Factors You Must Note Ahead of ServiceNow's (NOW) Q3 Earnings

ServiceNow, Inc. NOW is scheduled to release third-quarter 2020 results on Oct 28.

The company's third-quarter performance is anticipated to have benefited from solid traction for the company’s digital workflow solutions stemming from rapid digital transformation taking place across all industries owing to coronavirus-led remote work wave.

The Zacks Consensus Estimate for revenues is currently pegged at $1.11 billion, which indicates growth of 25.3% from the year-ago quarter.

The Zacks Consensus Estimate for third-quarter earnings has been steady at $1.03 cents in the past seven days, which suggests an improvement of 4% from the prior-year quarter.

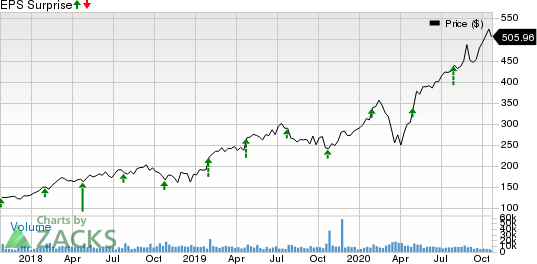

ServiceNow, Inc. Price and EPS Surprise

ServiceNow, Inc. price-eps-surprise | ServiceNow, Inc. Quote

Notably, the company has a trailing four-quarter earnings surprise of 12.57%, on average.

Factors Likely to Have Influenced Q3 Performance

Strong uptake of ServiceNow’s customer service management (CSM) solutions might have driven the to-be-reported quarter’s performance.

Markedly, ServiceNow CSM solution is helping Zoom Video ZM update its customer service operations. Zoom Video is also utilizing ServiceNow’s AIOps capabilities to enable its new hardware as a service business model.

This momentum is likely to have contributed to the third-quarter revenues, as customer support departments of companies are being flooded with calls and queries owing to the pandemic.

ServiceNow expects third-quarter subscription revenues between $1.055 billion and $1.060 billion. Notably, the Zacks Consensus Estimate for subscription revenues is currently pegged at $1.058 billion, which indicates an improvement of 30% over the year-ago quarter.

Besides, the company’s platform has been gaining traction among U.S. government agencies, which holds promise for third-quarter results. Notably, emergency response apps developed on the Now platform have been adopted by the states of Washington, Los Angeles and San Francisco, to counter the growing threat of the pandemic.

Growing clout of the company's products instill optimism in the stock. Notably, shares of the company have returned 79.2% in the year-to-date period compared with the industry’s rally of 31.7%. ServiceNow currently carrying a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ServiceNow’s HR solutions have also been growing in popularity due to the increased need for efficient employee management amid changing work environments. This is likely to have had a positive impact on revenues in the to-be-reported quarter. In fact, during the quarter under review, ServiceNow announced the expansion of its partnership with Deloitte to help customers boost their HR Service Delivery (HRSD) efforts and provide enhanced digital experiences to employees.

Additionally, the company’s partnerships with Microsoft MSFT and Accenture are anticipated to have aided in acquiring more customers. This factor is likely to get reflected in ServiceNow’s third-quarter revenues.

However, coronavirus induced weakness across small and medium businesses is likely to have limited growth. Also, higher expenditure on product innovation, might have weighed on margins during the quarter under review.

Return-To-Work Initiatives Deserve a Special Mention

As the gradual unlocking phase begins, with economies re-opening and people commencing to go back to work, companies will need to ensure highest safety standards for their employees. This is compelling employers to put in place effective measures. Hence, the demand for an effective contact tracing tool is likely to increase among employers to safeguard their employees.

In this regard, during the quarter, ServiceNow announced collaboration with Cisco’s CSCO DNA Spaces to augment its Contact Tracing app to create a safer return to workplace environment amid the COVID-19 outbreak. By integrating Cisco’s DNA Spaces, a location-based cloud platform, ServiceNow’s Contact Tracing app can import location-based data of the employees.

Moreover, the company has expanded its ServiceNow Safe Workplace Suite with a new Employee Travel Safety App. Notably, the suite boasts of more than 700 customers. Employee Safety App will help organizations to provide employees a prior authorization for business travel based on the safety level of the destination. It will include contact tracing check-ins on everyday basis, and health verification beforehand to ensure minimization of virus exposure.

Further, ServiceNow’s WorkPlace Suite and dashboard, launched in May 2020, is noteworthy. Notably, ServiceNow Workplace Suite offers its customers various solutions like Workplace Safety Management, Employee Health Screening and Workplace PPE (personal protective equipment) Inventory Management, and the latest Contract Tracing app to make workplace environment safe as employees start returning to offices.

These initiatives are likely to have driven adoption of ServiceNow’s return-to-work-focused offerings, including Contact Tracing app and in turn bolstered the top line in the third quarter.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance