How falling house prices will hit your Isa

House prices have been rising at their fastest rate for 18 years, according to Nationwide Building Society. But, as the saying goes, what comes up must go down and when this happens the impact is not limited to the property market.

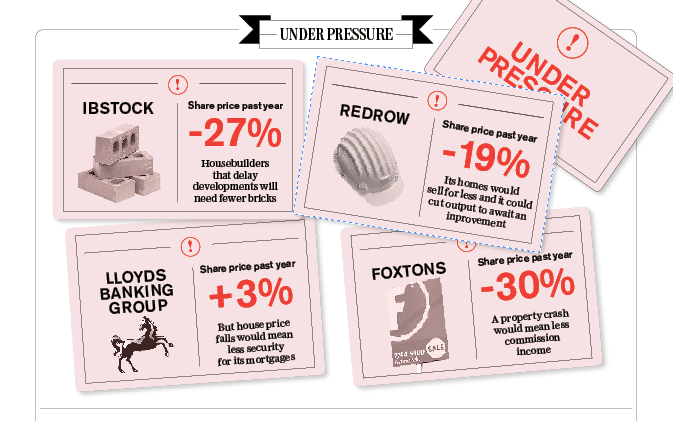

A house price crash could have serious knock-on effects for DIY investors. Many funds count housebuilders, brick makers, estate agents and associated businesses among their holdings. All would be hit by falling property prices. Banks would not escape the fallout either – their loans are underpinned by the value of mortgage borrowers’ property.

Higher mortgage costs, coupled with expensive household bills, could dampen sentiment from buyers, resulting in a correction in the market.

Emma-Lou Montgomery of Fidelity, an investment firm, said: “What makes the current house price rises more noteworthy is that they come at a time when the fundamentals of the property market look weaker than they have for a very long time.”

Rising interest rates will also hit demand from buyers. Lenders make small margins on mortgages and will pass any increase in the Bank Rate quickly to borrowers. This will come just as real incomes fall by 2.5pc as inflation outstrips pay increases. In 2008, a real take-home pay fall of 1.5pc during the financial crisis corresponded with an 18pc fall in house prices.

Investors who have recently ridden the “value investing” wave will be at particular risk because banks and housebuilders are often the cornerstone of such funds.

Laith Khalaf of AJ Bell, the fund shop, estimated some 8pc-10pc of London-listed stocks by value would be exposed to a crash in house prices.

“Clearly some of the housebuilders would be affected because their revenues are determined by the prices at which they sell homes,” he said. “In terms of banks, Lloyds Banking Group and NatWest would be most at risk because they have quite big mortgage books – which were built on the prices of the houses they are secured against.”

Estate agencies such as Foxtons and Purplebricks and housebuilders such as Persimmon and Redrow would feel an immediate impact.

Rightmove, the online property listings company, could fare better as listing properties for sale is an essential service, regardless of price. However, in March, the number of searches from potential buyers fell to its lowest level since June 2020, when the country was in lockdown.

Shares in Mortgage Advice Bureau, a broker, could drop if people stopped moving, but the business would not be directly affected by a price crash – people still need mortgages, even if for lower amounts.

Elsewhere, ancillary businesses such as Ibstock and Michelmersh, the brickmakers, could suffer a fall in demand if housebuilders scrapped or delayed developments.

Among the funds with heavy exposure to banks is Jupiter UK Special Situations, run by Ben Whitmore, which has more than 10pc of its assets in the sector. The manager takes a patient approach, however, so long-term investors may seek to ride out a house price fall.

Dzmitry Lipski of Interactive Investor, another fund shop, said: “The manager recognises that realising value can take a long time, so the average holding period for a stock is often high.”

Funds that have backed housebuilders include Man GLG Income, whose top 10 holdings include Bellway and Taylor Wimpey. Mr Lipski said the fund focused on dividend growth as opposed to the absolute level of yield. This goal, if achieved, should offer investors protection: it’s rare for a company’s share price to fall if it is consistently raising its dividend.

Some individual companies in sectors exposed to a house price crash could even offer an opportunity to more adventurous investors. Ms Montgomery said the housebuilder Bellway was a good bet: it has set a company record for building and has a target to construct 12,200 homes annually for the next two years.

“Whether greater property volumes will equate to an increase in operating profits remains to be seen,” she said. “However, when you factor in its share price, which is around 25pc lower than its pre-pandemic peak, it starts to look interesting.”

Among the banks, HSBC, which makes most of its profits in the Far East, would be better cushioned from a dip in house prices in Britain than some of its competitors, Mr Khalaf said.

As ever, investors’ most powerful defence against shocks such as a house price crash is diversification. Funds minimise the impact of the failure of an individual company, but you can still be hit if a fund has heavy exposure to sectors that are suffering.

Here the answer is to diversify the investment styles your funds adopt, so that they do not all have large proportions of their money in the same companies. You can check fund factsheets, published monthly, to ensure that you are not inadvertently investing in the same stocks many times over.

Yahoo Finance

Yahoo Finance