Fair Isaac Corp (FICO) Q2 Earnings: Exceeds Revenue Expectations, Misses on EPS Estimates

Earnings Per Share (EPS): Reported at $5.16, falling short of the estimated $5.81.

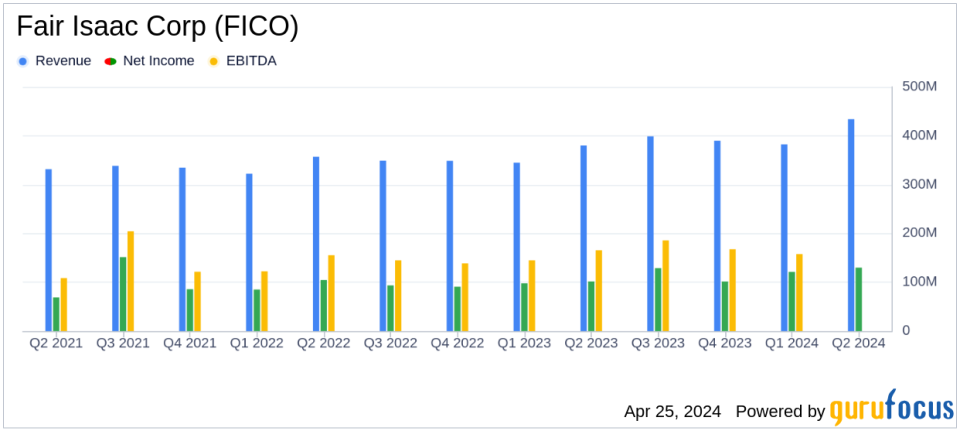

Revenue: Reached $434 million, surpassing the estimated $425.77 million and showing a year-over-year increase from $380 million.

Net Income: Totaled $129.8 million, below the estimate of $145.43 million but increased from $101.6 million in the prior year.

Free Cash Flow: Reported at $61.6 million, down from $88.3 million in the previous year.

Non-GAAP Net Income: Increased to $154.5 million from $121.4 million in the prior year period.

Software Segment Revenue: Grew to $196.9 million, an 8% increase, driven by higher recurring revenue.

Updated Fiscal 2024 Guidance: Revenue forecast raised to $1.690 billion from $1.675 billion, and GAAP EPS increased to $19.70 from $19.45.

On April 25, 2024, Fair Isaac Corp (NYSE:FICO) released its 8-K filing, announcing earnings for the second quarter of fiscal year 2024. The company reported a revenue of $434 million, surpassing the estimated $425.77 million, and an earnings per share (EPS) of $5.16, which fell short of the anticipated $5.81.

Founded in 1956, Fair Isaac Corporation is a leader in applying analytics to make better decisions. Known for its FICO scores, the company also provides software solutions to various industries, enhancing operational decisions and profitability.

Financial Highlights and Operational Challenges

FICO's revenue saw a notable increase from $380 million in the prior year to $434 million this quarter. This growth was driven by a 19% increase in scores revenue and an 8% rise in software revenue. Despite these gains, the company experienced a decline in net cash from operating activities, dropping from $89.8 million in the previous year to $71.0 million.

The company's CEO, Will Lansing, commented on the performance, stating,

We delivered a strong second quarter, posting double-digit growth across all our guided metrics."

He also announced an upward revision in the full-year guidance for fiscal 2024, reflecting confidence in the company's ongoing strategies.

Analysis of Income Statement and Balance Sheet

FICO's net income for the quarter was $129.8 million, a significant improvement from $101.6 million in the same quarter last year. The balance sheet shows an increase in total assets from $1.575 billion to $1.703 billion, with a notable rise in accounts receivable and goodwill and intangible assets. However, the company's long-term debt increased to $2.028 billion, raising concerns about its debt levels.

Updated Financial Outlook

Reflecting its strong quarter performance and strategic initiatives, FICO has updated its fiscal 2024 guidance. The company now expects revenues to reach $1.690 billion, up from the previous forecast of $1.675 billion. GAAP net income is projected at $495 million, slightly up from $490 million, with a GAAP EPS forecast of $19.70, increased from $19.45.

Non-GAAP measures were also highlighted, with non-GAAP net income expected to be $573 million, and non-GAAP EPS projected at $22.80, providing a clearer picture of the company's operational efficiency excluding one-time items and certain non-cash expenses.

Investor and Analyst Information

FICO will host a conference call to discuss the quarterly results and provide strategic updates. Interested parties can access the call through FICO's investor relations website.

This earnings report demonstrates FICO's ability to navigate market challenges and capitalize on its core business of credit scoring and software solutions. The company's revised upward guidance indicates a positive outlook, making it a potentially attractive option for investors focused on analytical and decision-management solutions.

Explore the complete 8-K earnings release (here) from Fair Isaac Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance