helps identify stocks with the most attractive value, the best growth and the most promising momentum.

Robust Growth Prospects

The Zacks Consensus Estimate for Marsh & McLennan’s 2023 earnings is pegged at $7.49 per share, indicating a 9.3% increase from the year-ago reported figure. The same for revenues stands at $21.9 billion, implying 5.8% growth from the prior-year number.

The Zacks Consensus Estimate for 2024 earnings is pegged at $8.17 per share, suggesting 9.1% growth from the year-ago estimate. The same for revenues stands at $23 billion, which indicates a rise of 5.2% from the prior-year estimate.

Robust Earnings Surprise History

MMC boasts an impressive surprise record. Its earnings outpaced estimates in each of the trailing four quarters, the average being 4.08%.

Growth Drivers

Solid contribution from the Risk and Insurance Services and, Consulting segments contribute to the revenue growth of Marsh & McLennan. Barring 2015, its revenues have consistently grown since 2010.

The Risk and Insurance Services segment benefits on the back of new business generation and solid retention, while the Consulting segment is aided by continued solid demand for workforce transformation solutions and sound contribution from those geographies wherein MMC operates.

Marsh & McLennan frequently resorts to an inorganic growth strategy. Time and again, MMC makes acquisitions within its different operating units that clearly reflect its keen eye to delve into new regions, explore deep within the existing ones, develop new segments and specialize within its existing businesses. In 2022, MMC completed 20 buyouts.

While the purchase of the full-service broker, HMS Insurance, was the largest one within the Risk & Insurance services segment last year, the Avascent Group (an aerospace and defense management consulting firm) buyout was the most significant acquisition of the Consulting segment.

Marsh & McLennan comprises sound cash reserves and adequate cash-generating abilities. A strong financial position is of immense importance for companies like MMC, which put an intensified focus to pursue frequent acquisitions.

A commendable financial position also imparts MMC the ability to pursue a disciplined capital management through share buyback and dividends. Management approved a dividend hike of 10.3% in July 2022, which marked the 13th consecutive year of dividend hikes. Its dividend yield of 1.4% remains higher than the industry average of 1.1%.

Stocks to Consider

Some better-ranked stocks in the insurance space are Voya Financial, Inc. VOYA, Arthur J. Gallagher & Co. AJG and Aon plc AON. While Voya Financial sports a Zacks Rank #1 (Strong Buy), Arthur J. Gallagher and Aon carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Voya Financial’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 38.68%. The Zacks Consensus Estimate for VOYA’s 2023 earnings suggests an improvement of 5.5%, while the same for revenues indicates growth of 7% from the respective year-ago estimates.

The Zacks Consensus Estimate for VOYA’s 2023 earnings has moved 0.8% north in the past seven days. Shares of Voya Financial have gained 11.8% in a year.

Arthur J. Gallagher’s earnings surpassed estimates in each of the last four quarters, the average being 2.07%. The Zacks Consensus Estimate for AJG’s 2023 earnings indicates a 13.2% rise, while the same for revenues suggests an improvement of 12.5% from the respective prior-year estimates.

The consensus mark for AJG’s 2023 earnings has moved 1.7% north in the past 30 days. Shares of Arthur J. Gallagher have gained 23% in a year.

Aon’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average being 2.05%. The Zacks Consensus Estimate for AON’s 2023 earnings indicates a 8.7% rise, while the same for revenues suggests an improvement of 4.7% from the respective prior-year estimates.

The consensus mark for AON’s 2023 earnings has moved up 0.3% in the past 30 days. Shares of Aon have gained 8.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance