Factors Setting the Tone for Seaspan's (SSW) Q4 Earnings

Seaspan Corporation SSW is scheduled to release fourth-quarter 2019 numbers on Feb 19, before market open.

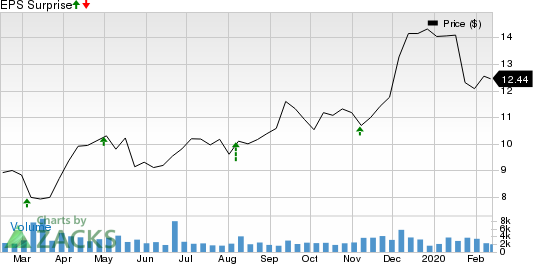

The company has an impressive track record with respect to earnings per share, having outperformed the Zacks Consensus Estimate in each of the last four quarters.

Seaspan Corporation Price and EPS Surprise

Seaspan Corporation price-eps-surprise | Seaspan Corporation Quote

Given this backdrop, let’s delve into the factors that might have influenced the company’s performance in the fourth quarter.

Akin to the past few quarters, vessel utilization (the number of operating days as a % of ownership days) is likely to have been high in the fourth quarter as well, courtesy of increased operating days. Significant contribution from the additional vessels purchased via the acquisition of Greater China Intermodal Investments LLC is likely to have boosted operating days in the December-end quarter.

Apart from the inclusion of new vessels due to the GCI acquisition, higher average charter rates are expected to have boosted revenues in the to-be-reported quarter. Also, cash flow from operations is likely to have been high during the period in discussion, reflecting the company’s financial strength.

However, the fourth-quarter bottom-line number will likely reflect higher ship operating expenses. Ship operating expenses are likely to have flared up during the October-December period due to higher maintenance costs.

Highlights of Q3 Earnings

In the last reported quarter, the company delivered a positive earnings surprise of 16.7%. However, earnings per share plummeted 41.7% primarily due to high costs. Quarterly revenues decreased 4.2% to $282.7 million.

What Does the Zacks Model Say?

The proven Zacks model does not conclusively predict an earnings beat for Seaspan in the final quarter of 2019. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here as elaborated below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Seaspan has an Earnings ESP of 0.00% as the Most Accurate Estimate is in line with the Zacks Consensus Estimate of 21 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Seaspan currently carries a Zacks Rank of 3.

Stocks to Consider

Investors interested in the broader Transportation sector may consider Azul AZUL, Frontline FRO and LATAM Airlines LTM, as these stocks possess the perfect mix of elements to beat on earnings in their next releases.

Azul has an Earnings ESP of +16.13% and sports a Zacks Rank #1, currently. The company will release fourth-quarter numbers on Mar 12.

Frontline is another Zacks #1 Ranked company and has an Earnings ESP of +41.18%. This company will report quarterly figures on Feb 28.

LATAM Airlines has an Earnings ESP of +4.26% and currently holds a Zacks Rank of 3. The company will release fourth-quarter 2019 results on Mar 4.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Frontline Ltd. (FRO) : Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM) : Free Stock Analysis Report

Seaspan Corporation (SSW) : Free Stock Analysis Report

AZUL SA (AZUL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance